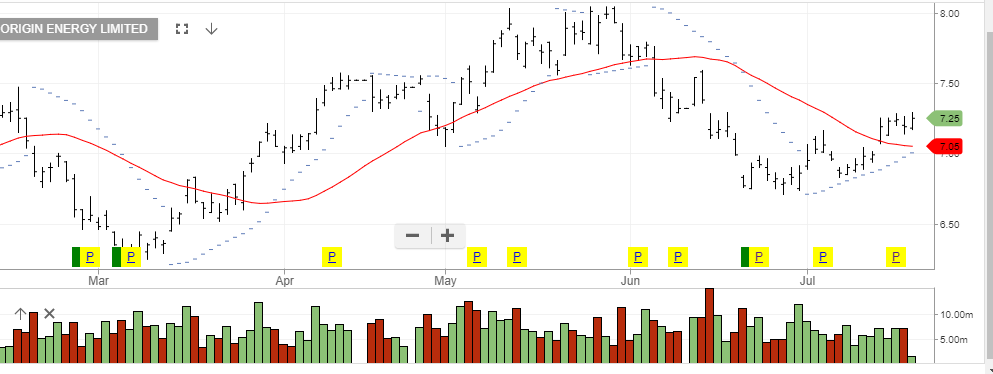

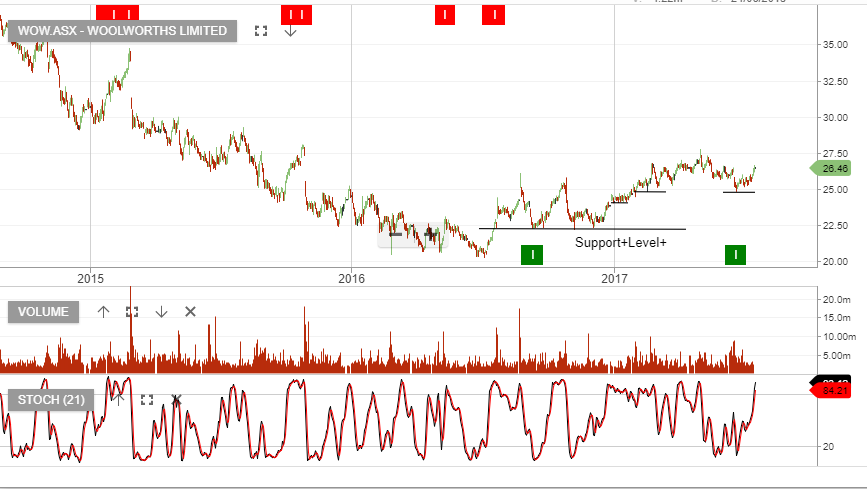

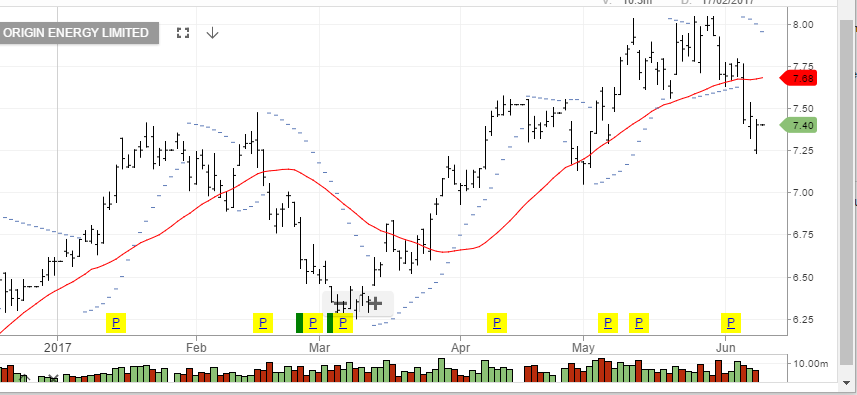

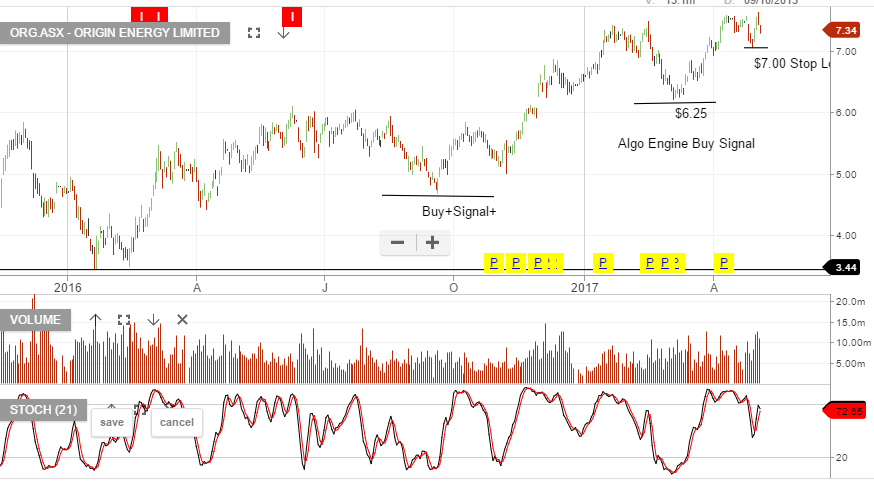

Algo Update – WOW & ORG

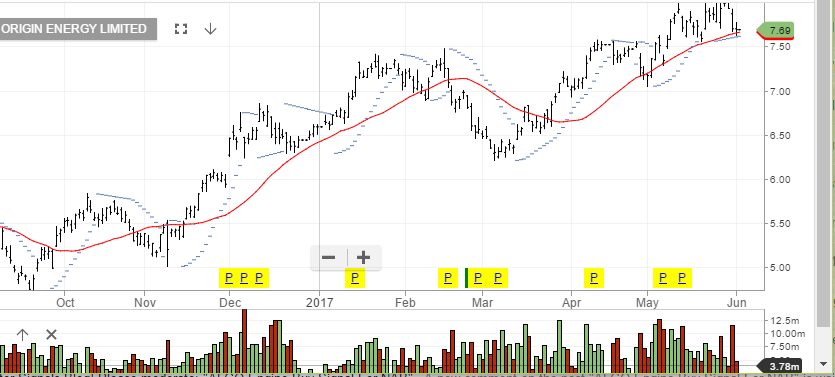

As the Algo Engine identified the “higher low” price pattern in both Woolworths and Origin Energy, we’ve regularly highlighted these as preferred buying opportunities.

We’ve remained buyers of ORG and WOW throughout the past 12 months but now feel that we’re approaching a level where we see full value.

Resistance in ORG will likely be found at or near $8.00 and WOW is likely to experience selling based on valuation grounds at or near $27.50.