Domino’s Pizza – Algo Signal

Domino’s Pizza Enterprises is now under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

We see price support between $65 & $71.

Domino’s Pizza Enterprises is now under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

We see price support between $65 & $71.

Domino’s Pizza Enterprises is now under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

We see price support between $65 & $71.

Domino’s Pizza Enterprises is now under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

We see price support between $65 & $71.

Domino’s Pizza Enterprises is under Algo Engine sell conditions and is a current “high conviction” short.

A combination of underperforming international stores and an eroding position within technological leadership across fast food means we struggle with the 30x PE multiple and low 2.5% yield.

Within 2 – 5 years we forecast the business trades at 14x earnings and 4% yield, meaning the fair value is closer to $20, not the current price of $52.

The market is looking for Domino’s to grow earnings in FY19 at 10%.

This translates into $1.80 EPS, which will place the stock on a forward yield of 2.4%.

We believe the February result will miss consensus expectations and will act as a catalyst for downside selling pressure to build.

Dominos

Shares of Domino’s Pizza are up over 2% at $45.60 as a research report from Morgan Stanley forecasts the stock rising to $53.00 over the next 12 months.

The report suggests the recent fair-wage claims and complains from franchisees have been overstated in the sell off in the share price.

The report also points out that DMP is the third most shorted stock on the ASX, with 16.5% of the company in the hands of short sellers.

From a technical perspective we see a key price hurdle in the $50.00 area, which is the bottom of the price gap lower on August 11th.

Short-term traders looking to buy DMP should place a stop around the $44.80 level.

Domino’s Pizza

Our ALGO engine originally triggered a sell signal for Domino’s Pizza on July 25th at $58.00. Another sell signals was triggered on the close yesterday at $45.80.

As the chart below illustrates, the dominant chart pattern in the stock is the 13% gap lower between August 14th and 15th.

This gap lower coincided with Domino’s rollout of their new “Quality Fresh” promotion. Early numbers from the company haven’t shown that the “premium” pizza promotion has been a success.

Yesterday’s sell signal is just inside the gap area and fits into the “lower high” chart formation.

A reasonable downside target on DMP over the medium term is $38.00.

Domino’s Pizza

Domino’s Pizza

The chart below shows the recent Algo Engine short signals in DMP. We look for the price action to test lower levels in the near-term as the lower high structure remains the predominate technical pattern.

Stay on watch as the last and final leg lower in the selling occurs. Investors can expect a sharp rally higher from oversold conditions, once we see DMP trade below $38.

