Z Scaler

Zscaler, Inc. – Common is under Algo Engine buy conditions.

Zscaler, Inc. – Common is under Algo Engine buy conditions.

Micron Technology, Inc. – Common is under Algo Engine buy conditions.

Advanced Micro Devices, Inc. – Common is under Algo Engine buy conditions.

NVIDIA Corporation – Common is under Algo Engine buy conditions.

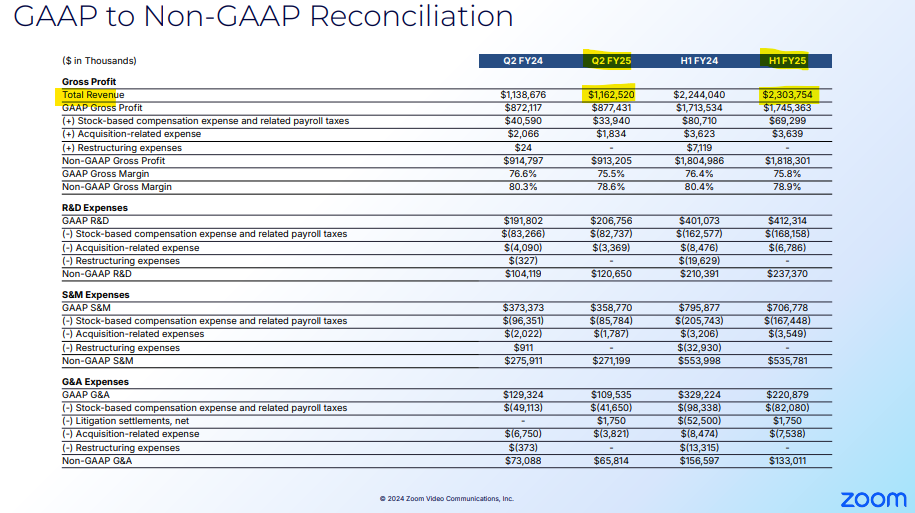

Zoom Video Communications, Inc. – Class A Common surged 17% after delivering better-than-expected 2Q FY2025 results and raising forward guidance.

NVIDIA Corporation – Common is under Algo Engine buy conditions.

The company is expected to report fiscal second-quarter 2025 results on August 28th, and analysts expect another robust quarter for the company. Earnings and revenue are expected to more than double versus a year ago, to $0.65 per share on revenue of $28.7 billion.

In case you missed it, you can watch last night’s webinar here.

SMCI:NAS reported FY24 results with a 109% increase in top-line revenue, at $14.9B vs $7.1B a year before.

FY25 revenue is forecast to be up 90% to $28 billion.

HON:NAS is rated a buy at $190.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.