Telstra

RIO Tinto

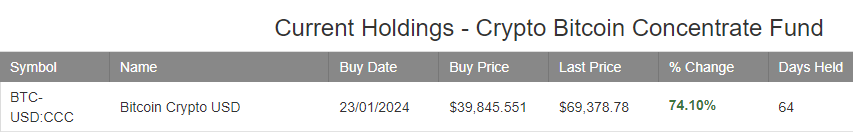

Bitcoin

Bitcoin is up 74% after a 64-day holding period.

Telstra

Watch Last Night’s Webinar

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Fortescue

FMG:ASX is under Algo Engione buy conditions. Buying momentum is increasing, and the pivot low is in place at $23.43

US Interest Rates

The Fed Decision

The Fed kept rates on hold between 5.0% and 5.25%, in-line with market expectations. As for Powell’s commentary, here are some of his key comments:

- Rate outlook: “We are prepared to maintain the current target range for longer if appropriate … If the economy evolves going forward, the appropriate level of the federal funds rate will be 4.6% at the end of this year, 3.9% at the end of 2025 and 3.1% at the end of 2026.”

- Rate outlook: “We believe that our policy rate is likely at its peak for this time in the cycle.

Overall – The Fed still seeks greater confidence inflation is moving sustainably down before making its first rate cut.

Boss Energy

BOE:ASX acquired a 30% interest in Alta Mesa in early 2024 for US$60m. Positive drilling results are likely to underpin the recent $4.50 support level.

The project remains on track for production in mid-CY24.

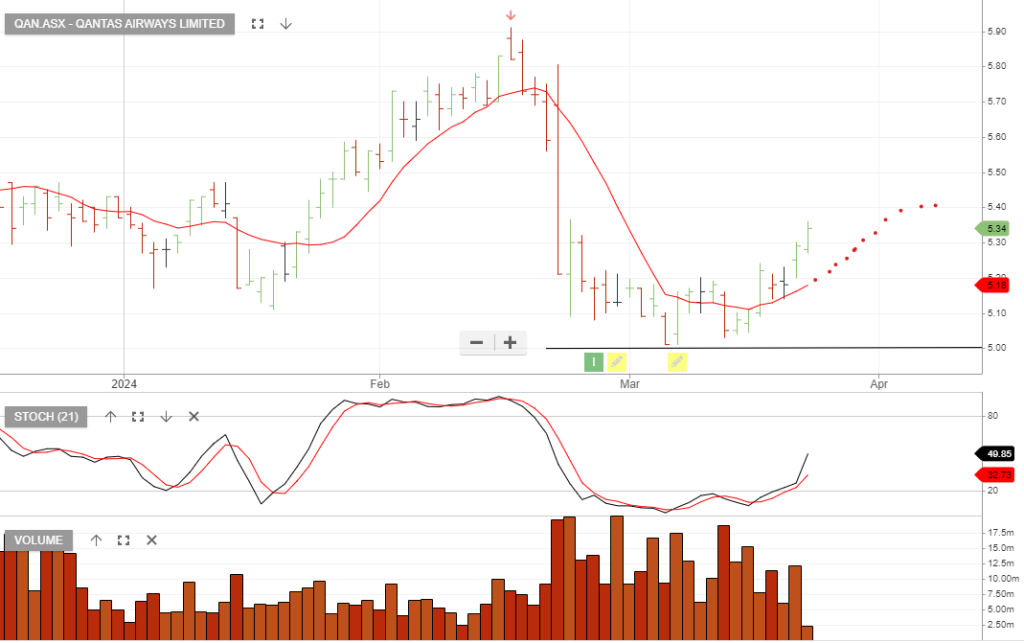

Qantas

Send our ASX Research to your Inbox

Or start a free thirty day trial for our full service, which includes our ASX Research.