RBA Preview

There has been plenty of Central Bank action on interest rates around the world but none of it coming from the RBA.

That trend is very likely to continue at tomorrow’s RBA board meeting where the official cash rate is expected to remain at 1.5%.

Australian monetary policy is currently stuck between underlying inflation, which is below target, and accelerating house prices.

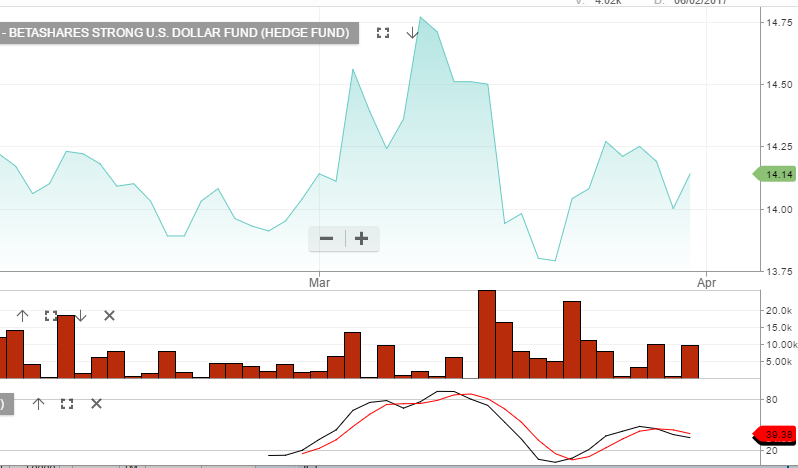

The market may move on comments about the Aussie Dollar or the banks recent out-of-cycle rate rises, and that APRA has again slightly tightened the terms on investor lending.

As such, real estate names will be in focus after the announcement.