Cure ETF – Buy

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Cure ETF – Buy

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Cure ETF – Buy

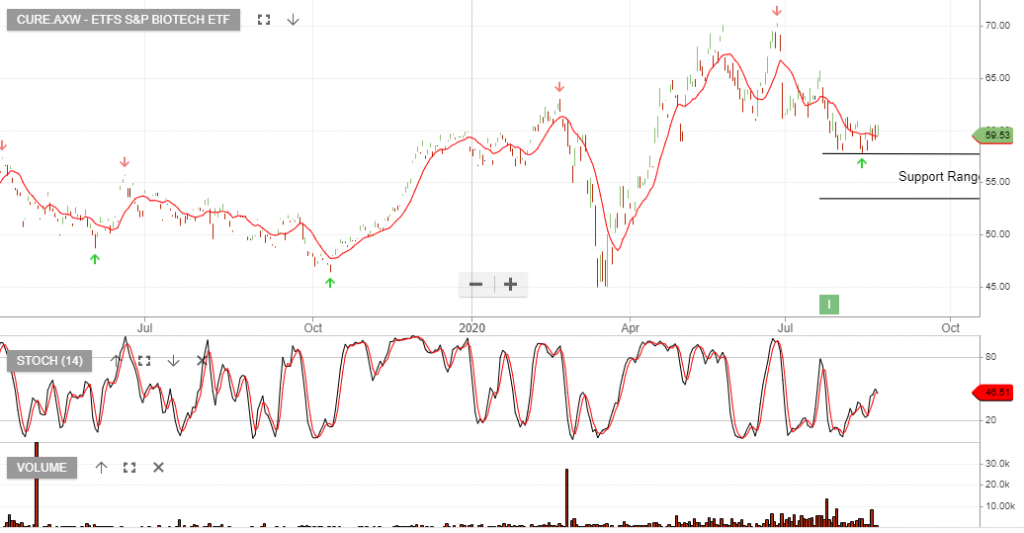

CURE:AXW is under Algo Engine buy conditions and the current pullback provides another buying opportunity.

ETFS S&P Biotech ETF (ASX Code: CURE) offers investors exposure to U.S. biotechnology companies. These companies are engaged in research, development, manufacturing and/or marketing of products based on genetic analysis and genetic engineering.

.

CURE ETF – Rallies 10%

ETFS S&P Biotech has been an overweight portfolio allocation and either taking profit now or sticking with the position, whilst the price action remains above the 10-day average, will provide a positive outcome.

The added buying interest in the US biotech sector following the recent announcement from Biogen is helping propel the CURE ETF.

CURE ETF Rallies 20%

ETFS S&P Biotech is under Algo Engine buy conditions and was added to our “high conviction” model following the low formed at $52.

The ETF has since rallied 20% and the buying momentum among biotech stocks remains strong.

CURE ETF – Jumps 10%

ETFS S&P Biotech rallied 10% from last week’s $52 low.

CURE ETF – Buy

ETFS S&P Biotech is under Algo Engine buy conditions and is a current holding in our “ASX All ETF” model portfolio.

Watch for the short-term indicators to reverse higher as buying support begins to build near the $53 price level.

Cure ETF – Buy

ETFS S&P Biotech is under Algo Engine buy conditions. Buying support has been building since the price traded at $58.

CURE ETF offers investors exposure to US biotechnology companies.

S&P Biotech ETF

ETFS S&P Biotech is now under Algo Engine buy conditions.

CURE ETF offers investors exposure to US biotechnology companies. These are companies engaged in research, development, manufacturing and/or marketing of products based on genetic analysis and genetic engineering. Examples include the development of immunotherapy treatments and vaccines to treat human diseases.

CURE aims to provide investors with a return that, (before fees and expenses), tracks the performance of the S&P Biotechnology Select Industry Index. CURE uses a full-replication strategy to track the index, meaning that it holds all of the shares that make up the index. It is equal-weighted, meaning each holding makes up the same portion of the portfolio and therefore, contributes equally to the overall performance.