Nvidia

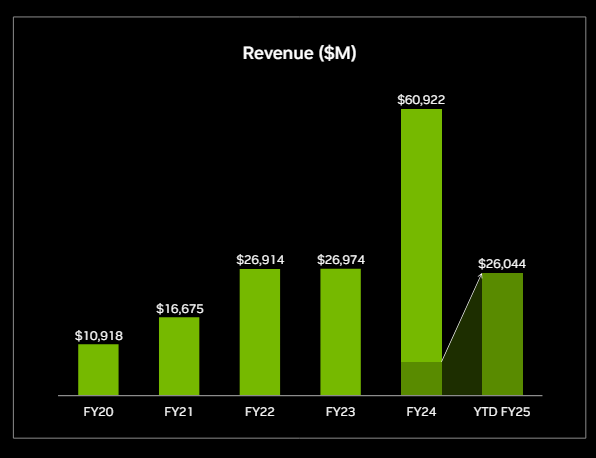

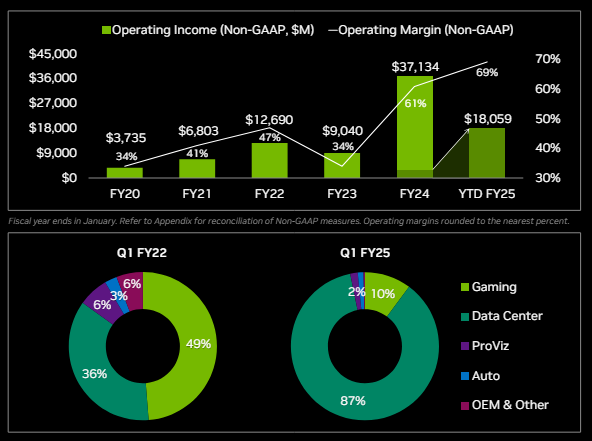

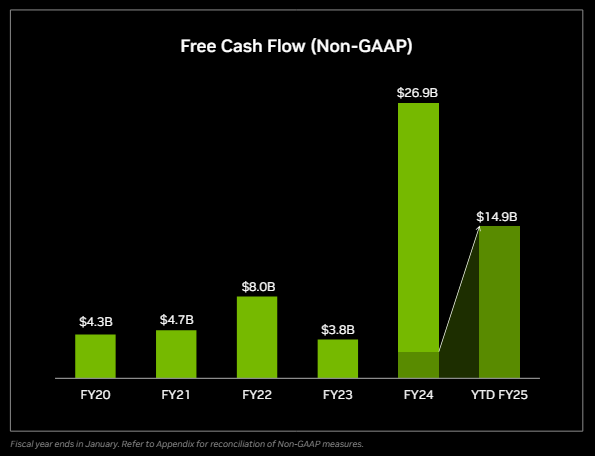

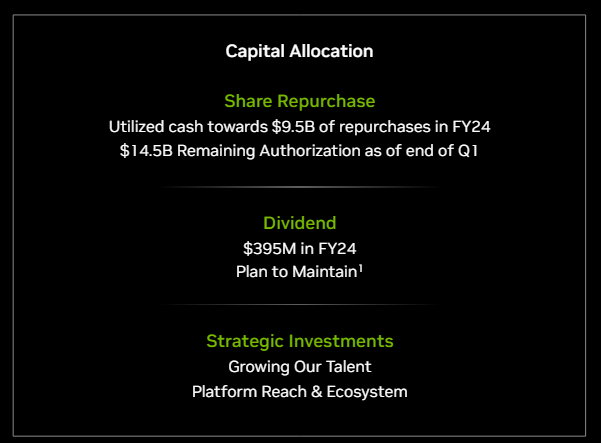

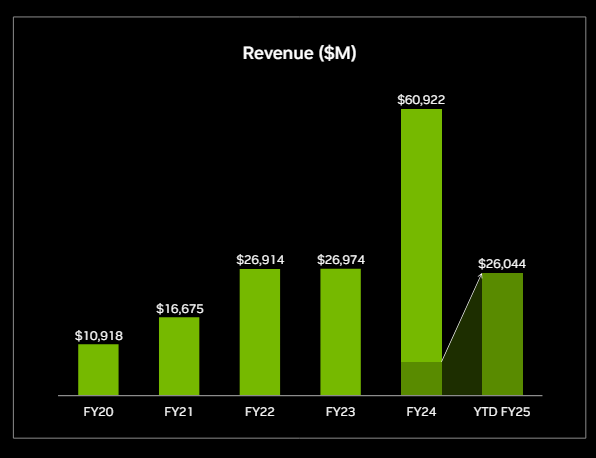

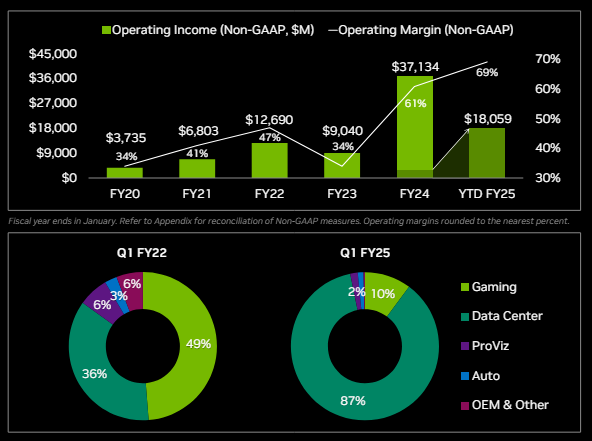

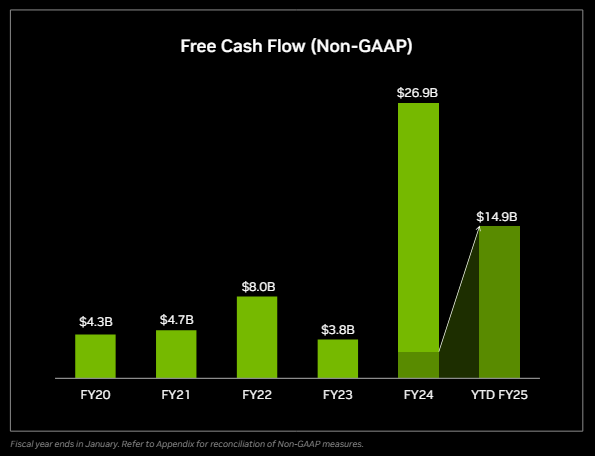

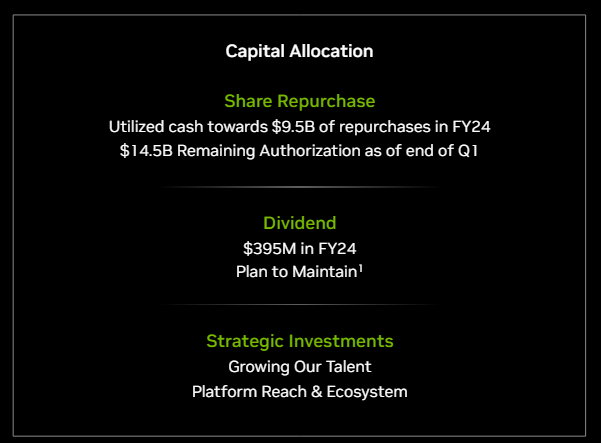

NVIDIA Corporation – Common Q1 earnings produced record revenues and profits as the Data Center business continued to grow rapidly. The company announced a ten-for-one stock split. Nvidia shares are now trading at 40x forward earnings.

NVIDIA Corporation – Common Q1 earnings produced record revenues and profits as the Data Center business continued to grow rapidly. The company announced a ten-for-one stock split. Nvidia shares are now trading at 40x forward earnings.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

PayPal’s first-quarter results show a 9% revenue increase and a 14% rise in Total Payment Volume, driven by enhanced features in Venmo and strategic market expansions.