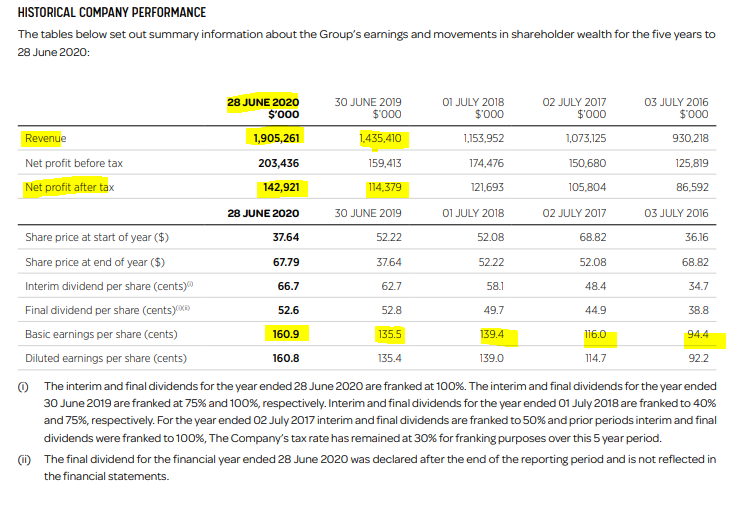

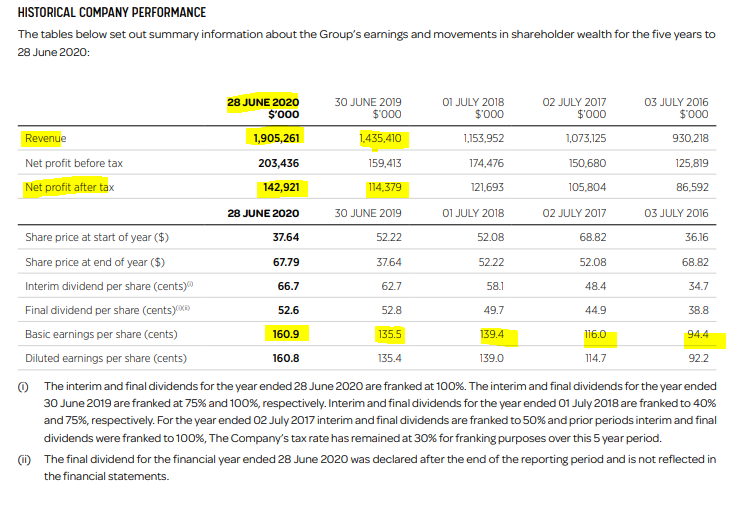

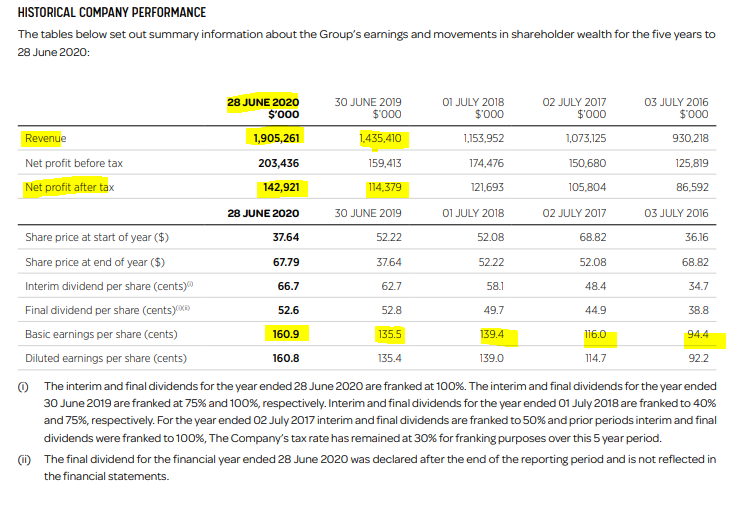

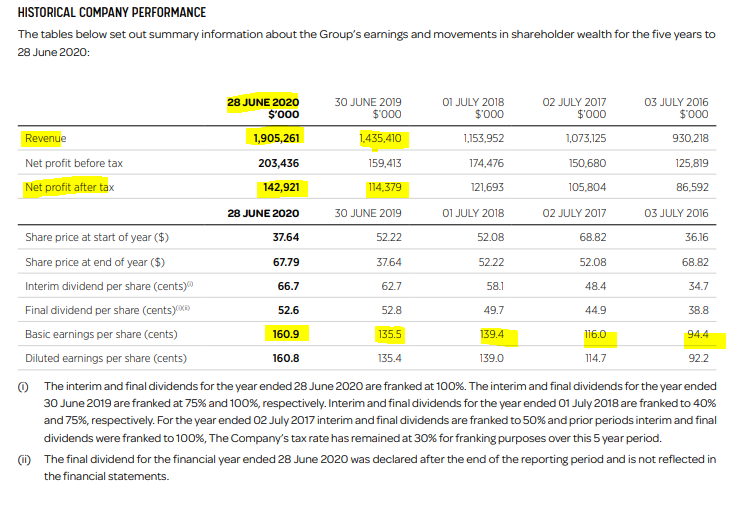

DMP’s upgraded FY17 earnings guidance to NPAT growth of 30% and upgraded margin targets.

Group store openings guidance of 175-195 was maintained.

FY17 revenue $1.2b, EBITDA $250m, Net Profit $130m, EPS $1.48 & DPS $1.05 placing the stock on a forward yield of 1.5%. PE = 46x

The recent low on the 2nd of November created the first lower low pattern we’ve seen in DMP since December 2014. Nevertheless, with the earnings upgrade, it’s likely the stock price will bounce from here but we’re thinking momentum will fade once the rally gets into the $75 range.

We’ll revisit DMP in the coming weeks and months.

Our algorithm engine is flagging the following stocks as potential buy on the dip alerts.

DMP.ASX

JHX.ASX

Or start a free thirty day trial for our full service, which includes our ASX Research.