Bank Results – Weak Revenue Trends

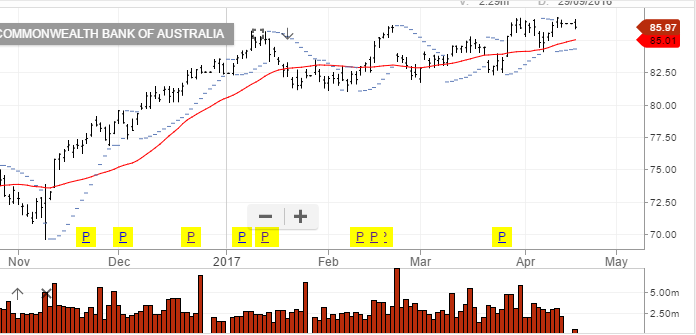

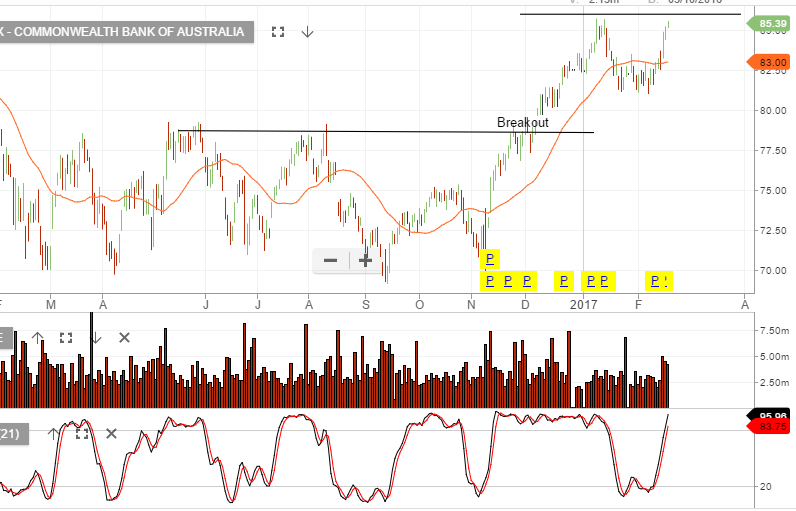

The soft underlying revenue trends which impacted the other major bank

results over the last week were obvious in CBA’s Q3 result. Offsetting the weak revenue trends in the major banks has been a strong performance on asset quality.

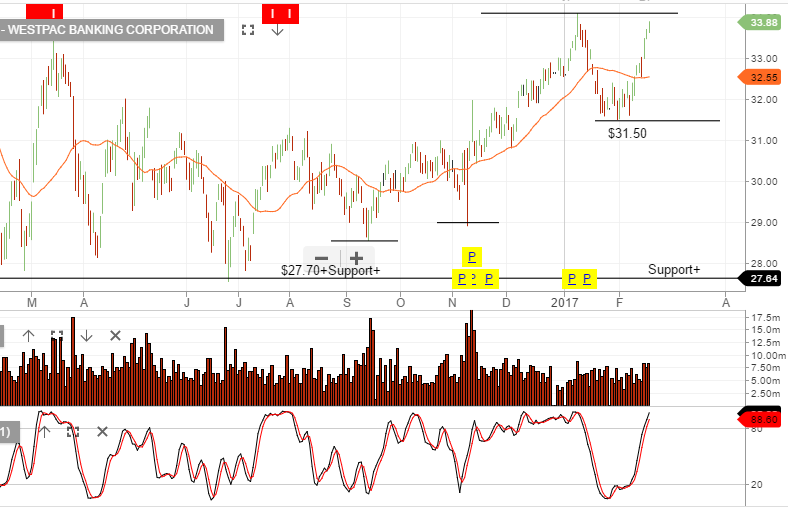

We see downside risks building around regulatory change & economic weakness leading to higher bad debts.

CBA FY18 forecasts net profit to remain flat at $9.8b, EPS $5.50, placing the stock on a forward yield of 4.9%.

