Cosmos – Large Cap Crypto

ATOM

ATOM

XRP

Crypto weekly review 10/4

Crypto weekly review video 27/3

Crypto weekly review: 17/3

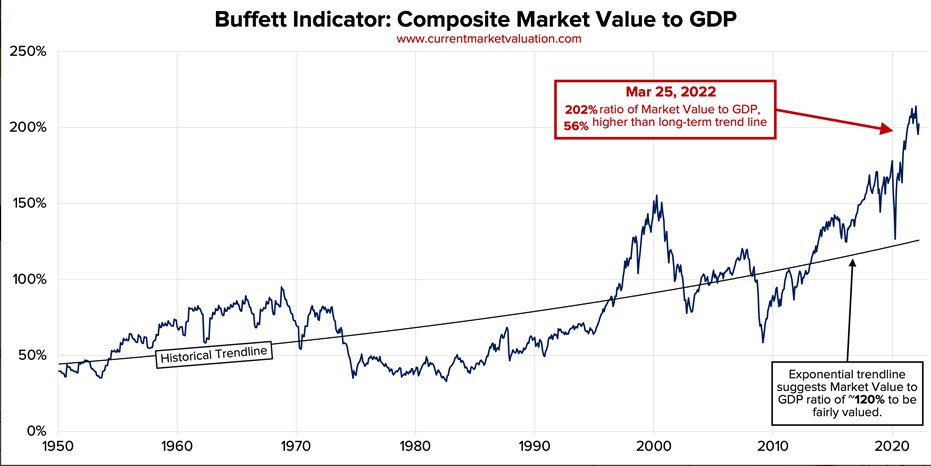

NASDAQ’s PE ratio is now 27X forward earnings with 2022 earnings growth rate forecast at 12.3%. The recent rally is a significant extension given the move higher in interest rates.

The graph below looks at the valuation of the S&P relative to US GDP.

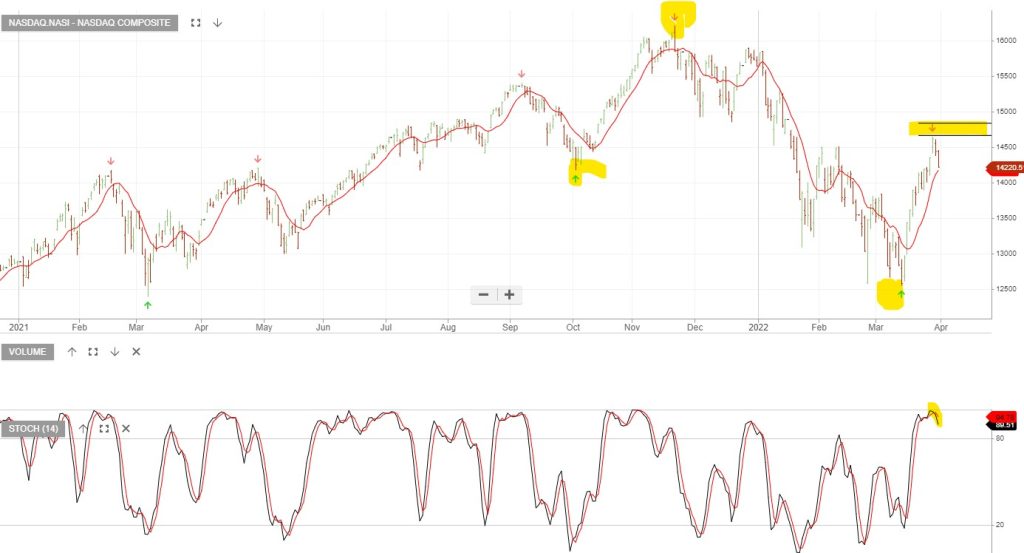

9/4 update: The downside momentum continues in the NASDAQ.

The rebound in the NASDAQ has been sharp and it’s possible we’re now looking at a level of overhead resistance. For crypto investors, this provides an opportunity to consider hedging or an outright short position.

The strategy requires a stop loss which means any short exposure is closed out if the market rally continues.

