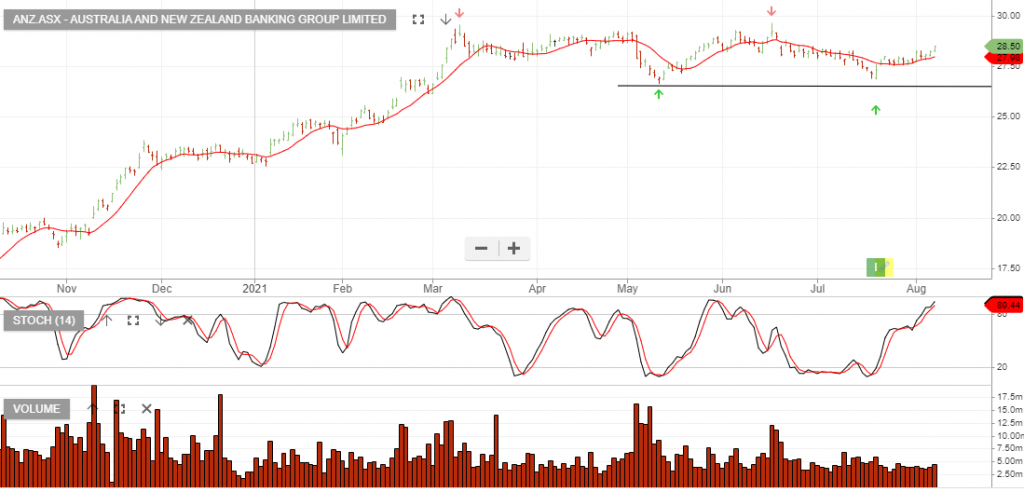

ANZ – Algo Buy

Australia and New Zealand Banking Group is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

Australia and New Zealand Banking Group is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

