Algo Update – Crown

Crown has made an aggressive push higher after finding renewed buying support at the $11.93 low in yesterday’s session.

Our Algo Engine generated a buy signal in Crown on the 28/9/17 at $11.13

Crown has made an aggressive push higher after finding renewed buying support at the $11.93 low in yesterday’s session.

Our Algo Engine generated a buy signal in Crown on the 28/9/17 at $11.13

If you missed our Webinar last night, then you can catch up by watching it here.

Our next Webinar is this Thursday night – Register Now.

Join us in this webinar as we explain the new features and best ways to navigate through the research, charts, algo engine & new model portfolio features. You’ll also be invited to a 30-day free trial of the technology.

Don’t miss the opportunity to build your understanding on how to benefit from our new technology, as your window to the market.

Join us in this webinar as we look at shorter-term trading strategies for both long & short positions & we review how we utilise the Saxo Trader Go platform to take advantage of trading opportunities within the ASX top 50 stocks. We explore the features, how to place and manage orders and look at how short term traders can use the Investor Signals’ research to trade both long and short signals using CFD’s.

Don’t miss the opportunity to learn how we apply proven techniques to shorter term trading on ASX 50 CFD’s.

Shares of the major banks have traded on both side of the ledger since the announcement of the Banking Royal Commission last week.

There’s been plenty of articles written about what the impact will be and what investors can expect from the share price and dividends from these blue-chip companies.

However, one of the areas of the banking business which has not received much press is the negative impact from increased funding costs for the banks from overseas lenders.

Over the last two years, CBA, WBC and the NAB have issued over $145 billion in long-term wholesale debt to overseas lenders.

This is up from just under $110 billion in FY 2015 and reflects the increased reliance that the local banks have on overseas lenders

We would expect the increased in funding costs, combined with lower domestic loan margins, to cap any protracted rallies in the local banks over the next 12 months.

Our ALGO engine triggered a sell signal for the CBA on November 10th at $80.90. This is in addition to the ALGO sell signals in SUN at $14.20 and BEN at $12.30.

CBA

SunCorp

Bendigo BAnk

Our ALGO engine triggered a sell signal for OSH on November 11th at $7.50.

Since then the share price traded as low as $7.00 last week.

A combination of the OPEC production agreement last week and the PNG LNG expansion this week has seen the share price rally back over $7.30.

We still prefer the Short side of OSH back below $7.00 on lower longer-term Crude Oil prices.

We suggest short-term investors look to sell OSH CFDs on our SAXO Go trading platform.

Oil Search

Shares of mining giant RIO Tinto are over 1% lower at $71.25 as company CEO, Jean-Sebastian Jacques expressed a negative view on the Chinese economy over the near-term.

While addressing investors in Sydney yesterday, Mr Jacques predicted a slowdown in construction, infrastructure growth and automotive demand from China over the next six months.

The company also announced that they would close some Iron Ore mines over the Christmas break as part of their “value over volume” strategy. Even with high-grade Iron Ore price firming over the last 6-weeks, we consider the CEO’s message a negative signal for RIO shares.

Our ALGO engine triggered a buy signal in RIO back in April at $61.40. Even though the ALGO engine has not triggered a sell signal, we suggest investors can take profits on long RIO exposure, sell a covered call to enhance cash flow, or go short the RIO CFD on our SAXO Go Platform

The next significant level on the daily charts is near the October low of $68.50.

RIO Tinto

ASX 200 REIT index was up 5.3% for the month of November, outperforming the broader ASX 200 index, which was up 1.6%.

The strong performance within the REIT’s can be attributed to the flattening yield curve and doubts over the reflation trade.

Our preference has been, WFD, SCG, GPT and the SLF property ETF.

Telstra’s future earnings are sensitive to delays in the NBN payments The latest announcement will see $600m in earnings pushed out to later years.

FY18 EPS reduces from $0.32 to $0.29. The good news is TLS has reiterated its $0.22 DPS guidance for FY18.

Further, we expect Telstra to develop additional long-term revenue streams through growth in Mobile as well as products within 5G and Big Data solutions.

However, as tempting as it is to accumulate TLS at these levels, it may prove prudent to wait for the “higher low” formation and the next Algo Engine buy signal.

US 3Q GDP grew faster than originally estimated, at 3.3%. The improvement was on the back of improved readings for business investment and government spending.

For the first time since 2010, the world economy is outperforming consensus exceptions and 2018 outlook for global GDP forecast now stands at 3.6 – 4.0%.

iShares Global 100 ETF is up 20% in 2017.

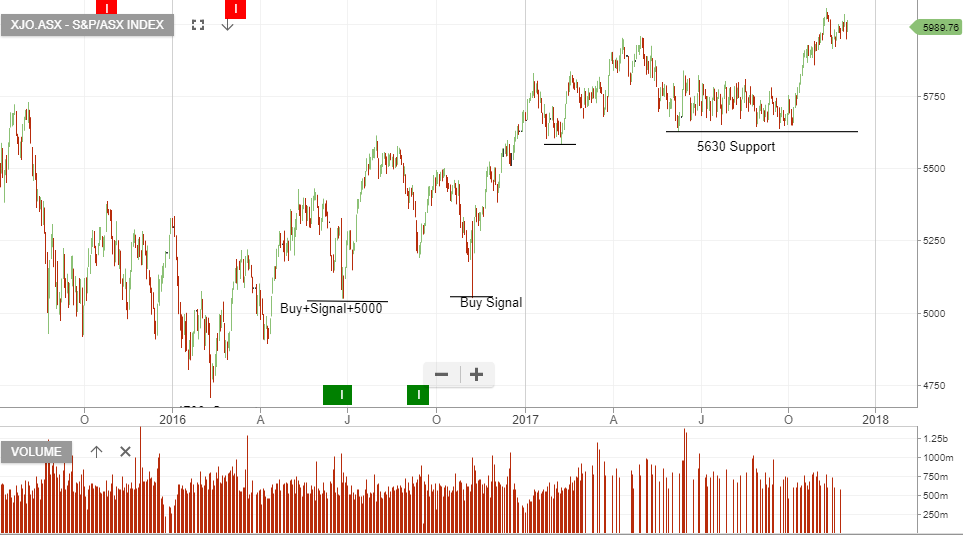

The S&P/ASX 200 Index finished the week to Friday up 0.12%.

The best performer was the Utilities sector, up 4.5% and the worst performer was the Materials sector, down 1.2%.

Our Algo Engine has triggered a number of buy signals in ORG, as the two year downtrend reversed and a new uptrend of “higher lows” commenced in early 2016.

The recent buy signal at $6.75 means the stock is still in our ASX 50 Model Portfolio, however, shorter-term investors may wish to consider taking profit, as the stock now looks fully valued.