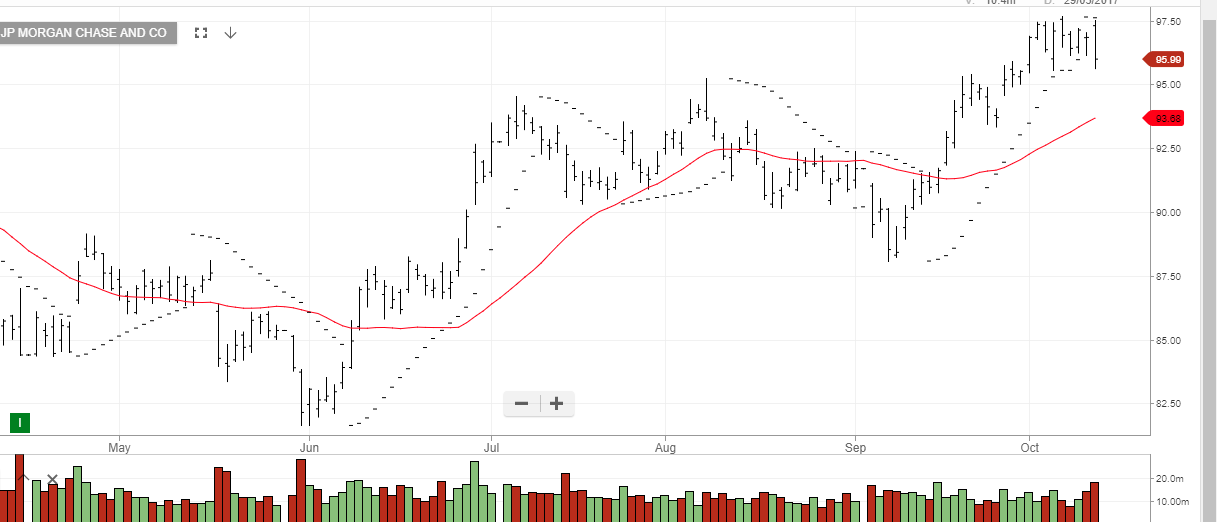

JP Morgan – 1Q Earnings

NYSE:JPM is under Algo Engine buy conditions and is a current holding in our Dow 30 model portfolio.

JPM reported March quarter earnings with revenue up 5% to $29.9b and profit also up 5% to $9.18bn.

Growth was most evident in the group’s retail lending business, where profit surged 19 percent to $3.96bn.

Investment banking and asset management divisions were weaker.

Overall, J.P. Morgan’s results show the firm is still benefiting from the Fed’s four rate hikes last year. It remains our preferred US bank stock with strong buying support near the $105 level.