With global financial markets firmly focused on central bank meetings in the US and Japan last week, it was easy to overlook the bad news delivered to Germany’s largest bank. On September 16th, the US Department of Justice (DoJ) demanded that Deutsche Bank (DB) pay $14 billion in penalties for their role in deceptive marketing practices dating back to 2005. More specifically, the DoJ’s claim is about the way the bank selected mortgages, packaged them into bonds and sold them on to investors.

These bonds are known as residential mortgage-backed securities and very few investors walked away from the DB products without damage.

DB is just one of several banks penalized by the DoJ with Goldman Sachs and Citi-Bank both settling with the DoJ earlier this year for $5 billion and $7 billion, respectively. With that in mind, it’s likely that DB will be able to negotiate a lower number over time. However, over the weekend, German Chancellor Angela Merkel ruled out any government assistance for DB, which has not only pushed the share price to a 16-year low under €12.00 but also initiated enormous scrutiny on BD’s derivative and financing books.

In short, DB has more than €2.5 trillion of derivative exposure coming due or needing to be rolled over within the year. DB has had a serious reduction in its credit rating by Moody’s and has seen its share price drop 40% since January. The DoJ’s $14 billion demand represents more than 70% of DB’s current market value. Without going into the specific composition of the derivative book, it’s reasonable to believe that DB is probably not on the right side of all of these trades and that refinancing rollovers will put additional pressure on their bottom line.

With respect to the price of the Euro, one must ask the following questions: What is BD’s exposure to other troubled banks in Europe; specifically, the collapsing Italian bank system? And, now that Ms Merkel has ruled out state aid, will BD be able to pay the fine without a depositor bail-in? The ECB chief, Mario Draghi, is scheduled to testify on Monday in front of the Committee on Economic Affairs in Brussels. It’s a fair bet that DB’s stability and exposure will be addressed.

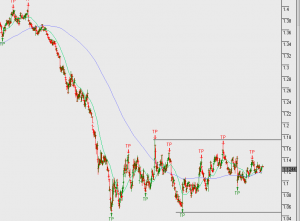

Even without the DB legal mess, the current technical pattern in the EUR/USD looks tenuous.

EUR/USD