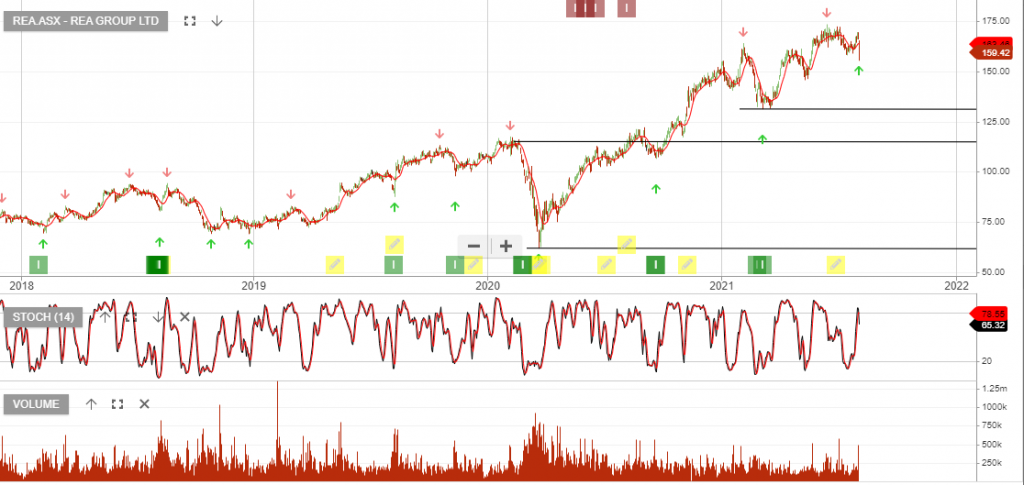

REA Group is under Aglo Engine buy conditions and among the best-performing stocks in our ASX model portfolio. REA was added to the ASX 100 model in September last year at $107.80 and is up 48.40%, (including dividends), to $159.42.

FY21 Revenue increased 13% to $927m and EBITDA increased 19% to $564m. Net Profit After Tax (NPAT) saw a similar lift of 18% to $318m.

The div increases to $0.72 per share and the ex-dividend date is 26 August.

We recommend buying the dip in REA, so please watch for the next Algo Engine buy signal. Long-term earnings growth will be underpinned by the recent acquisition of mortgage broker, Mortgage Choice.