Algo Short Signals – CBA, SUN & QBE

QBE, SUN and CBA are recent examples of the “lower high” formation being identified by the Algo Engine.

QBE, SUN and CBA are recent examples of the “lower high” formation being identified by the Algo Engine.

After a month of speculation, law firm Maurice Blackburn filed a statement of claim in Federal Court yesterday saying the CBA board knew of potential AML breaches in 2015 and failed to tell shareholders.

It’s estimated that the class action could cost the bank hundreds of millions if the suit proves successful. This doesn’t include the AUSTRAC litigation which will begin in November.

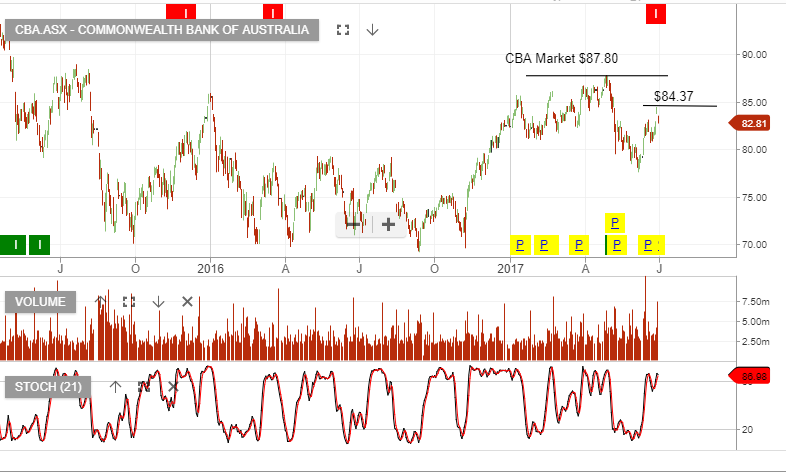

Shares of CBA are down fractionally at $76.40 in early trade. Our ALGO engine triggered a sell signal for CBA at $84.20 on July 4th. Since then the shares have posted a low of $73.20 on September 8th.

It’s our base case that the recent recovery in the share price is corrective and that slower loan growth combined with the potential litigation will weigh on the shareprice

Technically, the next key support level is found at around the $71.00 level.

Commmonwealth Bank

Shares of CBA opened higher in early trade on the news that the bank has sold its troubled insurance business to the Chinese owned AIA Group for $3.8 billion.

The sale of Comminsure Life was largely considered a fire sale considering several problems involving denying payments to policyholders and pressuring medical assessors to reject client’s claims.

Our ALGO engine gave a sell signal in CBA on July 4th at $84.00. We consider this bounce in price as corrective and still see scope for CBA shares to return to the low $70.00 handle.

Commonwealth Bank

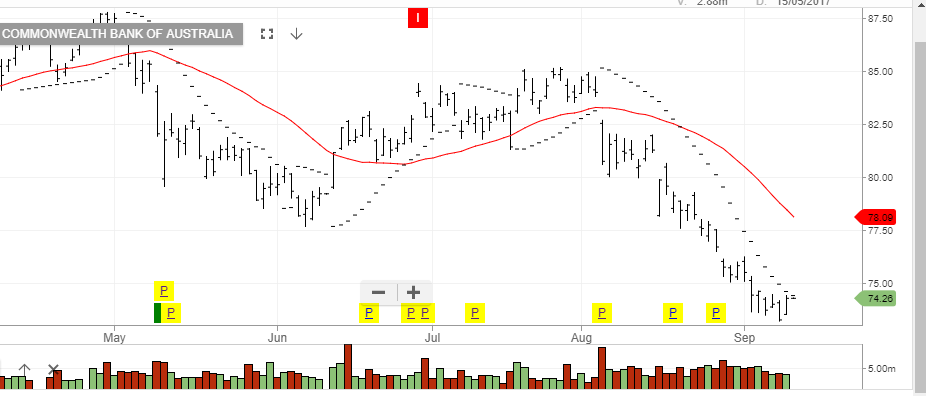

Shares of CBA have traded back over $75.00 in early trade on the back of solid gains in the US banking sector on Wall Street.

However, we see this as a brief corrective move within the broader 8% decline over the last month.

A report from Credit Suisse this morning suggests that the CBA could face a $200 million increase in its annual operating costs over the next two years because of legal fees and related costs to defend the AUSTRAC money laundering accusations.

Our ALGO engine triggered a sell signal in CBA on July 4th at $84.00. We see solid technical resistance in the $75.60 area and more range extension to the $70.00 handle over the medium term.

