Real Estate Technolgy Opportunities

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

REA Group – Buy or Sell?

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

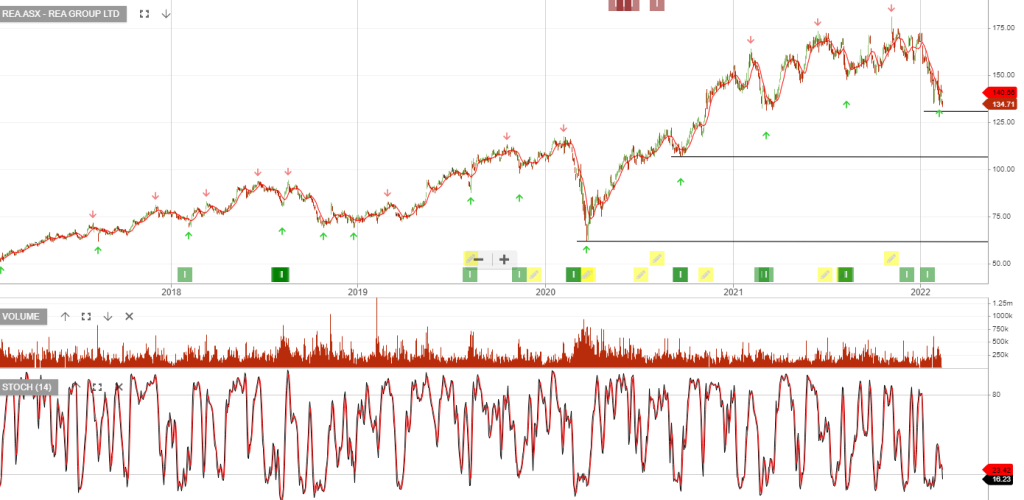

REA Group: 1H FY22 Earnings

REA Group reported 1H FY22 revenue growth of 25% or $109mn with EBITDA of $84mn. Full-year EPS is forecast to be up 20%+ on the prior year and the stock now trades on a forward yield of 1.2%.

Buying support is likely to rebuild within the $115 to $135 price range.

REA Group is up 67%

REA Group is among the best-performing stocks in our ASX 100 model portfolio, with the share price up 67% since being added in September last year.

REA Group has acquired 100 percent of the shares in Mortgage Choice for $1.95 a share, valuing the company at $244 million. REA is now focused on accelerating its financial services strategy to become a leading player in the home loan market.

REA is a high quality business with terrific growth potential, however, the 65x PE multiple is a little rich and we recommend waiting for the next Algo Engine buy signal.

5/11 update: REA Group delivered 22% revenue growth for Q1 FY22.

