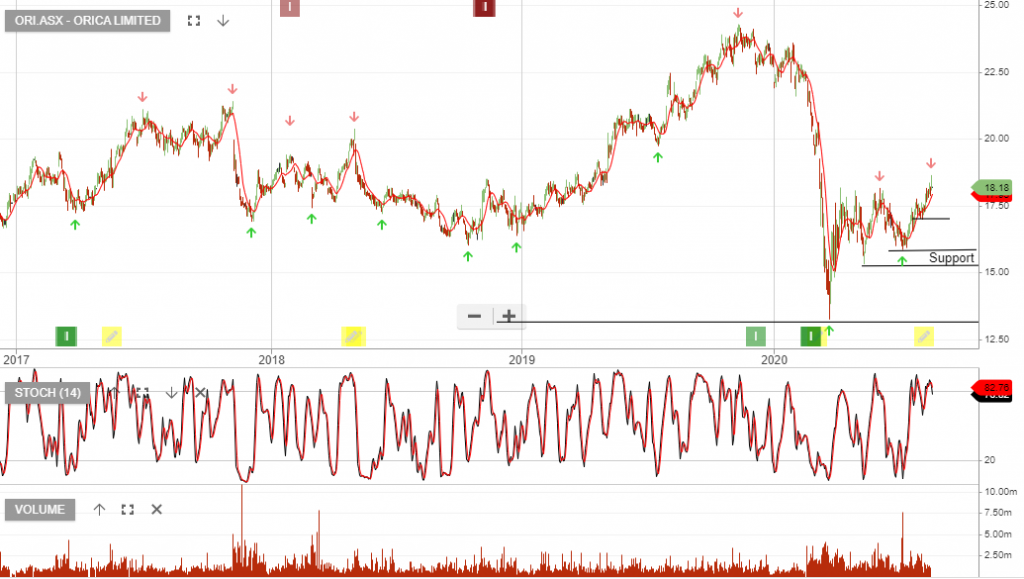

After accumulating Orica on the $16.50 higher low formation, we now see the share price trading within our $18 – $19 price target.

With the trade offering over 10% return, locking in the gains is the “no-lose” scenario.

Investors will be waiting until Q4 for the 6 months to September earnings update. The last reported results for the six months to 31 March 2020, showed statutory Net Profit After Tax (NPAT) of $165 million compared to $33 million in the prior corresponding period. Earnings Before Interest and Taxes (EBIT) were up 2%.

Note: 25 JUNE 2020 ORICA COMPLETES SUCCESSFUL LONG-TERM US PRIVATE PLACEMENT.

Orica completed a new US$451 million and A$70 million (A$725 million equivalent) issue of fixed-rate senior unsecured notes (“Notes”) in the US Private Placement (USPP) market. Initially launched as a US$250 million issue to refinance a USPP maturing in October 2020, the transaction achieved a final order book of US$1.3 billion representing an oversubscription of more than 5x.

Investors may choose to focus on the strong balance sheet and strength within the mining industry as reasons to stick with the longer-term thematic underpinning Orica.