Commonwealth Bank

Commonwealth Bank

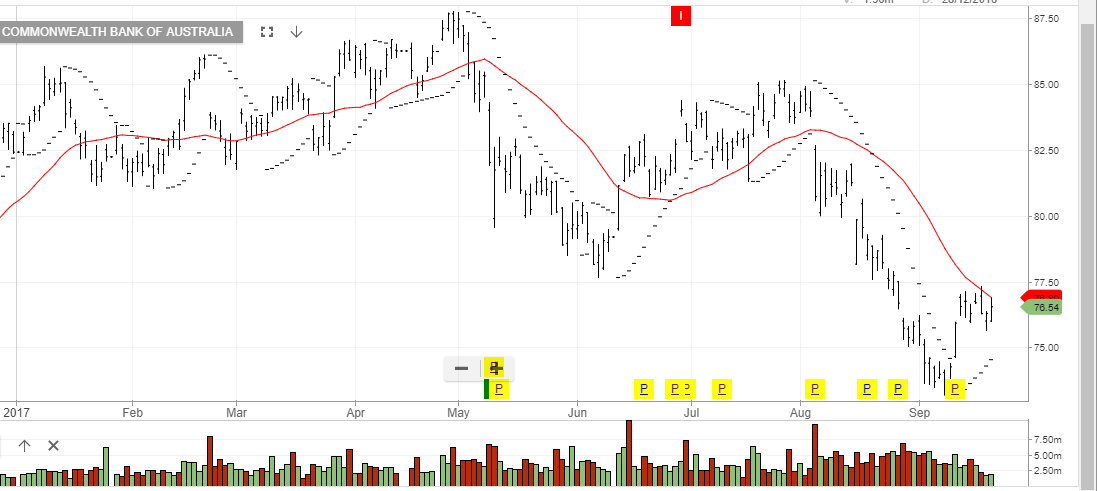

Shares of CBA have posted a new low for the year at $76.55 as APRA announced that they will be setting up an inquiry after a series of problems prompted concerns about the bank’s culture, leadership and accountability.

This is not a good addition to CBA’s current AML allegations from AUSTRAC and a class action suit filed on the behalf of shareholders.

On balance, we don’t see any obvious catalyst to drive any of the domestic banking names higher and CBA now has the weakest technical structure.

The next key price support for CBA will be found near the October 2016 area near $75.00.

Commonwealth Bank

Commonwealth Bank

Our Algo Engine flagged the negative technical structure in leading financials firms Commonwealth Bank and Goldman Sachs. These are both leading industry names which have bearish price action developing.

Investors should remain on the short side of these assets.

The charts below illustrate the recent Algo Short signals along with the resistance or selling pressure, which is now building.

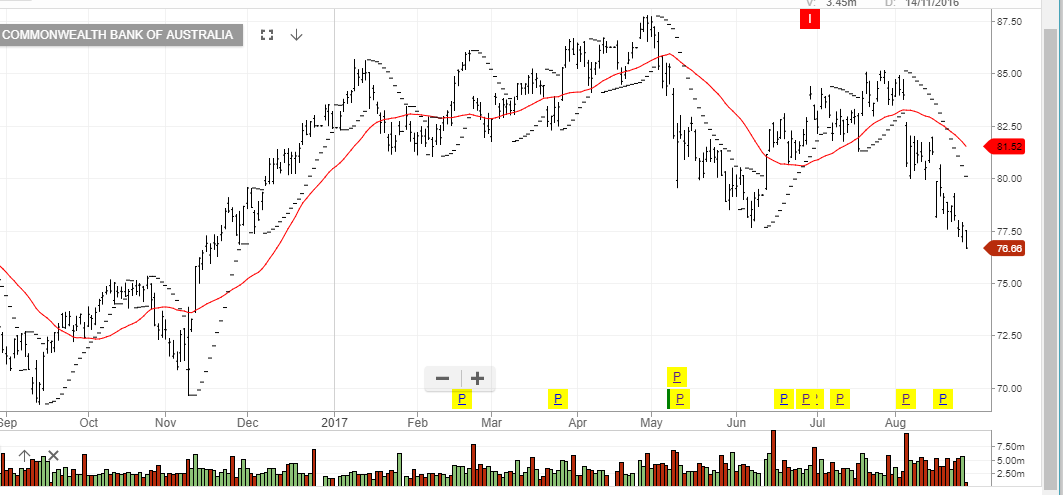

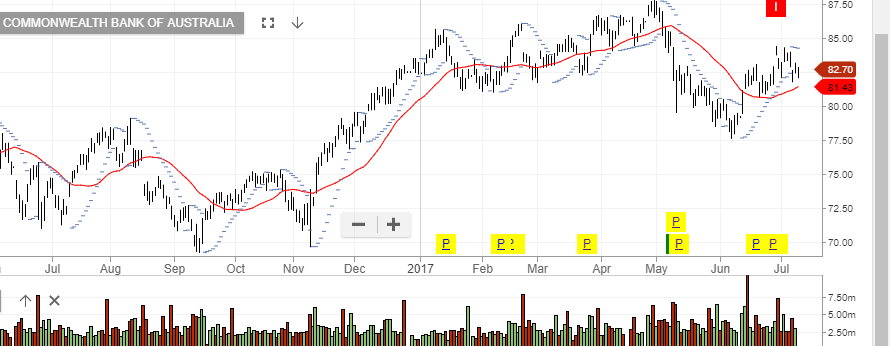

On June 29th, when CBA was trading at $84, our Algo Engine generated a sell signal, as CBA formed a “lower high” structure.

