Sonic and Ramsey – Value has Emerged

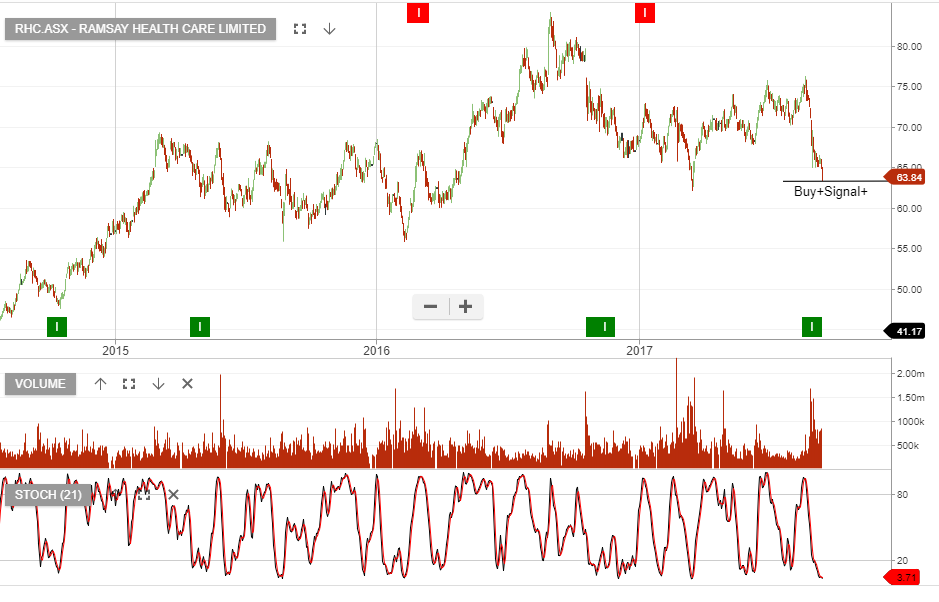

We feel both Sonic and Ramsey Healthcare are now reaching oversold price levels.

We feel both Sonic and Ramsey Healthcare are now reaching oversold price levels.

