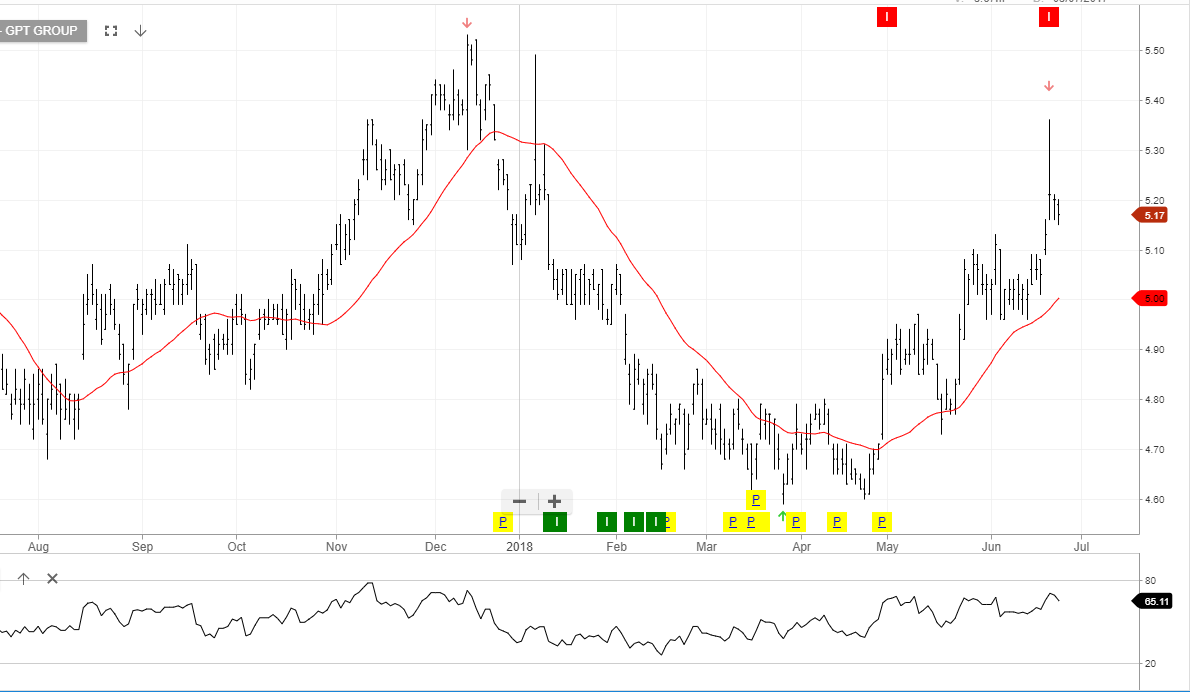

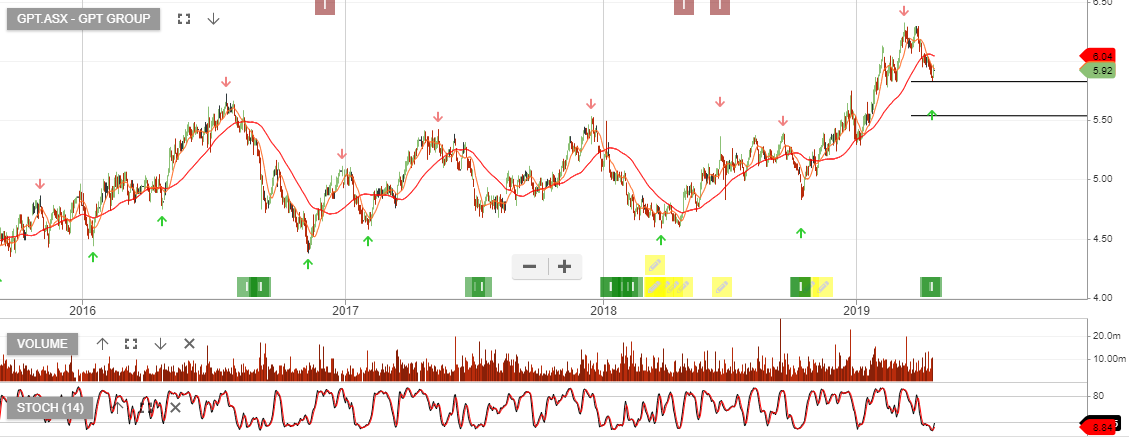

GPT – Algo Buy Signal

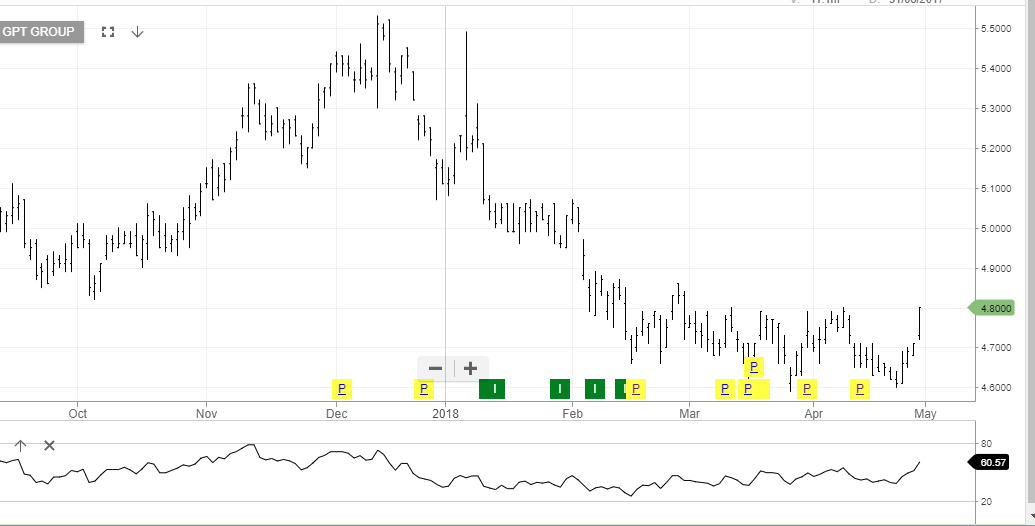

GPT is under current Algo Engine buy conditions and has been in the ASX 100 model portfolio since October last year.

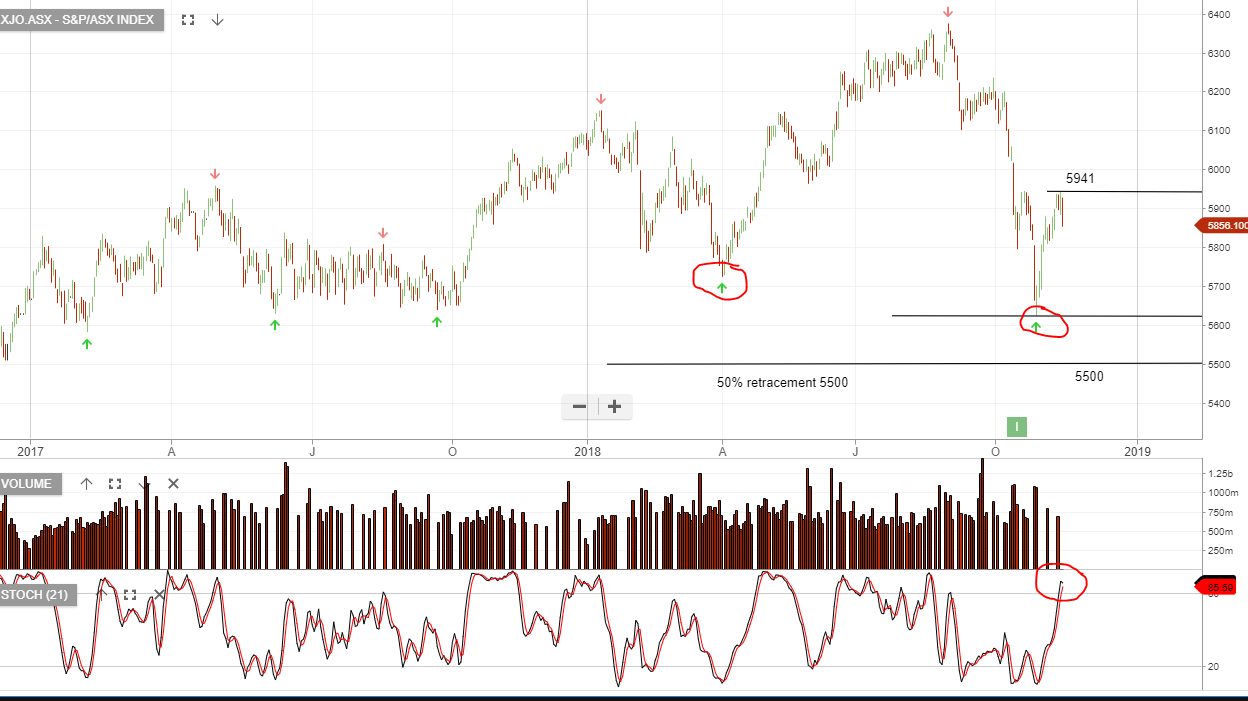

The recent retracement from $6.32 back to $5.65 has triggered a new entry signal and we draw investors attention to the opportunity.

GPT is growing earnings at 5% per annum and trades on 4.8% dividend yield. Through adding a covered call option, we are able to boost the annualised cash flow to over 10%.

Buy within $5.50 to $5.75 range.

–

–