US Earnings

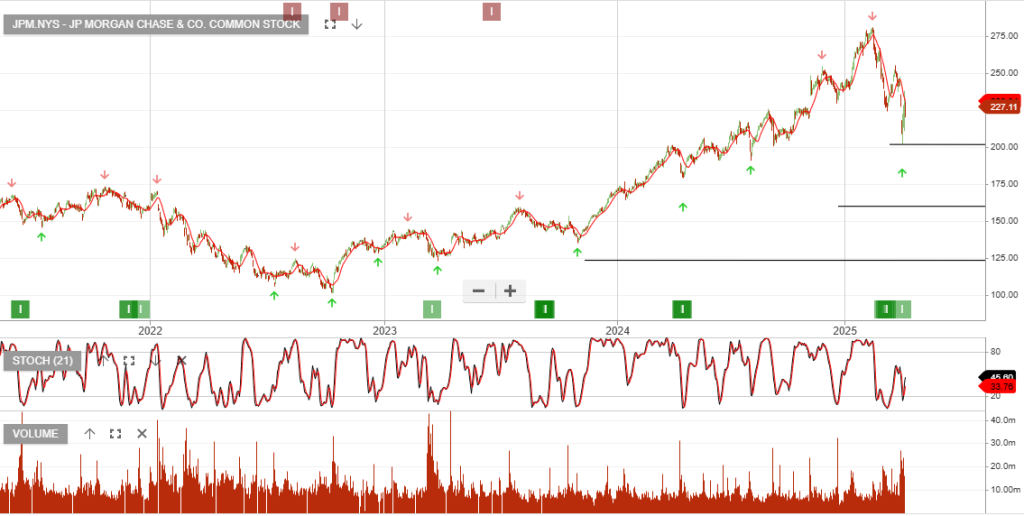

It’s the first-quarter earnings season, and Morgan Stanley, Wells Fargo, JP Morgan, and BlackRock are set to report their financial results.

It’s the first-quarter earnings season, and Morgan Stanley, Wells Fargo, JP Morgan, and BlackRock are set to report their financial results.

Key data will be released this week, starying on Tuesday, April 1, with the ISM Manufacturing report, Wednesday the ADP private payroll reports, ISM services report on Thursday and of course, Friday morning will bring us the BLS job report.

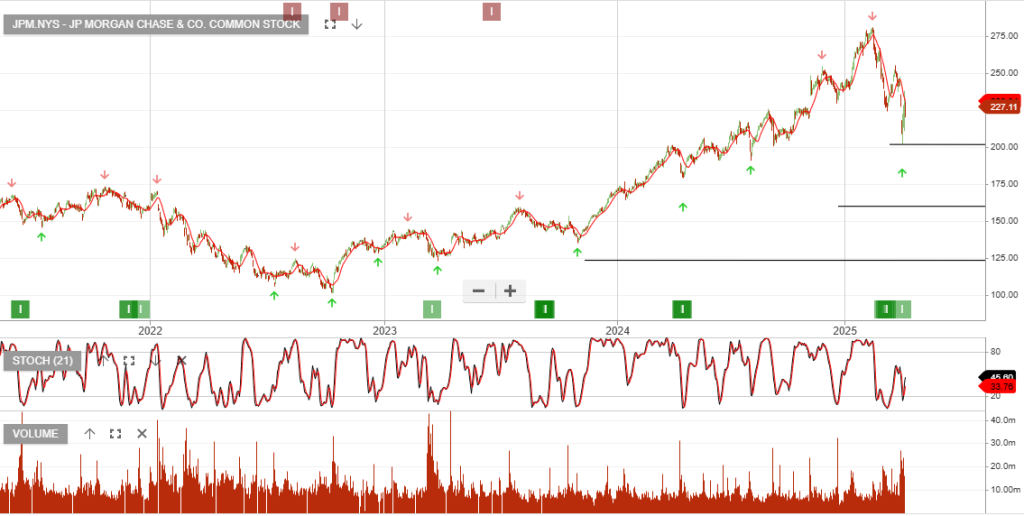

Early economic data for the first quarter of 2025 is pointing towards negative growth. Gross domestic product is on pace to shrink by 1.5% for the January-through-March period.

Annualized GDP growth will likely slow from 2.3% to 1.3%.

Monday, March 3 – Okta and GitLab

Tuesday, March 4 – CrowdStrike and Sea Ltd.