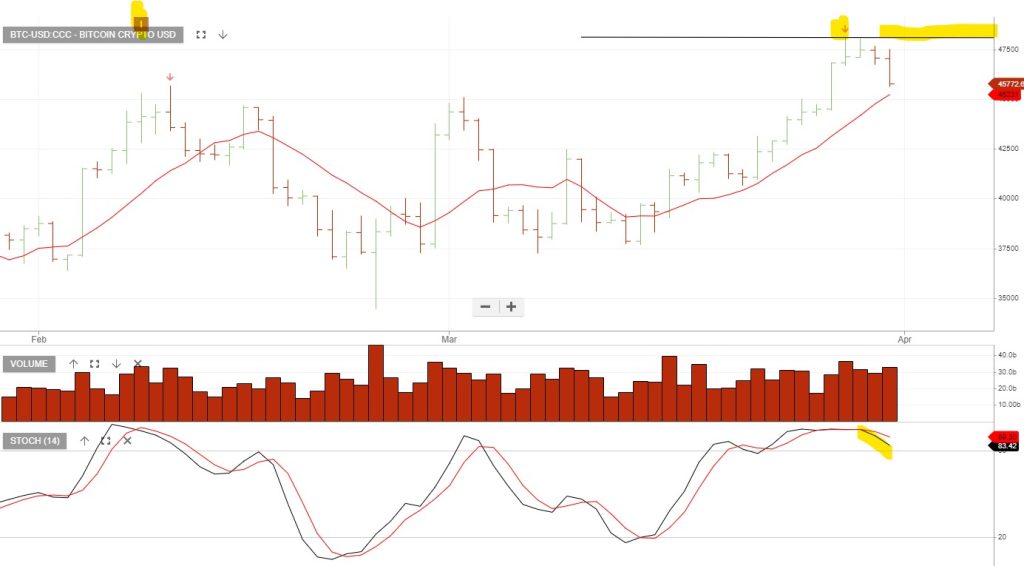

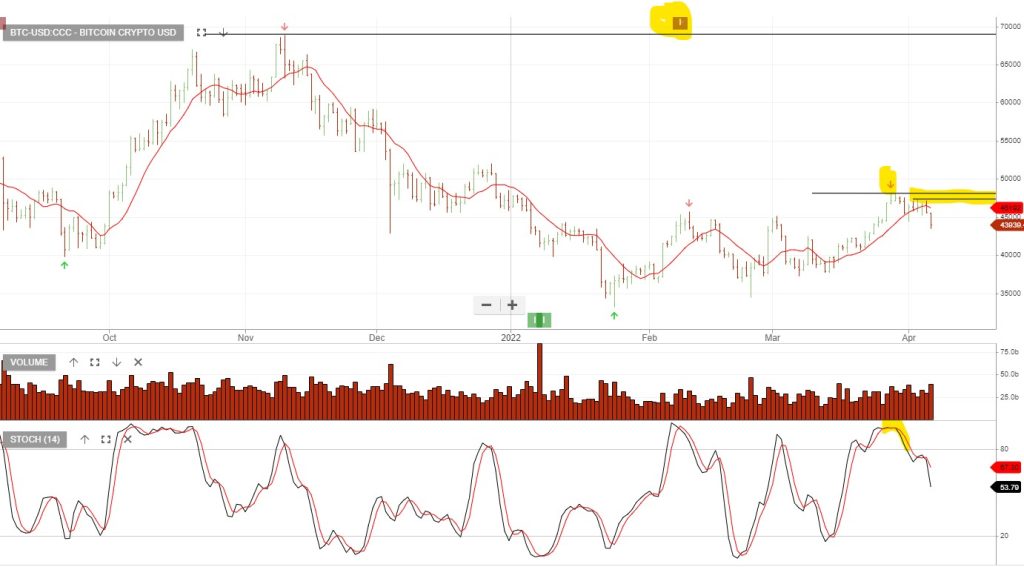

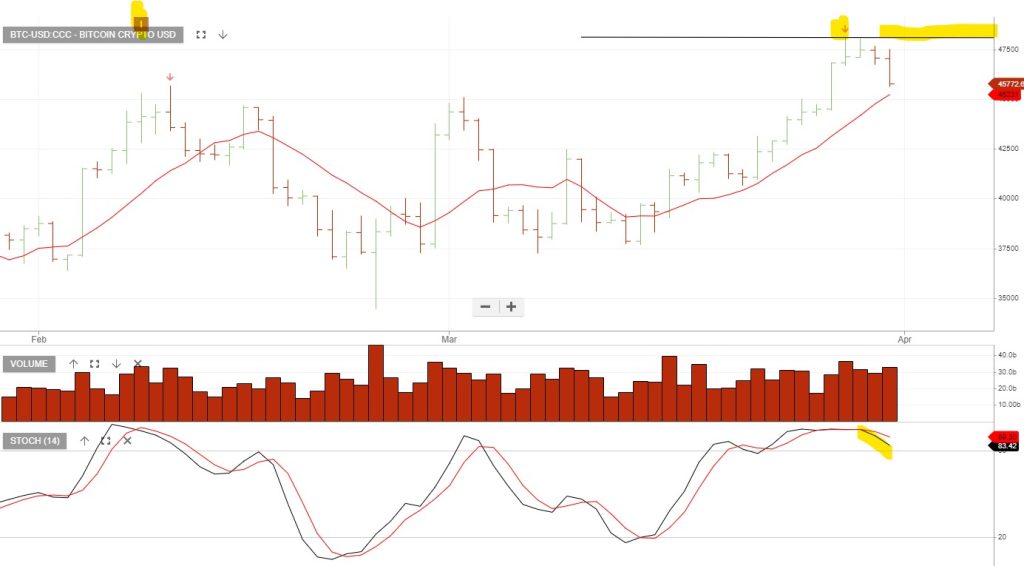

7/4/22 update: BTC-USD has rolled over and the technical setup remains negative.

