CSL

CSL Buy with a stop loss at $234.14

CSL Buy with a stop loss at $234.14

BHP Group Buy with a stop loss at $36.36.

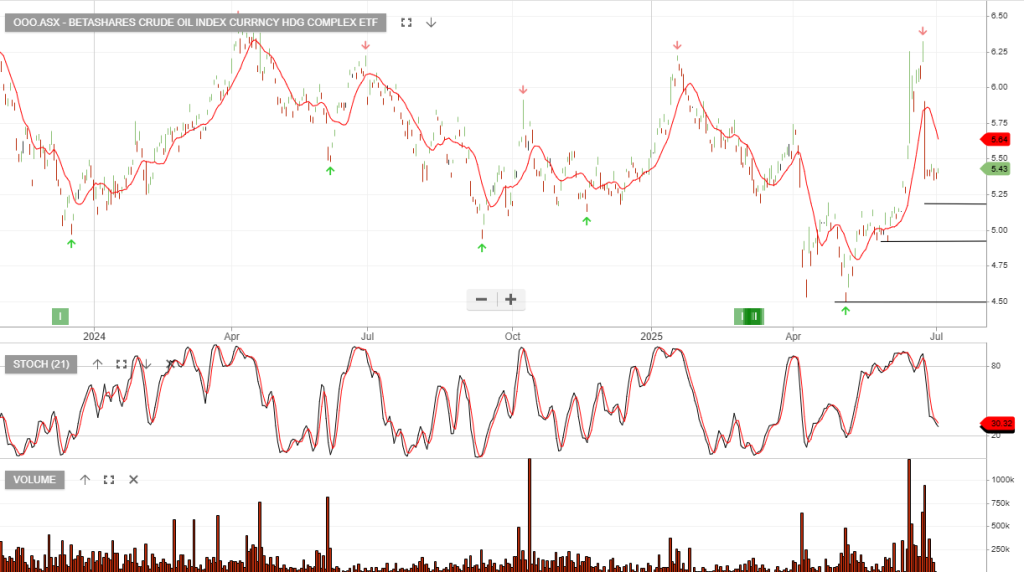

Betashares Crude Oil Index Currncy Hdg Complex : Add to watchlist

Fortescue : Buy with a stop loss at $15.05

AMP : Buy with a stop loss at $1.24

Amcor : Buy with a stop loss at $13.86

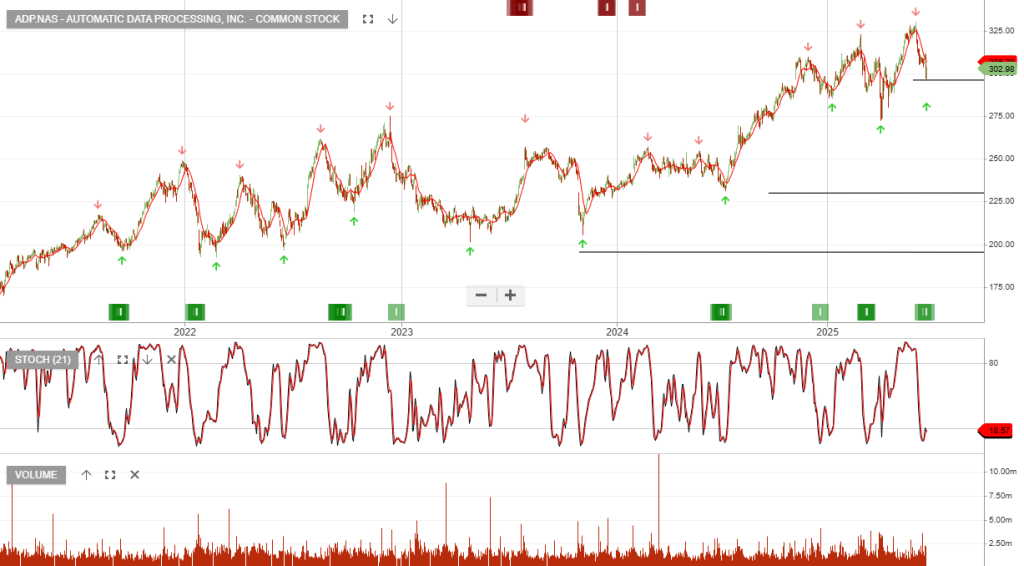

Automatic Data Processing, Inc. – Common is under Algo Engine buy conditions.

Ramsay Health Care Buy with a stop loss at $35.10

Or start a free thirty day trial for our full service, which includes our ASX Research.