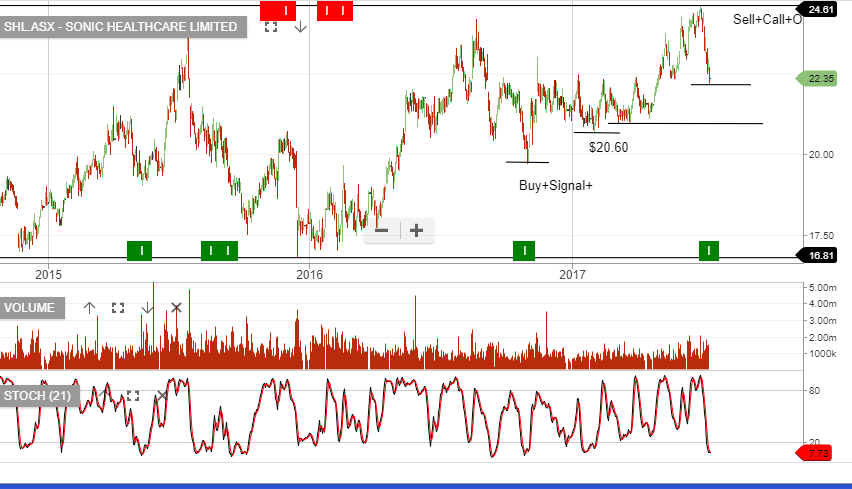

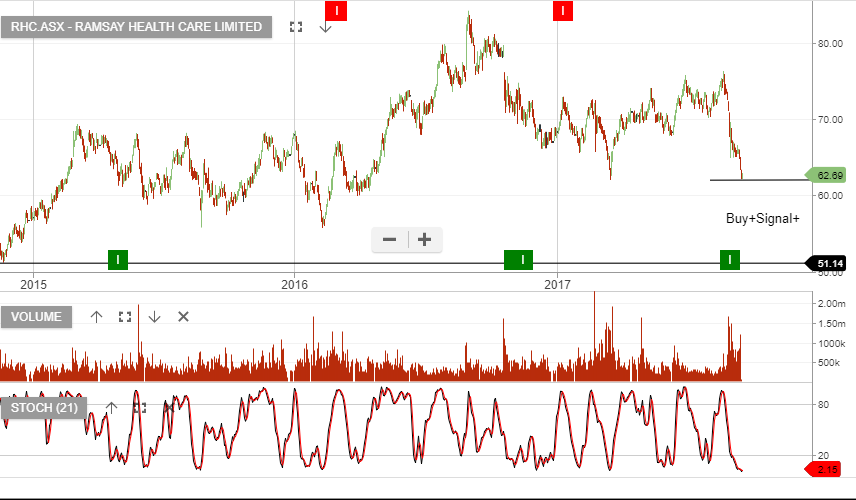

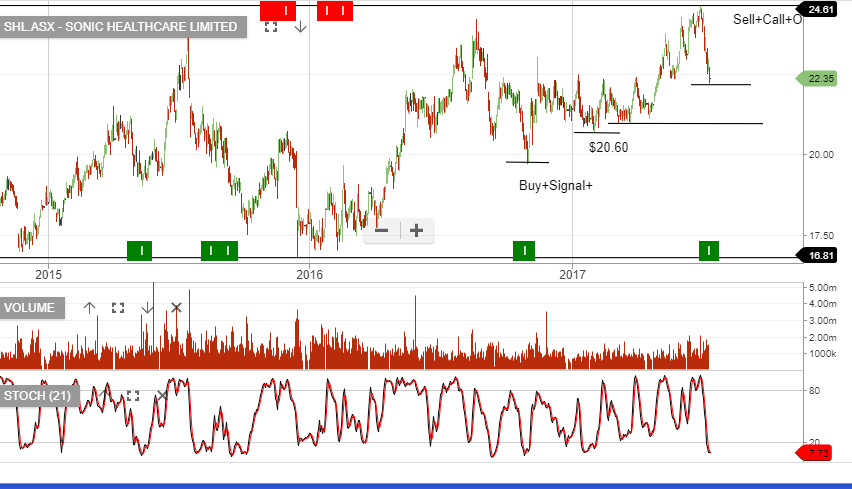

Our Algo Engine has triggered recent buy signals in SHL and RHC, we feel both of these names are now trading into an oversold price range and buying support will soon develop.

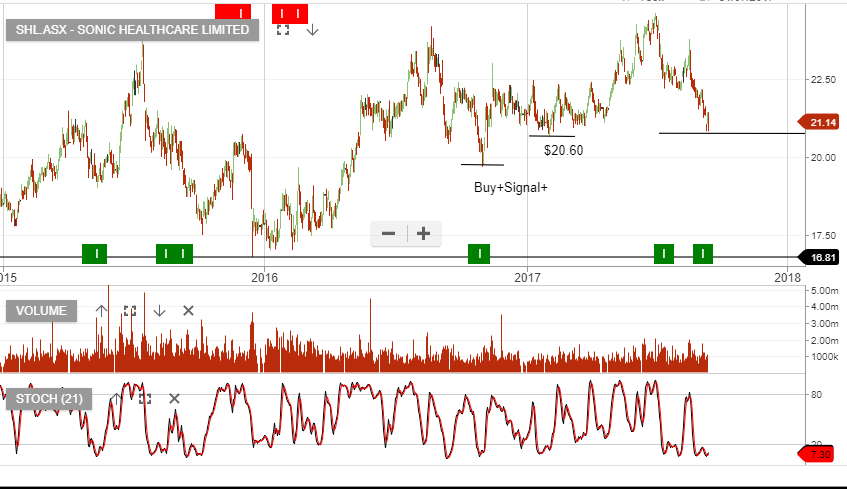

Our Algo Engine triggered a buy signal in SHL near the recent low. We continue to see a buy-side opportunity here at $21.00

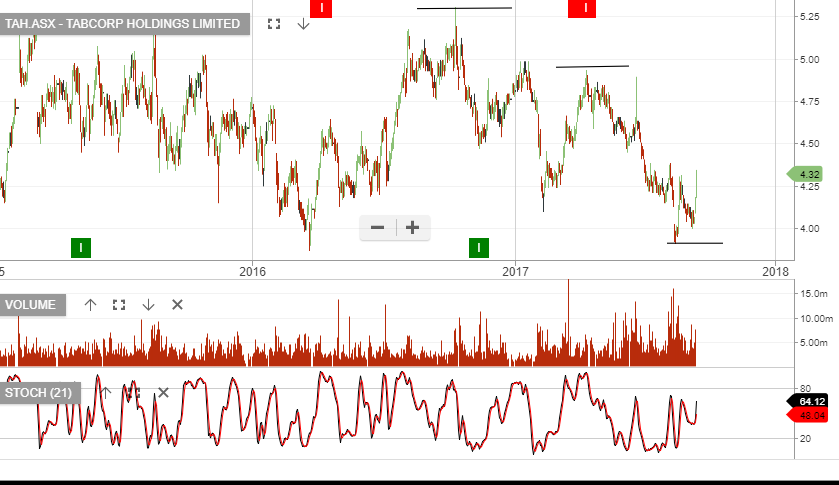

TAH has bounced from the $4.05 level highlighted in last weeks blog post and is now moving high, towards our $4.50 target.

AMC and SHL offer low risk entry points following the recent selling pressure.

