Bluescope Steel – Algo Sell Signal

BlueScope Steel is under Algo Engine sell conditions and we see price resistance at $13.00.

Momentum is trending lower with a bearish technical structure suggesting further downside risks.

BlueScope Steel is under Algo Engine sell conditions and we see price resistance at $13.00.

Momentum is trending lower with a bearish technical structure suggesting further downside risks.

Dow Jones, S&P500 and the XJO index are all displaying Algo Engine sell conditions and the short term price action has now turned negative.

The NASDAQ remains under Algo Engine buy conditions, however, the shorter-term indicators have now also turned negative.

Further softening of conditions in the residential and civil construction markets has seen selling pressure hit Lendlease and Boral.

Both are high-quality businesses and investors should look for an opportunity to capitalize on oversold conditions.

We continue to watch the short-term momentum indicators for a turn higher.

Commonwealth Bank of is under Algo Engine sell conditions and we’ll get insight into the earnings picture when the company reports their FY19 results on Wednesday 7th August.

We remain concerned about the declining profitability in retail banking.

With the stock trading on a 5% dividend yield, we expect to see buying support develop closer to the $75 price range.

Woodside Petroleum is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

The share price has found support at $34 and the short-term indicators have now turned positive.

Iluka Resources is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

The share price has found support at $9 and the short-term indicators have now turned positive.

GPT is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio. The share price is up 30% since being added back in October 2018.

The recent price retracement from $6.50 to $6.10 is temporary weakness following the rights issue this month. We suggest investors take advantage of the pullback in the share price and begin accumulating.

GPT goes ex-div $0.1285 on the 28th December 2019.

Cimic Group is under Algo Engine sell conditions since forming a lower high back in February at $50.

A weak first-half earnings result has seen the sell-off accelerate in the past few days. We’d normally give this name a wide berth, whilst we wait for confirmation of earnings and in particular, free cash flow improvements.

However, we draw your attention to the “up to 10%” share buyback which the company will recommence in August.

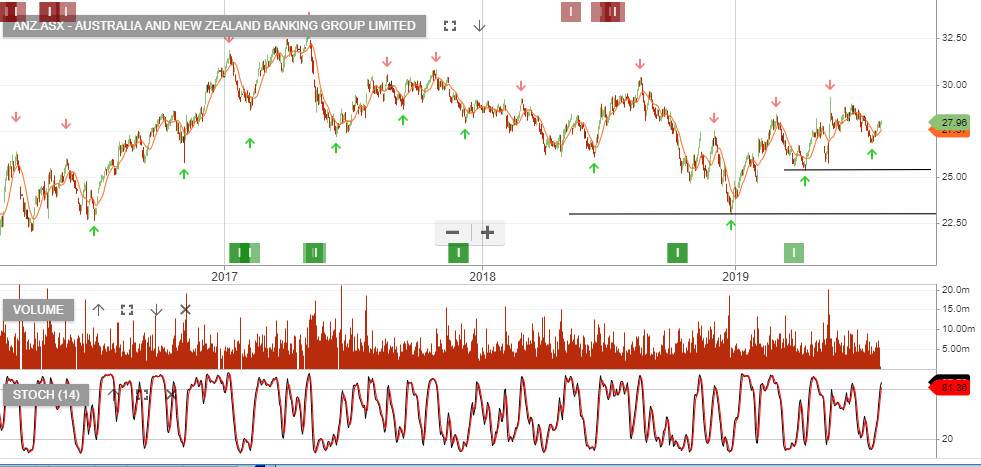

Australia and New Zealand Banking Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Based on $1.60 of dividends per share we have ANZ on a forward yield of 5.8%. The prospect of up to $2.5bn in share buybacks starting next year underpins downside risks.

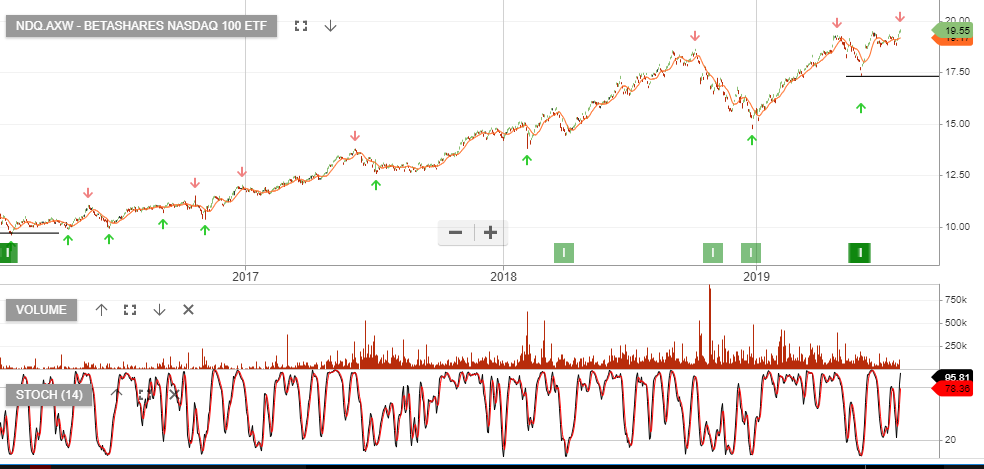

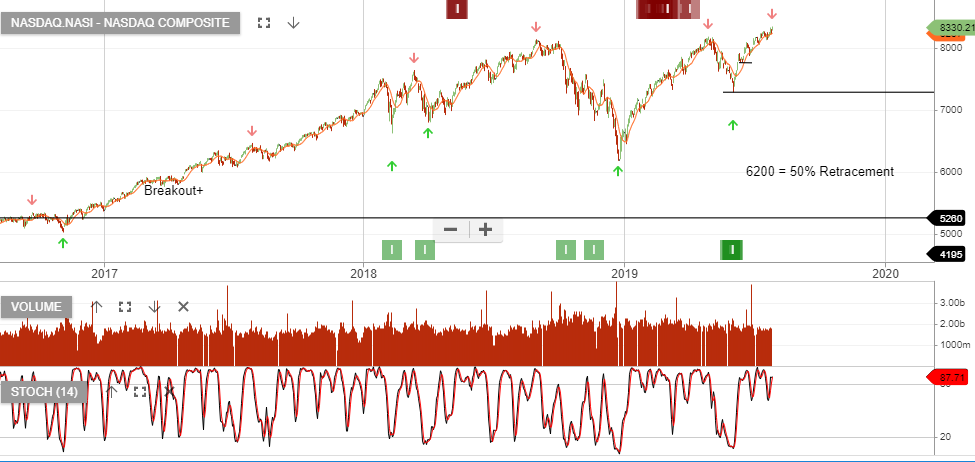

The NASDAQ index is under Algo Engine buy conditions following the higher low in May. Since the signal was generated, the index has rallied 15% and remains the only major index still under buy conditions.

The instrument to take advantage of the above trade is best represented in the Betashares Nasdaq 100