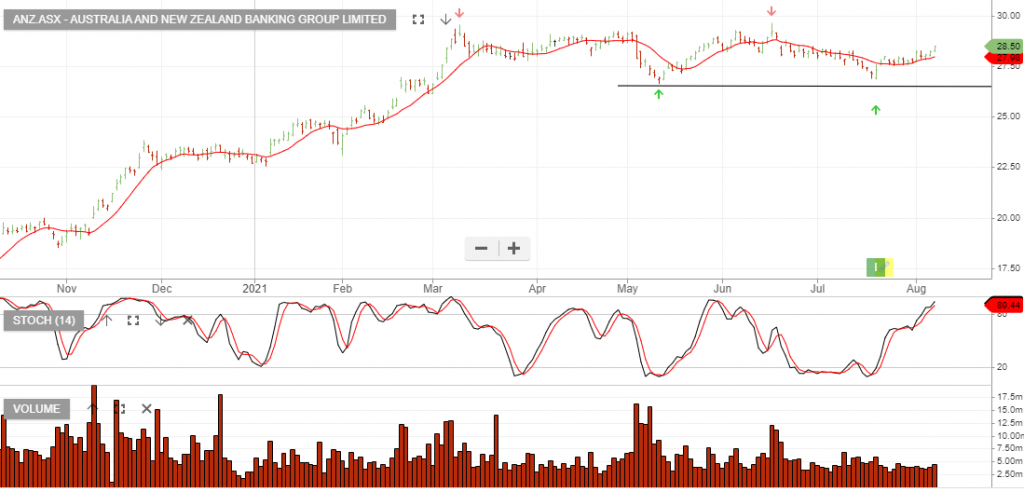

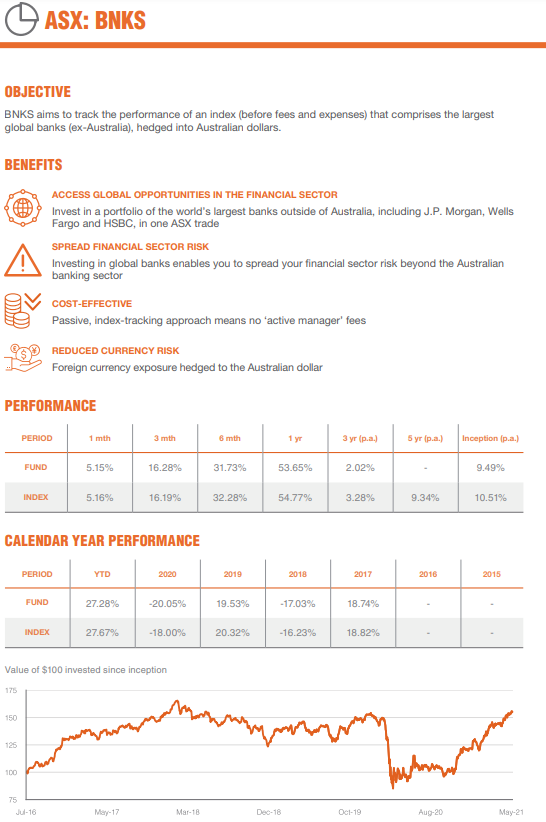

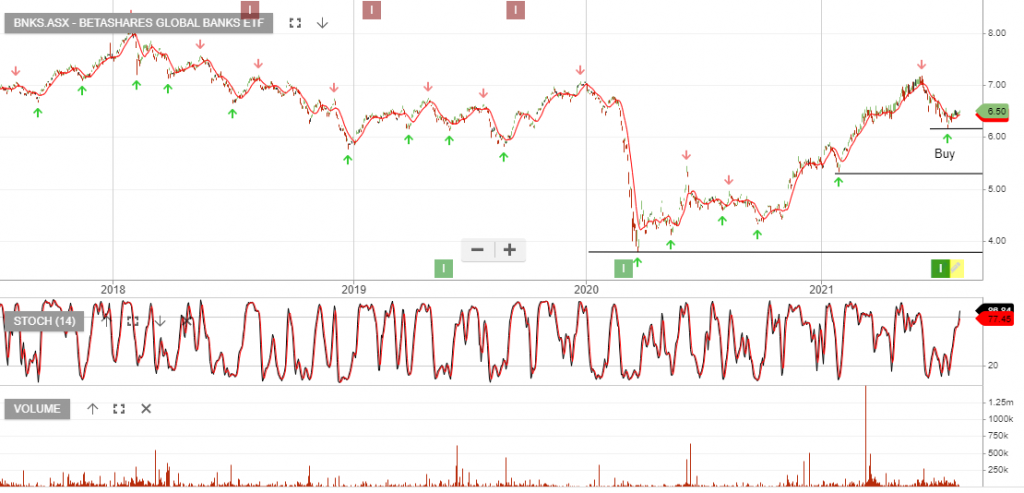

BetaShares Global Banks is now under Algo Engine buy signals and is a current holding in our “ASX All ETF” model.

This is an ASX-listed ETF.

7/8 update: BNKS is now trading $6.50

Iron Ore prices are now down 20% from the May peak of US$230 p/t, with the overnight close at US$180 p/t.

We expect buying support to build within the US$150 – US$180 price range. This will provide an entry-level to add to BHP and FMG.

Watch for RIO to soon shift to Algo Engine buy signals.

Insurance Australia Group pre-released guidance and announced its expectations for FY21E cash earnings of A$747mn and guided to low single-digit growth in FY22E.

IAG trades on a forward dividend yield of 3.8%.

Buy IAG with a stop loss @ $4.70

6/8 Update: IAG now trading $5.00

Pointsbet Holdings is now under Algo Engine buy conditions and we see buying support building above the $9.30 support level.

Zip Co is under Algo Engine buy conditions and the short-term momentum indicators are now trending higher.

iShares Asia 50 is under Algo Engine buy conditions and is a current holding in our iShares ETF model.

INVESTMENT OBJECTIVE: The fund aims to provide investors with the performance of the S&P Asia 50TM Index, before fees and expenses. The index is designed to measure the performance of the 50 leading companies listed in China, Hong Kong, Macau, Singapore, South Korea and Taiwan.

CURE:AXW is under Algo Engine buy conditions and the current pullback provides another buying opportunity.

ETFS S&P Biotech ETF (ASX Code: CURE) offers investors exposure to U.S. biotechnology companies. These companies are engaged in research, development, manufacturing and/or marketing of products based on genetic analysis and genetic engineering.

.

SPDR S&P/ASX 200 Listed Property in under Algo Engine buy conditions since February at $11.30 and In July we’ve seen a further buy signal at $12.50.

SLF provides a basket trade with diversification across the REIT sector. SLF and GMG remain our preferred property allocations.

Zip Co is under Algo Engine buy conditions and the short-term momentum indicators are now trending higher.