Aristocrat Leisure

extended its current on-market share buyback, allowing up to an additional $750 million of capital to be returned over a further 12-month period ending March 5, 2027, to take the total program to up to $1.5 billion.

extended its current on-market share buyback, allowing up to an additional $750 million of capital to be returned over a further 12-month period ending March 5, 2027, to take the total program to up to $1.5 billion.

Aristocrat Leisure delivered a solid FY25 result, posting healthy yoy growth. Revenue was up 9% and EBIT +12%.

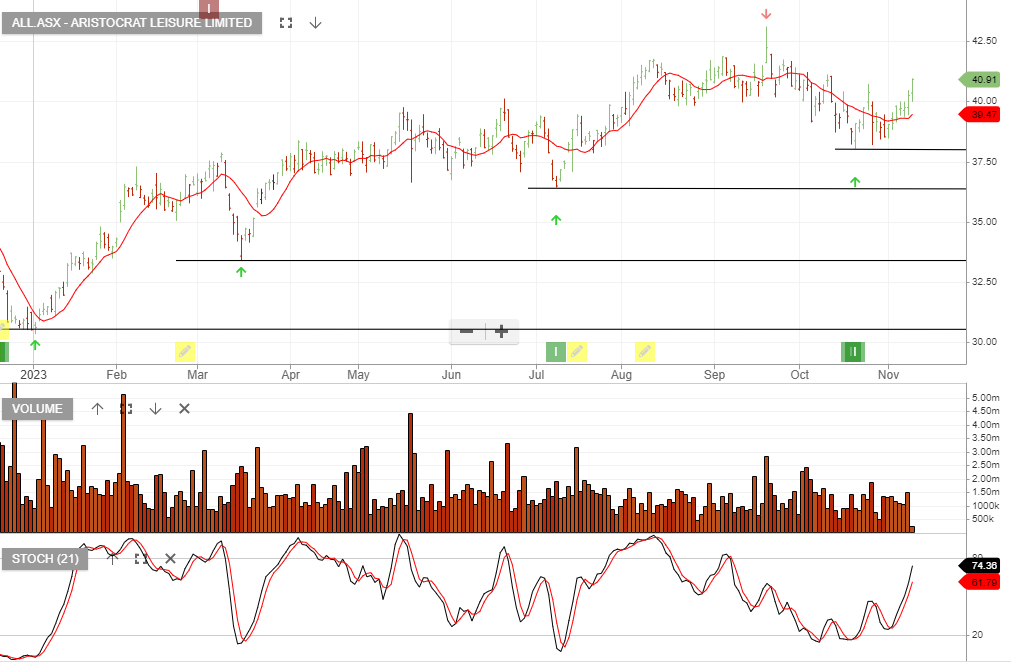

Look for buying interest to rebuild, and we’ll revisit the entry point once the price action is above the 10-day average.

Aristocrat Leisure is under Algo Engine buy conditions. We promoted the purchase of the stock only last week at $39.50 and following today’s earnings release, the share price has jumped 10%+.

Aristocrat reported EBITA of $1,027 million, with lower than expected corporate costs driving most of the earnings beat. The buyback has been extended by a further $350 million. We expect growth in FY24 to be 10 – 15%.

Aristocrat Leisure is now in our ASX 100 model portfolio.

Aristocrat Leisure is nearing support; look to buy on the cross above the 10-day average.

Aristocrat Leisure continues to build positive momentum following the switch to Algo Engine buy conditions in July.