The number of people using Venmo has gradually increased, from a low of 3 million in 2015 to a high of nearly 78 million as of the end of 2023.

FCF, which touched $1.763 billion in Q1 2024 alone. This resurgence can be attributed to, among other factors, robust management strategies, such as buying back shares aggressively in response to the stock’s depressed valuation, which suffered from a significant pullback of 80% in the last few years.

In 2023 alone, PayPal redirected $4.4 billion to buybacks,

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

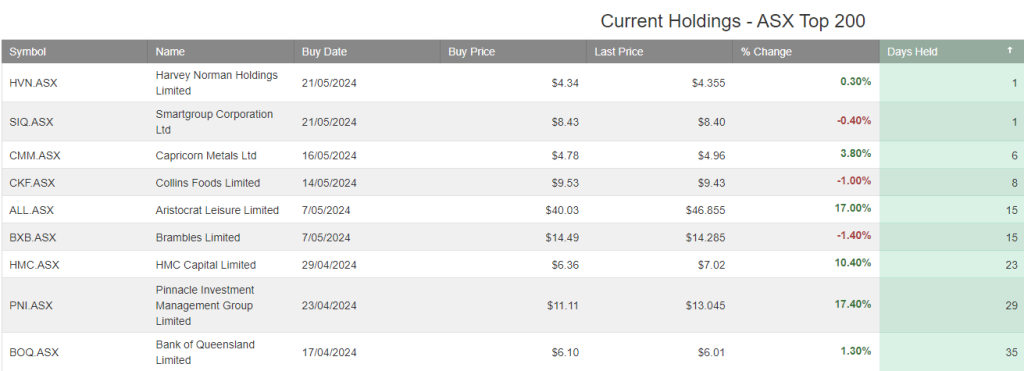

Updated holdings in the ASX200 Trade Table.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Santos will likely trade higher (supported by higher energy prices) after trading into our price range on Friday.

Aurizon Holdings is under Algo Engine buy conditions.

Santos is a buy at $7.50.

Or start a free thirty day trial for our full service, which includes our ASX Research.