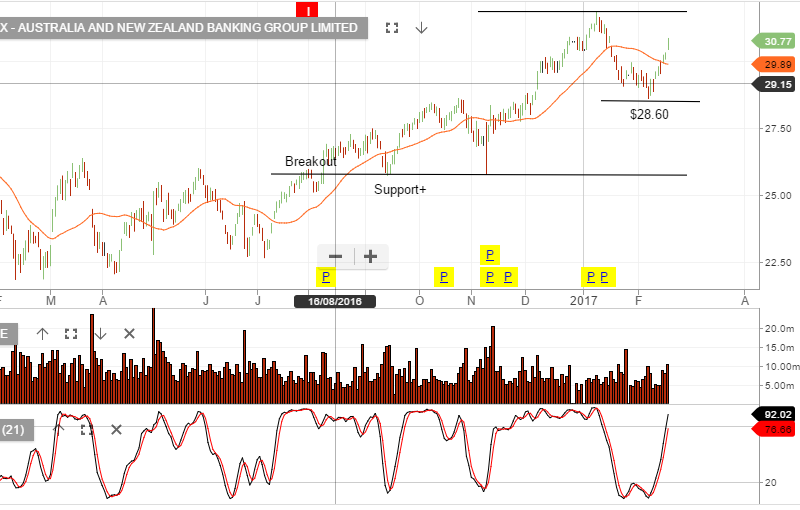

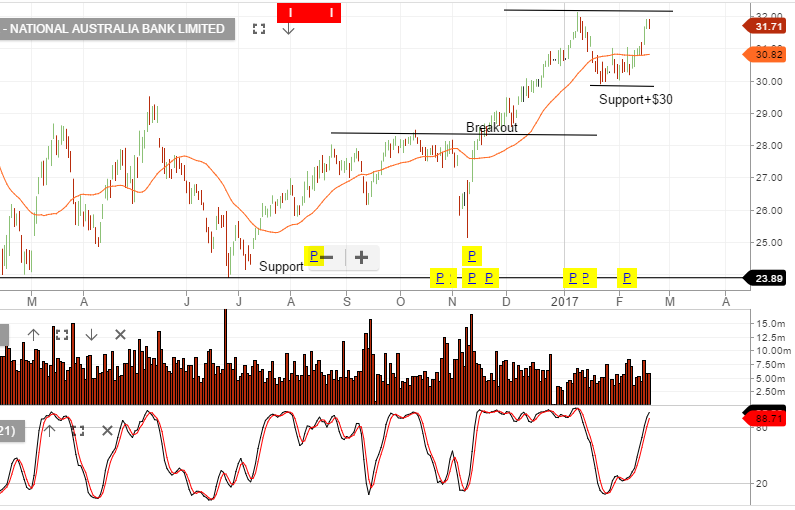

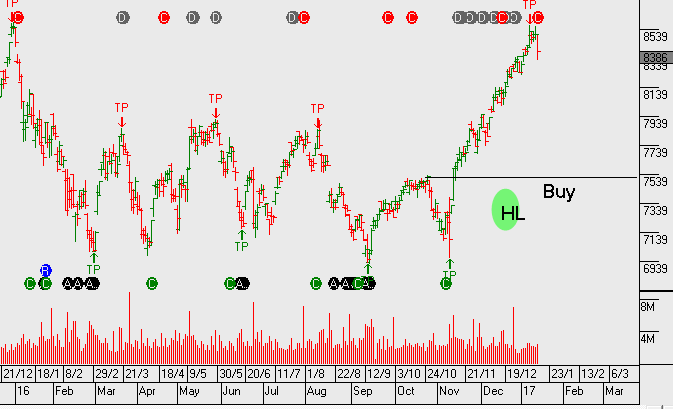

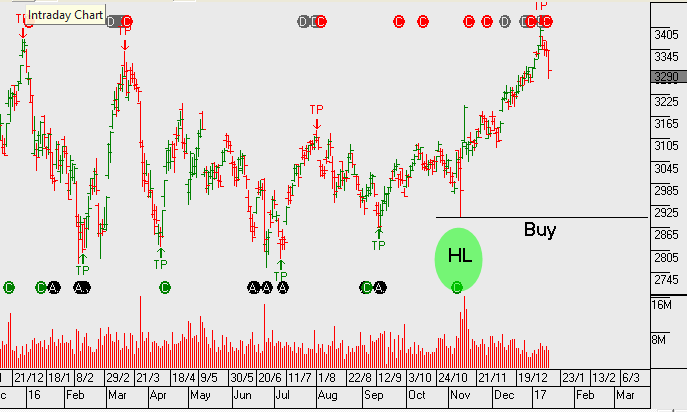

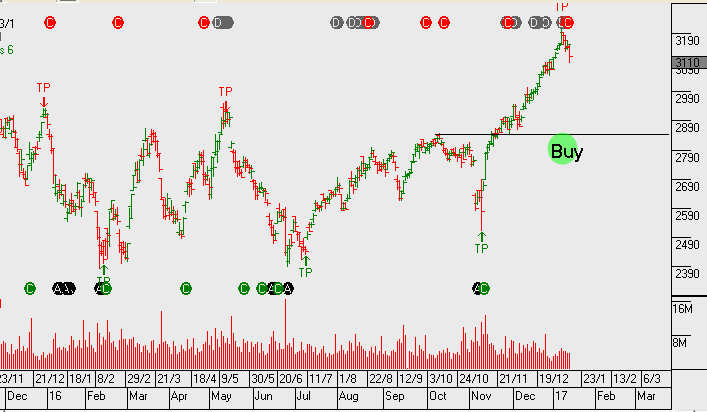

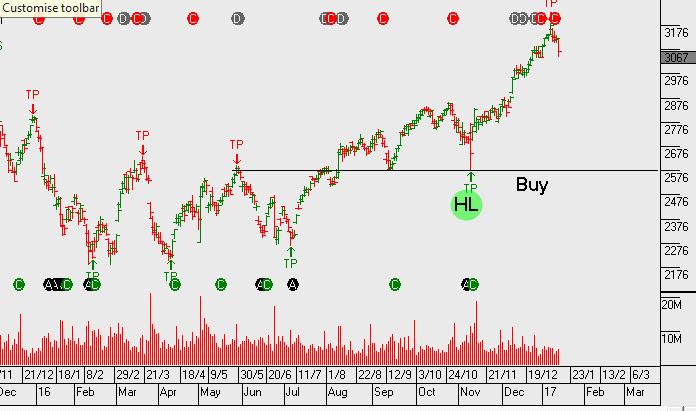

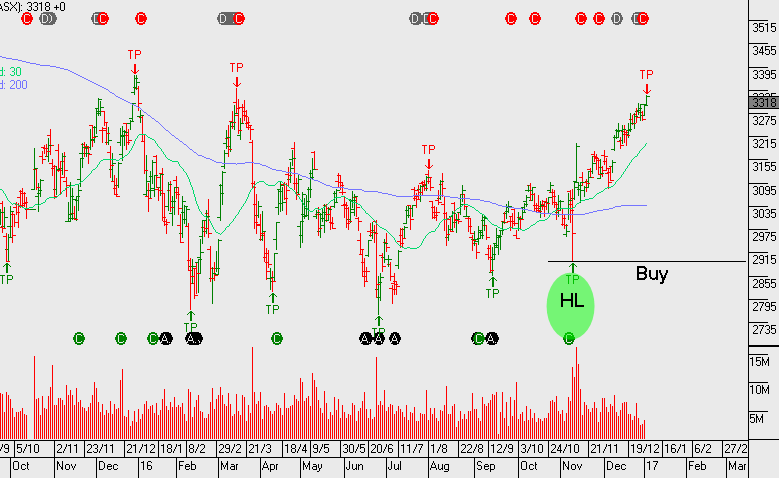

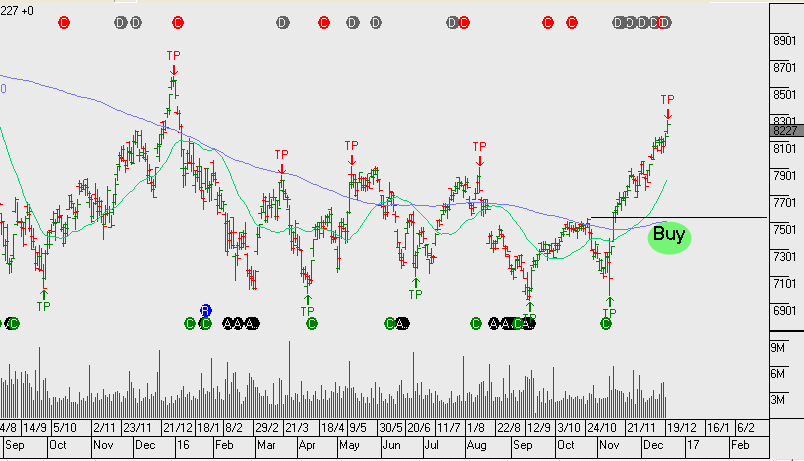

The Algo Engine has triggered a buy signal on the higher low formation in ANZ. We’re happy to look at this from a very short term perspective but remain on the short side of the banks and we’re inclined to sell any technical bounce from the current levels.

NOTE: The Australian Government announced the introduction of the Bank levy in its 2017 budget. Based on the Treasury estimates this levy will raise $6.2billion which will reduce earnings by up to 5% for the majors’.