Crypto Trade Table

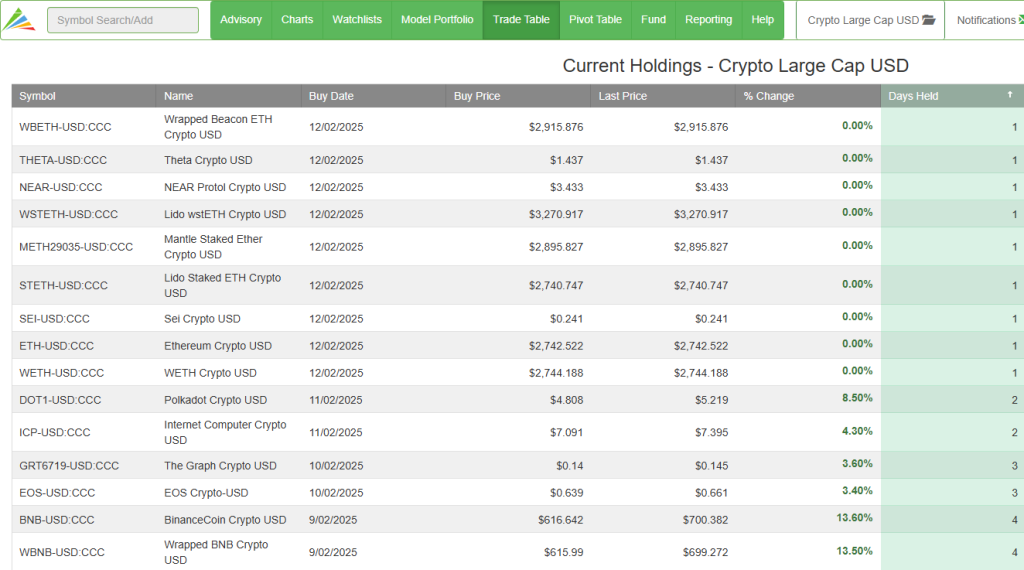

Our large-cap trading model has added nine new positions.

Our large-cap trading model has added nine new positions.

Meta, Amazon, Alphabet and Microsoft intend to spend as much as $320 billion combined on AI technologies and datacenter buildouts in 2025. That’s up from $230 billion in 2024.

Amazon offered the most ambitious spending initiative, aiming to spend over $100 billion.

Amazon is under Algo Engine sell conditions, and we’ll examine the stock more closely following a price retracement back toward $200.

Shopify Inc. Class A Subordinate Voting is under Algo Engine buy conditions.

The Q4 2024 results showed revenue growth of 31% year-over-year to $2.81 billion, which beat consensus. The company reported a net income of $1.29 billion compared to $657 million a year ago, and adjusted net income was $458 million compared to $337 million a year ago.

P/E of 92x makes this an expensive growth stock.

NAS: GOOG is under Algo Engine buy conditions.

Google Search accounted for 56% of revenue, with 12.5% YoY growth; YouTube grew by 14%, and Cloud by 30%. Other bets showed 7.8% YoY growth. Alphabet trades at 21 x earnings against the NASDAQ 100 at 28 x EPS.

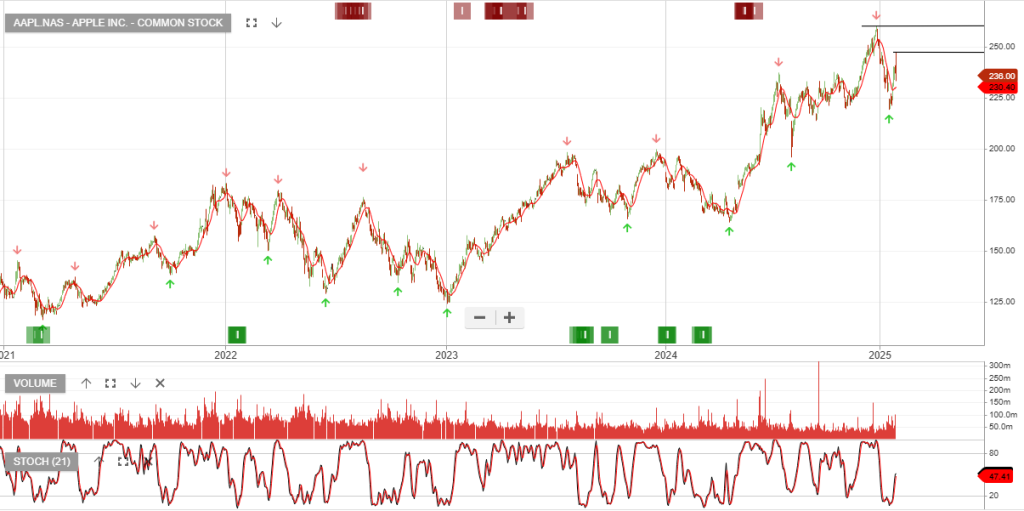

Apple Inc. – Common is under Algo Engine sell conditions.

Q1 2025 earnings: $124.3 billion in total revenue, YoY a 3.95% increase. Products increased by 1.56% YoY to $97.96 billion, while services grew by 13.94% YoY to $26.34 billion.

Apple increased its gross profit by 6.23% YoY to $58.28 billion. On the bottom line, AAPL generated $36.33 billion of net income, a YoY increase of 7.12%, and EPS increased by 13.73% or $2.41 per share.

Microsoft Corporation – Common

Microsoft’s revenue grew 12.3% year over year in the fiscal second quarter, which ended on Dec. 31. Net income of $24.11 billion was up from $21.87 billion in the same quarter a year ago.

The Magnificent 7 will be in focus, with results from Apple, Tesla, Microsoft, and Meta due out soon.

This week, key earnings reports from Comcast and Intel will show if the turnaround is underway.

RTX topped Q4 estimates, Reporting 9% revenue growth to $21.6 billion and a19% increase in earnings EPS to $1.54 (adjusted).

Lockheed Martin fell after missing earnings. Revenue eased to $18.62 billion, marking three quarters of declining sales growth and earnings of $2.22 per share.

Lockheed Martin guided 2025 earnings between $27 and $27.30 per share. The company forecasts net sales range from $73.75 billion to $74.75 billion.