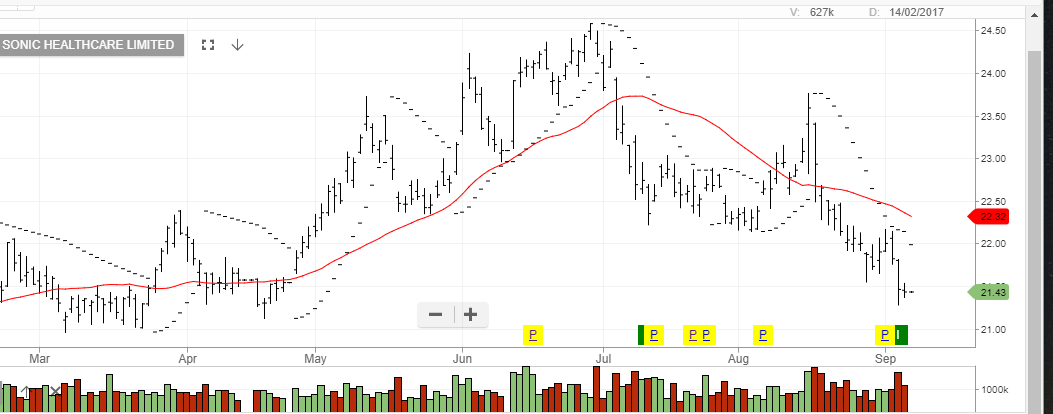

On August 16th, shares of Sonic Health care posted an intra-day high of $23.76.

The next day the company announced that NPAT fell 5% to $427 million, which was the worst component of a reasonably good earnings report.

Our ALGO engine triggered a buy signal on SHL on Tuesday at $21.46.

We consider SHL a defensive stock, which has been oversold, and has now found good buying support in the $21.40 area.

Investors with a medium-term outlook can look to buy SHL with an initial target of $22.35 and a $21.20 stop.

Sonic Healthcare

Resmed formed a “higher low” at $8.94 and found buying interest within our “buy zone”, as advised on the blog.

Sonic Healthcare should find buying support at $21.55. Apply a stop loss below the $21.55. SHL – Ex-Div 8/9/2017 (Div 46c, Franking 20%)

Ramsey Healthcare – Strong reversal of yesterday’s low at $65.

CSL – Algo Engine buy signal at $125.00 CSL – Ex-Div 12/9/2017 (Div $0.91 Franking 0%)

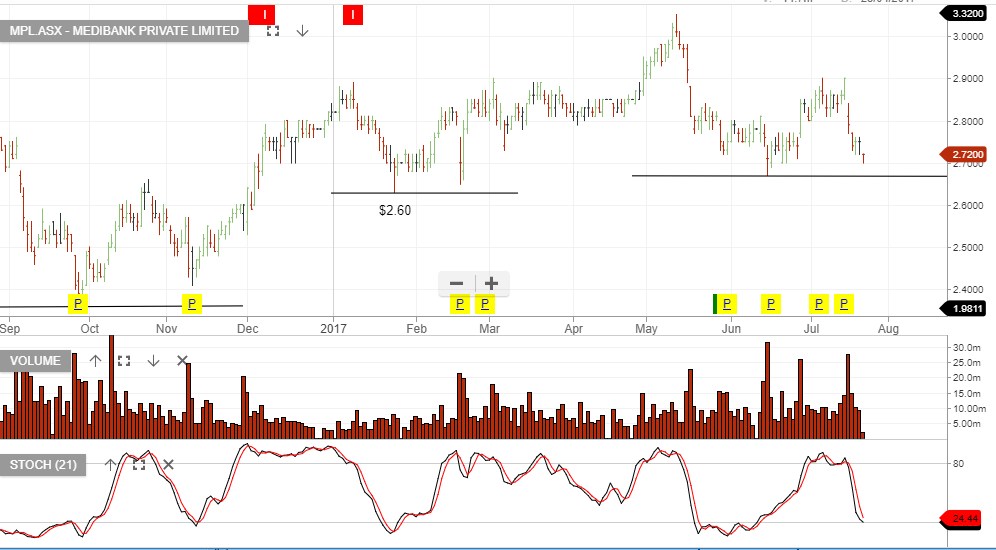

Medibank – Now looks expensive. Take profit!

Following the recent Algo Engine buy signal, Sonic Healthcare looks like it is finding support at or near $22.50.

We continue to like RMD, SHL, CSL, MPL & RHC in the healthcare sector.

On 12th July, our Algo Engine triggered a buy signal in Sonic Healthcare, at or near $22.20.

We see this as a level of price support and our base case is that Sonic trades sideways, at or near the current price.

Sonic reports earnings on the 16th of August and we expect underlying EPS growth of 8%, which will support a forward dividend yield of 3.8%.

When combining a covered call option, we’re generating 10 – 12% cash-flow per year.

MPL, SHL & CSL are worth adding to your watch-list. We see the current price levels in these names, at or near new buying support.

Our Algo Engine triggered a buy signal in Sonic Healthcare, following the recent sell-off from $24.60 back down to $22.30.

We continue to see Sonic delivering 6 – 8% EPS growth and a 3.7% dividend yield. The stock is fair value at or near the current price and investors can consider SHL as a suitable buy-write for enhancing portfolio cash flow.