The rebound in the NASDAQ has been sharp and it’s possible we’re now looking at a level of overhead resistance. For crypto investors, this provides an opportunity to consider hedging or an outright short position.

The strategy requires a stop loss which means any short exposure is closed out if the market rally continues.

Coinbase is a NASDAQ listed stock, Coinbase Global, Inc., branded Coinbase, is an American company that operates a cryptocurrency exchange platform.

The company is part of our Crypto Infrastructure list and model portfolio constituents. After 4 months of heavy selling, Coinbase is now finding increased buying support, and the technical indicator set up highlighted in the chart below, identifies our recent trading alerts.

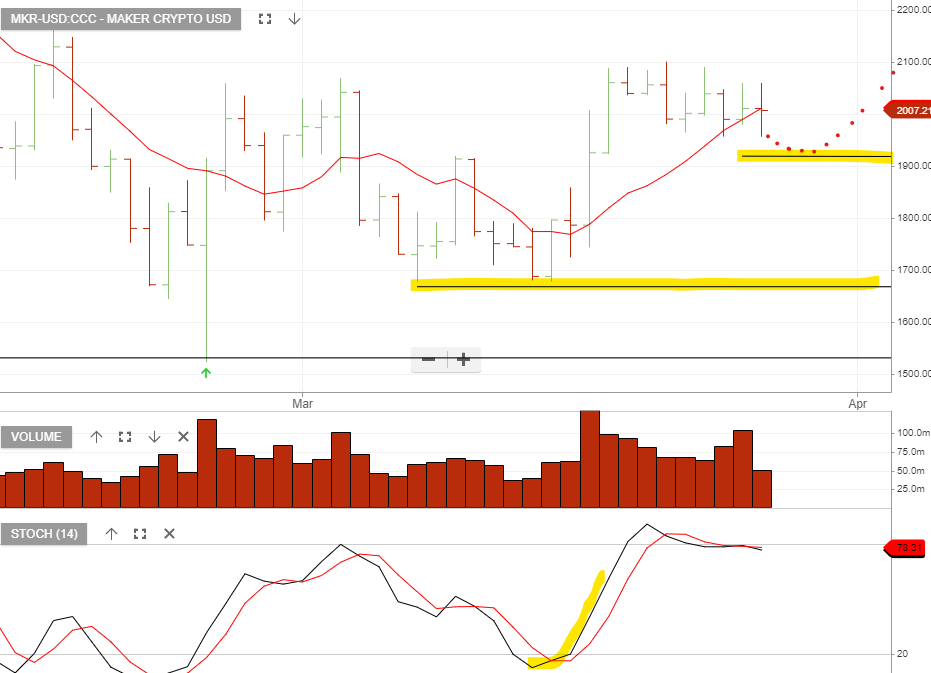

Maker goes onto our weekly trade setup watchlist

Chiliz was covered in last week’s edition of the weekly review video and we continue to look at the price action to hold above the $0.19 support

Biden issued a presidential executive order to the US Treasury and regulatory agencies to coordinate regulation of digital assets, protect consumers, mitigate systemic risk, and drive US competitiveness and leadership in, and leveraging off digital asset technologies.

Goldman Sachs Group is exploring offering over-the-counter bilateral crypto options, signaling the bank’s deepening participation in helping institutions trade digital-currency derivatives. Bilateral options allow trades to be customized so that crypto holders such as hedge funds and Bitcoin miners can hedge risks or boost yields.

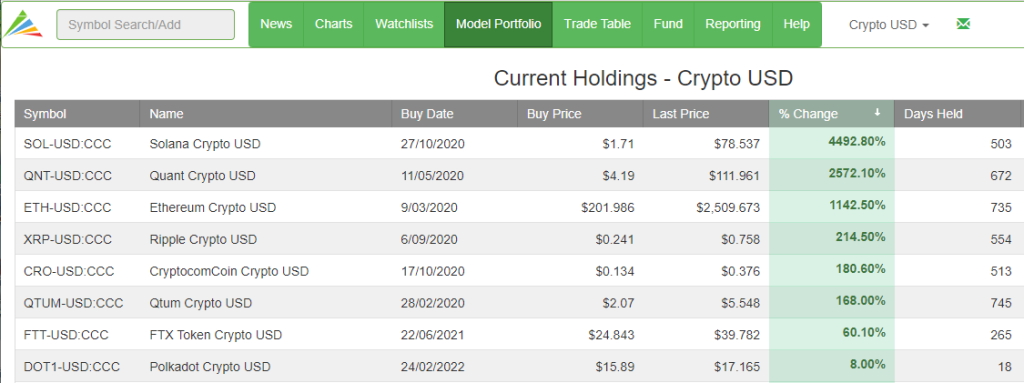

Our New Crypto Model Portfolio:

Create your free trial today https://www.investorsignals.com/register for more information call 1300 614 002.