NCM Meets Gold And Copper Output Targets

Shares of Newcrest have opened 1% higher at $19.80 as their quarterly production report reflected a uptick in production going into the second half of the year.

The company said that its Q4 gold production fell 7.7% from a year ago after the closure of its Cadia mine, but overall output was just enough to meet its full-year target.

Overall production of 551,815 ounces in the quarter helped the gold miner reach an annual output of 2.38 million ounces, which is at the lower end of their 2.35 to 2.60 million ounce forecast.

NCM also posted copper production of 83,900 tons, which is within the guidance of 80,000 to 90,000 for the year.

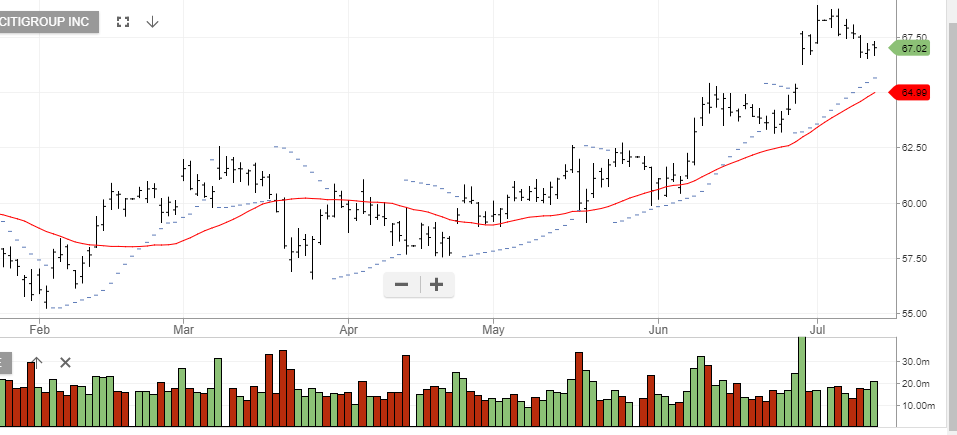

With spot Gold now trading at one-month high of $1255.00, we expect NCM to move back into the mid-June range of $21.50 to $21.75.

Newcrest

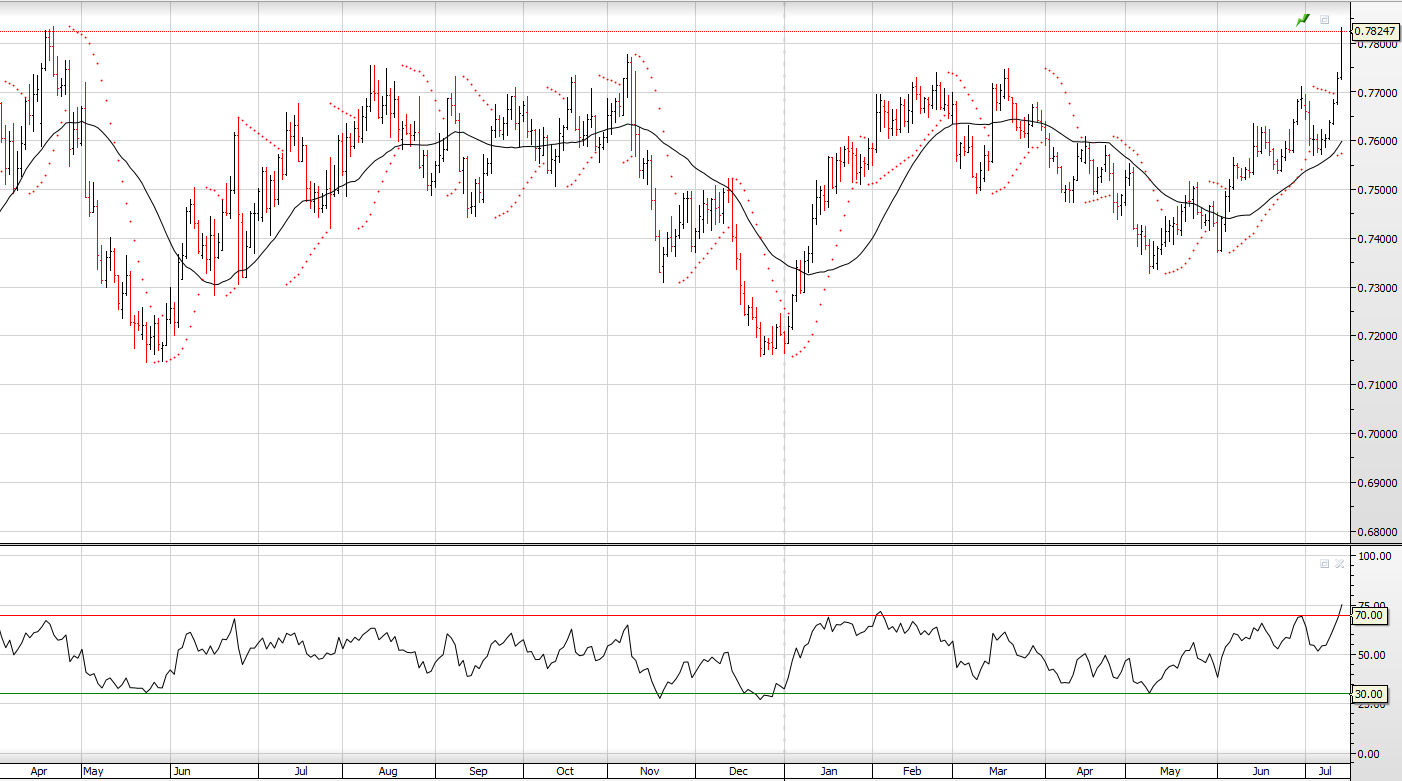

VIX Index

VIX Index Newcrest Mining

Newcrest Mining