The Aussie Dollar fell to a 1-month low against the USD at .7850 as comments from FED chief Janet Yellen increased the odds of a December rate hike to over 70%.

As the interest rate premium between the US and Australia continues to narrow, the AUD/USD will likely trade with increased downward pressure.

At this stage, the spread between the US and Australian 10-year yields has dropped to 50 basis points, the most narrow in over 5 years.

Investors looking to profit from a lower AUD/USD can buy the BetaShare ETF with the symbol: YANK.

YANK is an inverse ETF, which means the price of YANK increases as the AUD/USD trades lower. It also has a weighting of 2.5%, which means the unit price will fluctuate by 2.5% for every 1% change in the AUD/USD exchange rate.

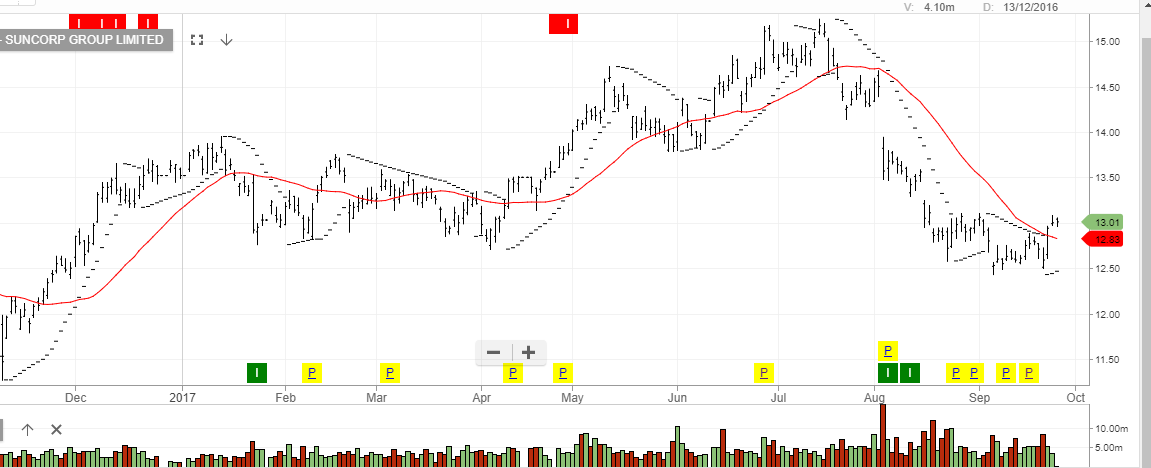

With a current price of $12.90, we calculate that the price of YANK will be near $16.50 as the AUD/USD returns to the January low of .7160.

BetaShare ETF: YANK