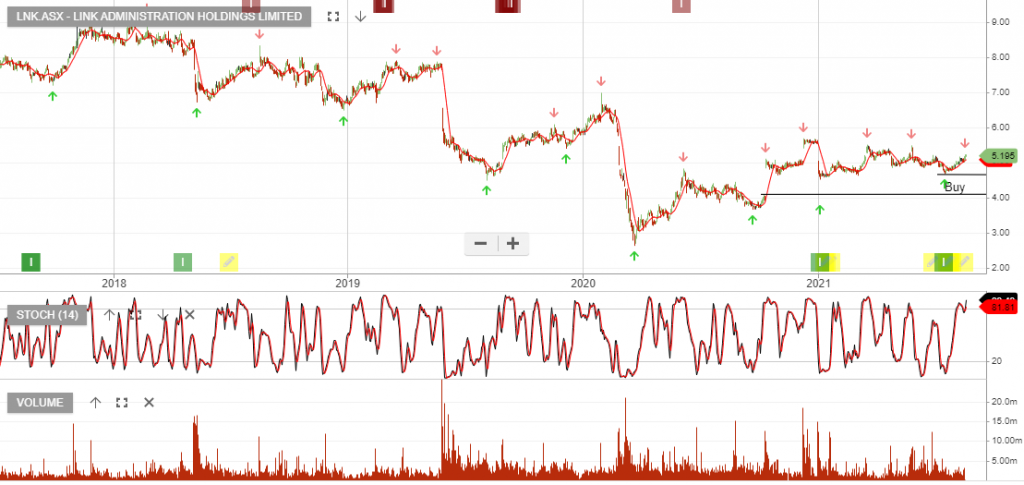

Link – FY21 Earnings

Link Administration Holdings reported FY21 profit of $112m. FY22 guidance is now low single-digit revenue growth and flat EBIT.

The downside in the share price is underpinned to a certain degree through the announced buyback of $150m.

The forward dividend yield is 2.7%.