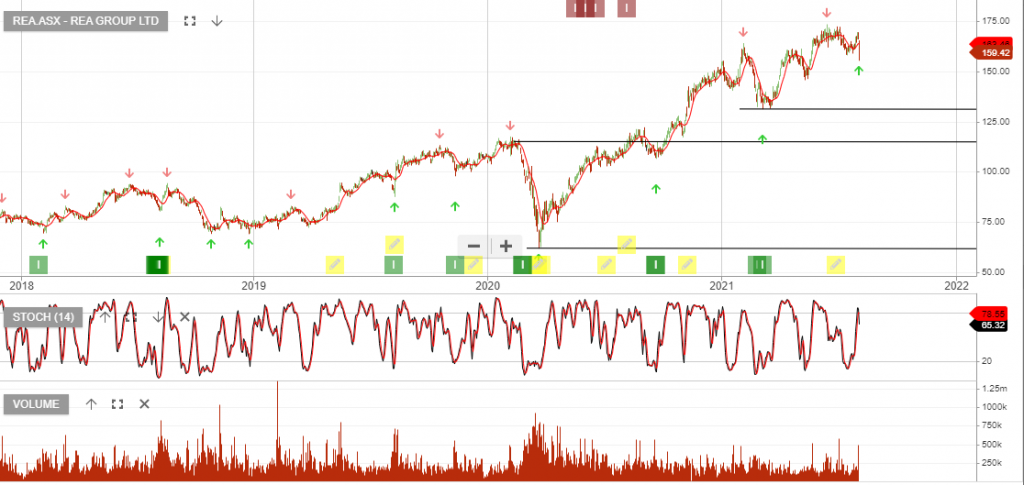

REA Group – FY21 Earnings

REA Group is under Aglo Engine buy conditions and among the best-performing stocks in our ASX model portfolio. REA was added to the ASX 100 model in September last year at $107.80 and is up 48.40%, (including dividends), to $159.42.

FY21 Revenue increased 13% to $927m and EBITDA increased 19% to $564m. Net Profit After Tax (NPAT) saw a similar lift of 18% to $318m.

The div increases to $0.72 per share and the ex-dividend date is 26 August.

We recommend buying the dip in REA, so please watch for the next Algo Engine buy signal. Long-term earnings growth will be underpinned by the recent acquisition of mortgage broker, Mortgage Choice.

REA Group is up 57%

REA Group is among the best-performing stocks in our ASX 100 model portfolio, with the share price up 57% since being added in September last year.

REA Group has acquired 100 percent of the shares in Mortgage Choice for $1.95 a share, valuing the company at $244 million. REA is now focused on accelerating its financial services strategy to become a leading player in the home loan market.

REA is a high quality business with terrific growth potential, however, the 65x PE multiple is a little rich and we recommend waiting for the next Algo Engine buy signal.

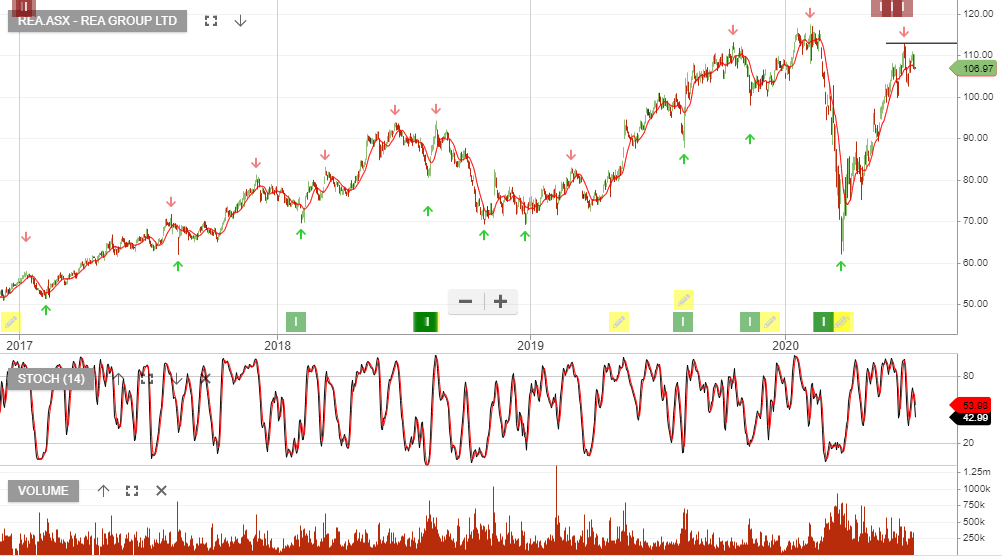

REA Group – Earnings

REA Group is under Algo Engine buy conditions since switching in mid-September at $106.

REA has reported 1Q21 results ahead of analysts estimates with revenue of $196mn nd EBITDA of $124mn.

Although the management outlook statement remains positive, we have some concerns about valuation and consider the stock near resistance.

REA – FY20 Earnings

REA Group reported FY20 revenue of $820m versus $879m and net profit of $112m.

REA – Profit Taking

REA Group is under Algo Engine sell conditions. We expect selling pressure to increase at $109.

Send our ASX Research to your Inbox

Or start a free thirty day trial for our full service, which includes our ASX Research.