Cleanaway – Buy

Cleanaway Waste Management is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Traders may watch the price action for a bounce higher and an upturn in the short-term momentom indictaors.

Cleanaway Waste Management is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Traders may watch the price action for a bounce higher and an upturn in the short-term momentom indictaors.

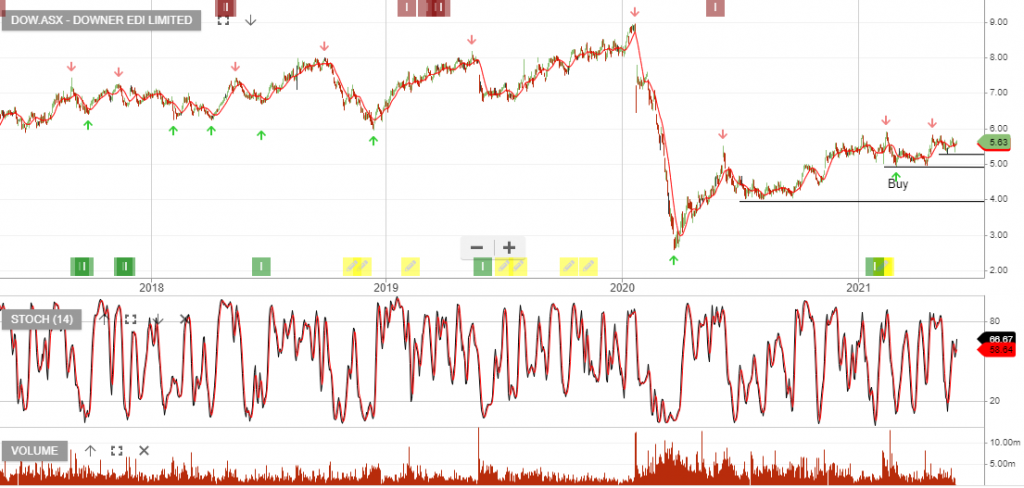

DOW:ASX is now under Algo Engine buy conditions. The company has guided towards double-digit earnings growth into FY22 & FY23.

Downer EDI has found support and buying interest has increased above $5.00.

12/8 Update: Downer EDI has now rallied from $5.00 to $5.80.

The current weakness in the Crown share price could be a buying opportunity. It’s unlikely that the current COVID-related operational impacts are going to deter the interested parties who have put forward takeover offers.

Continue to track the CWN share price and wait for a cross above the 10-day average.

12/8 Update: CWN is now trading above the 10 day average.

Bega Cheese is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

Accumulate within the $5.00 – $5.25 price range.

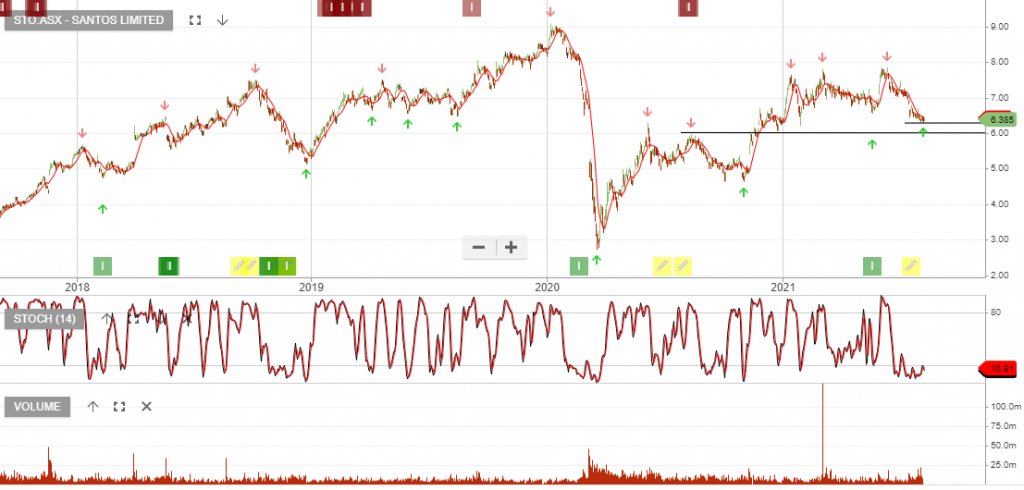

Santos has revised the offer for the merger under which Oil Search investors would receive 0.6275 new Santos shares for each Oil Search share held, implying $4.29 per Oil Search share based on July 19 prices.

The combined entity would become an ASX top-20 company, overtaking Woodside Petroleum as the nation’s largest oil and gas producer.

Northern Star Resources is under Algo Engine buy conditions and is our preferred gold exposure.

NST continues to deliver strong results in the June quarter. Group production finished with 450koz at $1460oz, (up 23%), whilst seeing costs come down almost 10%.

We continue to see the twin factors of a strong gold price and cost-saving, (post-merger with SAR), helping to support the share price.

Fortescue Metals Group has been in our ASX model portfolios since July 2019 with multiple buy signals. We are again presented with another reminder of the opportunity to accumulate FMG.

FMG is set to report its FY21 result on 30 August. An increase in shipments volumes and higher realised prices in FY21 will drive a strong financial result.

Cleanaway Waste Management is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Traders may watch the price action for a bounce higher off the $2.40 support and an upturn in the short-term momentom indictaors.

Collins Foods is now under Algo Engine buy conditions.

Stop loss @ 10.18

The share price has now rallied to $11.01 and we see further upside to $11.80 – $12.00.

10/8 update:

CURE:AXW is under Algo Engine buy conditions and the current pullback provides another buying opportunity.

ETFS S&P Biotech ETF (ASX Code: CURE) offers investors exposure to U.S. biotechnology companies. These companies are engaged in research, development, manufacturing and/or marketing of products based on genetic analysis and genetic engineering.

.