Wednesday, March 5 – Marvell Technology and Zscaler

Thursday, March 6 – Broadcom and Costco Wholesale

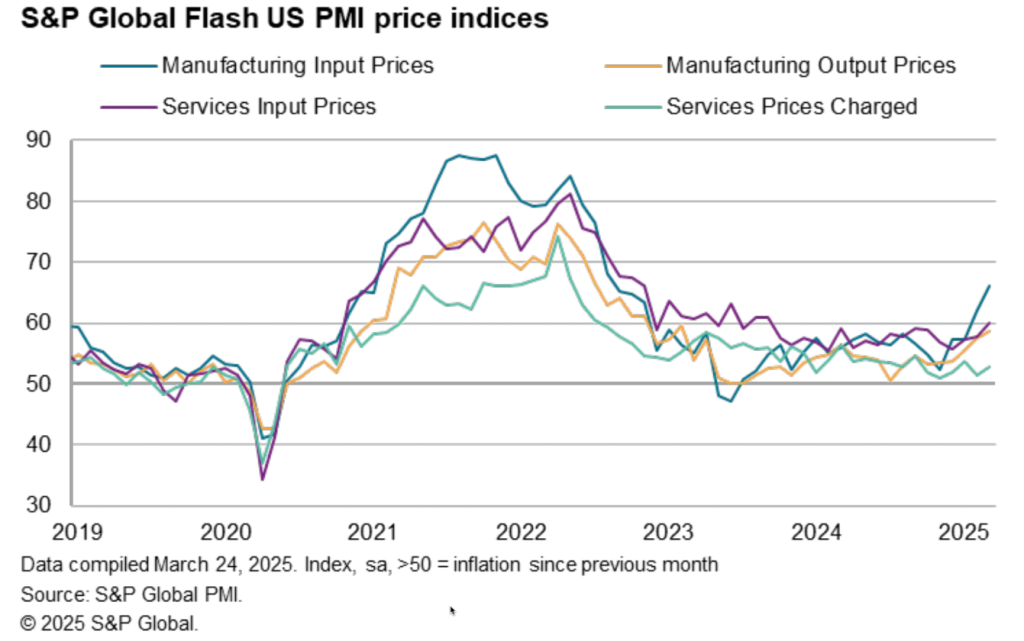

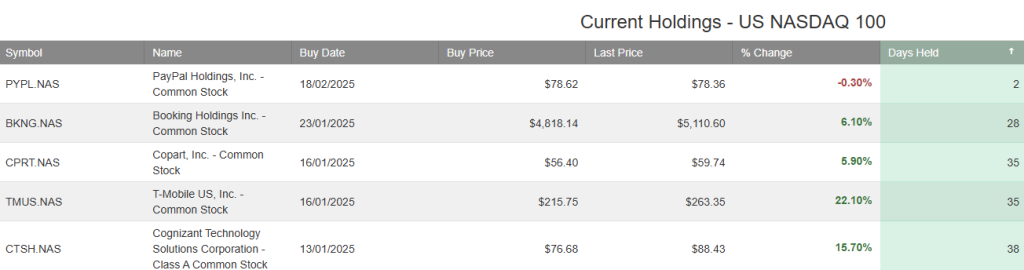

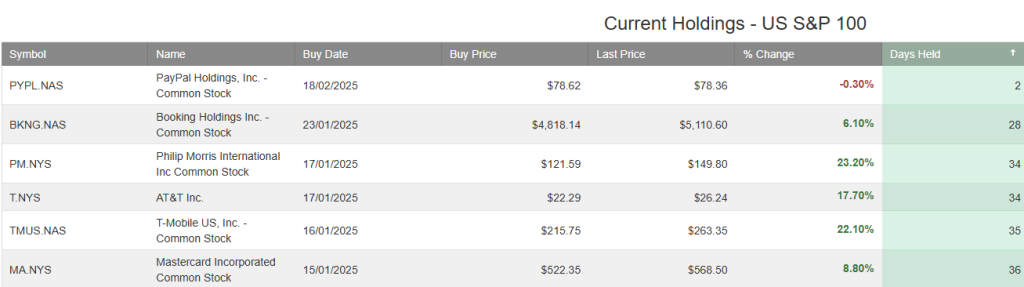

Our current holdings include…

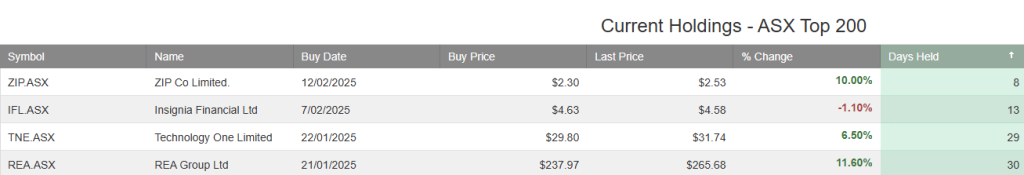

Our current holdings include…

Our current holdings include…

ASX:QCOM has a forward revenue growth of 8% with EPS projected to grow 13% in 2025

PayPal Holdings, Inc. – Common is under Algo Engine buy conditions. PayPal generated $8.4B in revenue in Q4’24, operating income was $1.5B, +2% year-over-year.

PayPal reported strong Q4 earnings, showing growth in active accounts, free cash flow, and operating income margins, and the board approved a $15B stock buyback authorization.

PayPal is trading at 14x P/E.

Guidance FY25: PayPal expects up to 10% year-over-year growth and an adjusted EPS range of $4.95-5.10 per-share.

Invesco PHLX Semiconductor is under Algo Engine buy conditions.