Xero

Xero is likely to find buying support near the $80 support level.

Xero is likely to find buying support near the $80 support level.

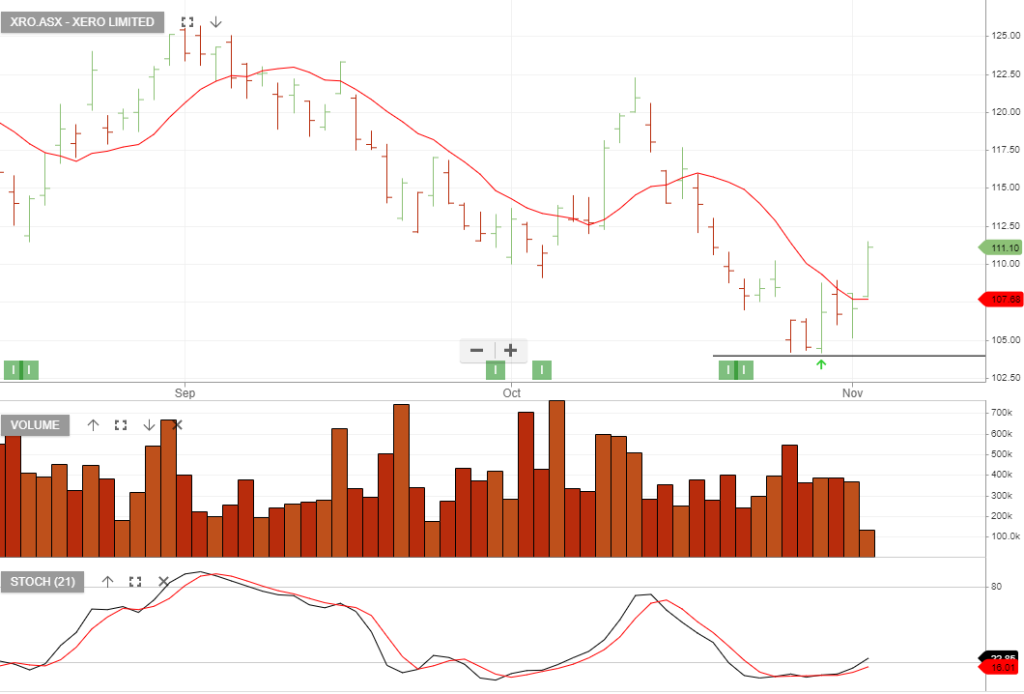

16/12 update: XRO is trading at $110, and we’re monitoring price action for increased buying interest and a close above the 10-day average.

Xero Add to your watchlist.

1H26: Overall, a weaker result vs market expectations despite EBITDA a slight beat. EBITDA-capex cash flow came in -6% below consensus. Whilst operating costs have seen good control, capex spend is trending up due to investments in new AI capabilities.

Look for buying interest to rebuild, and we’ll revisit the entry point once the price action is above the 10-day average.

Xero Add to your watchlist.

1H26: Overall, a weaker result vs market expectations despite EBITDA a slight beat. EBITDA-capex cash flow came in -6% below consensus. Whilst operating costs have seen good control, capex spend is trending up due to investments in new AI capabilities.

Look for buying interest to rebuild, and we’ll revisit the entry point once the price action is above the 10-day average.

Xero Add to your watchlist.

22/9 update: Xero is rated a buy with the stop loss at $158.88

Consensus could be underestimating Xero’s potential from AI as we expect it to drive higher growth through an increase in the take-up of AI enabled add-ons.

Xero: Add to your watchlist and wait for the price action to cross above the 10-day average.

Xero: Add to your watchlist and wait for the price action to cross above the 10-day average.

Xero is likely to be added to the ASX100 Trade Table following the recent positive price momentum.