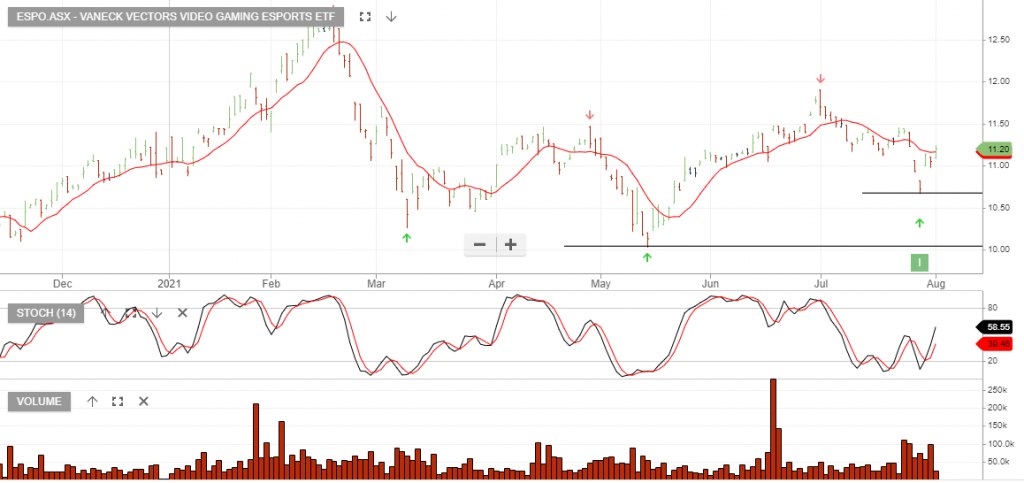

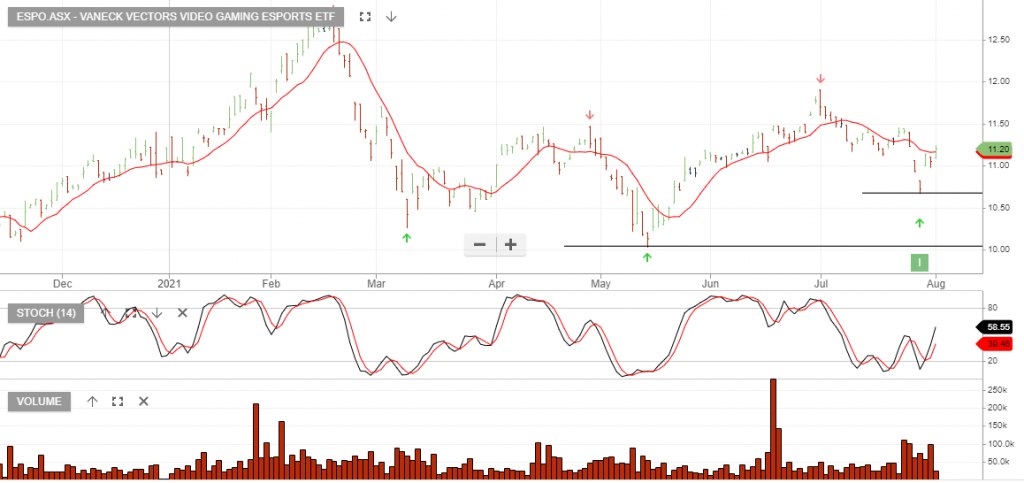

Video Gaming ETF – Buy

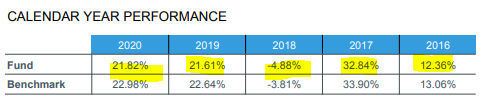

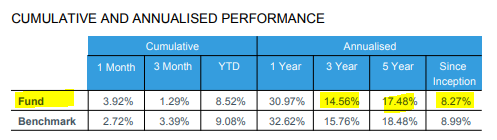

VanEck Vectors Video Gaming Esports is under Algo Engine buy conditions.

VanEck Vectors Video Gaming Esports is under Algo Engine buy conditions.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

iShares Asia 50 is under Algo Engine buy conditions and is a current holding in our iShares ETF model.

INVESTMENT OBJECTIVE: The fund aims to provide investors with the performance of the S&P Asia 50TM Index, before fees and expenses. The index is designed to measure the performance of the 50 leading companies listed in China, Hong Kong, Macau, Singapore, South Korea and Taiwan.

Gold Road Resources is now under Algo Engine buy conditions.

Gold Road anticipates gold production for the 2021 calendar year will be within the lower half of guidance (260,000 to 300,000 ounces on a 100% basis).

AISC for the 2021 calendar year is anticipated to be between $1,325 and $1,475 per attributable ounce, with lower June 2021 quarter production and higher maintenance and labour costs the main contributors to an increase from the guidance of between A$1,225 – A$1,350.

FY21 revenue forecast is for $300mil generating EBIT of $100mil.

Pexa Group has helped transform conveyancing from a clunky paper-based process into a digital one. PXA was recently listed on the ASX with a market cap of $3bn.

FY21 underlying earnings are expected to double to $108 million, before rising a further 20% in FY22.

CBA & Link are major shareholders.

Cleanaway Waste Management is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

.

Northern Star Resources is under Algo Engine buy conditions and is our preferred gold exposure.

NST continues to deliver strong results in the June quarter. Group production finished with 450koz at $1460oz, (up 23%), whilst seeing costs come down almost 10%.

We continue to see the twin factors of a strong gold price and cost-saving, (post-merger with SAR), helping to support the share price.

Buy NST

Aurizon Holdings is under Algo Engine buy signals.

Aurizon reported underlying earnings before interest taxation depreciation and amortisation (EBITDA) of $1.48 billion and told investors to expect underlying EBITDA of between $1.42 billion-$1.5 billion in fiscal 2022.

Or start a free thirty day trial for our full service, which includes our ASX Research.