The AUD/USD posted a 2.5-year high of .8125 on September 8th. On that day, the US 10-year bond yields had dipped to a six-month low of 2.03%

Since then, the 10-year yields have climbed higher and reached 2.19% in NY trade today. The AUD/USD has traded lower overnight and is testing support at .7980; a break of this level will give scope to the .7910 area.

There are many components of forex pricing but yield differentials will always have the biggest impact.

As such, if today’s domestic employment report posts lower than forecast, we expect to see more downside in the AUD/USD.

Investors looking to profit from a lower AUD/USD can buy the BetaShare ETF with the symbol: YANK.

YANK is an inverse ETF, which means the price of YANK increases as the AUD/USD trades lower. It also has a weighting of 2.5%, which means the unit price will fluctuate by 2.5% for every 1% change in the AUD/USD exchange rate.

With a current price of $12.60, we calculate that the price of YANK will be near $16.50 as the AUD/USD returns to the January low of .7160.

BetaShare ETF: YANK

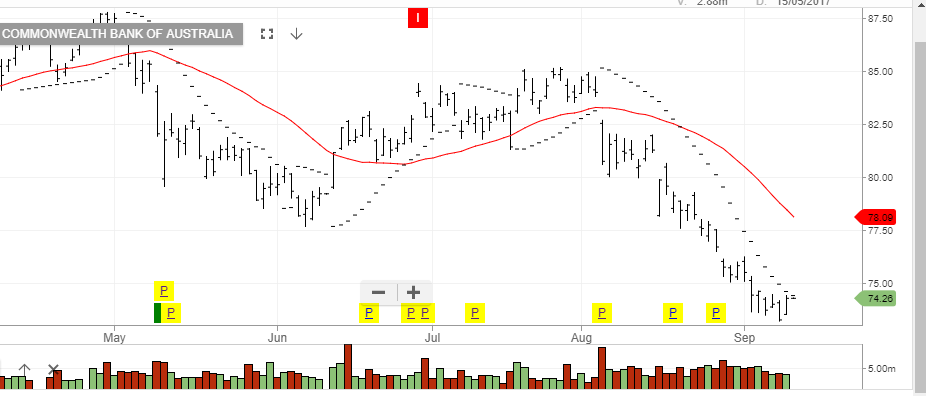

Commonwealth Bank

Commonwealth Bank