Since then, selling pressure has gradually increased with the $84 to $85 range forming the resistance of the bearish pattern.

Our ALGO engine triggered a sell signal in CBA on June 29th at $84.10.

Since then the stock has traded as low as $81.80 and has a clear downward bias. In addition, the share price of MQG has also moved lower since late-June and internal indicators appear to be picking up momentum on the downside.

The Aussie banks, in general, look to have a downward bias relative to the prices seen in late-May.

As such, we see the next technical support target for CBA at $78.50 and at $85.90 for MQG.

For more specific chart analysis of the local banking sector, send us an email or give us a call.

CBA

MQG

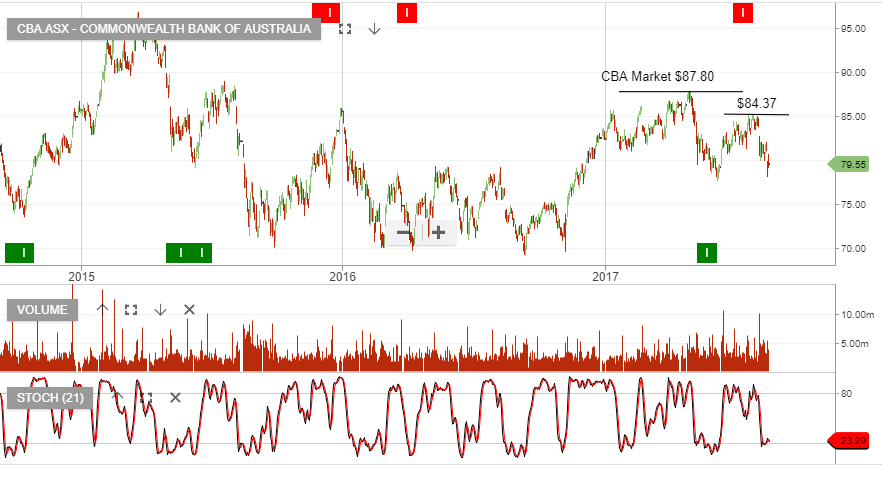

Our Algo Engine has triggered a short signal in CBA.

Thursday’s top in CBA at $84.37 creates a “lower high formation” following the prior high made in early May.

We remain cautious across the banking names and see the current counter trend rally as topping out at or near the current levels.

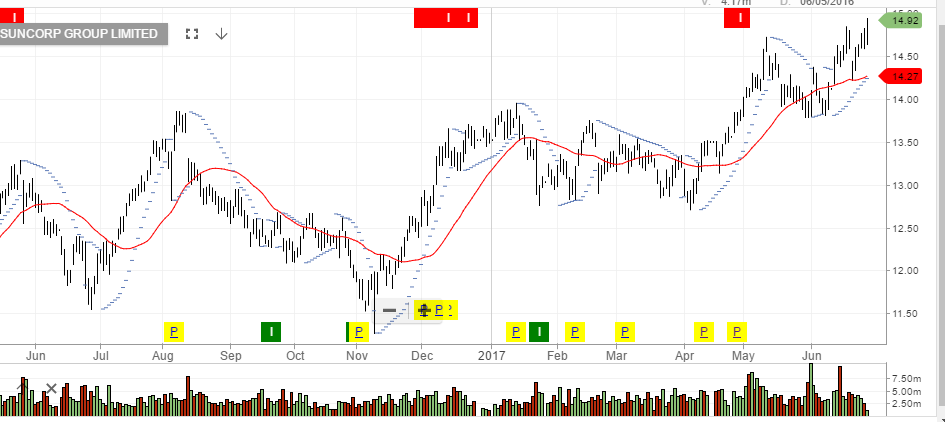

Since Treasurer Scott Morrison announced a banking levy in the May 9th budget, banking stocks have been sold off across the board.

It’s become clear that a fair percentage of this investment flow has rotated into the local Insurance names with IAG and Suncorp both posting material gains since early May.

We hold both of these stocks in client portfolios and they are now up 12% and 8% since mid-May, respectfully.

With respect to the re-valuation in the banking shares, NAB has posted a fresh low at 29.00 in early trade today.

Both WBC and ANZ are approaching the lows posted in early June, while MQG and CBA have held up better but are still pointing lower.

On balance, we continue to expect to see rotation out of the banking names to the benefit of the insurance stocks.

IAG

Suncorp

NAB

Or start a free thirty day trial for our full service, which includes our ASX Research.