Buy Caltex & sell covered call options

We consider Caltex a buy at $31 and recommend selling covered call options to enhance the income.

Caltex goes ex-div $0.60 on the 11th of September.

We consider Caltex a buy at $31 and recommend selling covered call options to enhance the income.

Caltex goes ex-div $0.60 on the 11th of September.

Our Algo Engine generated a buy signal in Tabcorp at $4.20 and we expect to see the share price trading in the $5.00+ range, following the August earnings result.

We’ve been holding Crown Resorts following the recent Algo buy signal at $12.41, back in February.

Crown has a renewed focus on cost control and the supportive back drop of a lower Australian dollar, as well as, increased inbound tourism should lead to the August earnings result surprising on the upside.

Crown goes ex-div $0.30 on the 21st September.

It’s been about 3-weeks since QAN released its Q3 update, which showed a 7.5% increase in revenue versus the previous quarter and an increase in capacity.

Since then, the share price has reached a 10-month high of $6.45 before slipping lower on the recent spike higher in crude oil/ fuel prices.

QAN was added to our Top 50 model portfolio last July at $5.24. We suggest looking for a pullback into the $6.00 area to add to long positions.

QANTAS

QANTAS

Our Algo Engine generated a buy signal in Graincorp on Friday, following the price action forming a “higher low” pattern at $7.58

We suggest buying GNC with stop-loss below $7.55

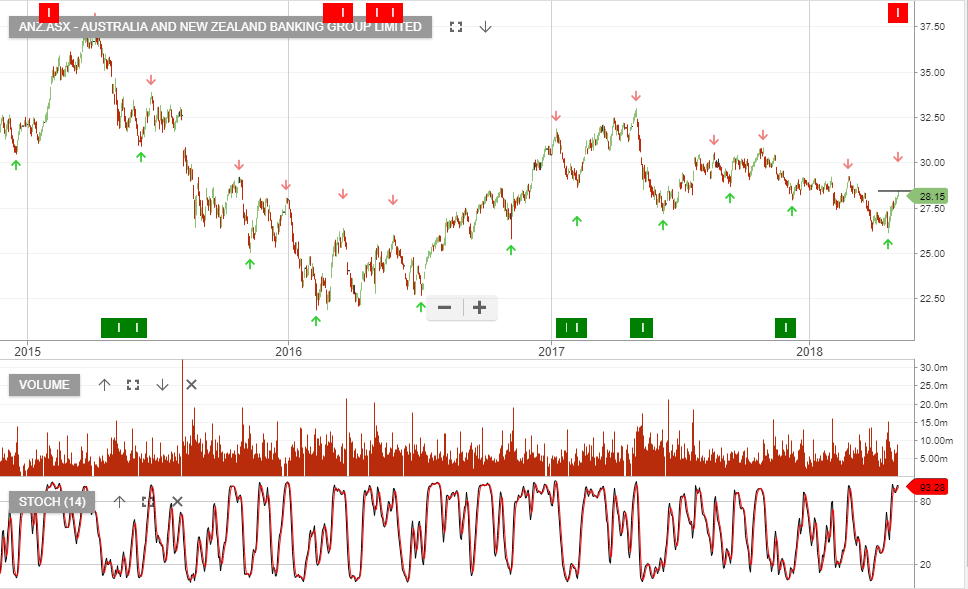

We expect the major banks to begin forming “lower high” patterns in the near-term and the Algo sell signals should be observed.

We advise holders of bank stocks to either sell covered call options and enhance the yield, or take the opportunity to rebalance portfolios from any overweight exposure to the sector.

Pilbara Ports Authority released its April shipping figures for its ports in the Pilbara region, which delivered a total of 59.1 million tons for the month, a seven per cent year-over-year increase.

Iron ore exports from Port Hedland remained consistent, up 1 per cent from April 2017 figures to 42.6 million tons.

These better-than-expected export numbers helped lift FMG over 4% for the week to reach a 4-month high of $4.95.

FMG is part of our ASX Top 50 portfolio and we see the next near-term target in the $5.50 area.

Fortescue Metals Group

Fortescue Metals Group

The S&P/ASX 200 Index finished the week up 0.88%.

The best performing sector was the Materials sector, up 3.0% and the worst worst performer was the Telecoms sector, down 1.0%.

The XJO looks over-extended and ready for a pullback.

Shares of TAH and SGR have both firmed in early trade as several broker notes have upgraded the forward price targets of the shares.

The common theme of the research is the suggestion that investor’s negative sentiment has been overstated and that upcoming growth and profit numbers will support higher multiples.

Our ALGO engine triggered buy signals on both of these names in early April at $4.22 and $5.11 respectfully.

Internal momentum indicators are improving on both stocks and we see the next area of resistance at $5.20 for TAH, and $5.90 for SGR.

With less than 2-weeks until shareholders vote on the $27 billion takeover by Unibail-Rodamco, WFD shares are trading at $9.15, 85 cents below the $10.00 per share offer.

We haven’t heard any indication that shareholders will reject the offer and see scope for a quick, short-term rally into the $9.75 area before the vote at the AGM on May 24th.

As such, we suggest investors can buy WFD shares in their cash accounts, as well as on the Saxo Go CFD platform.

Westfields