Micron Technology

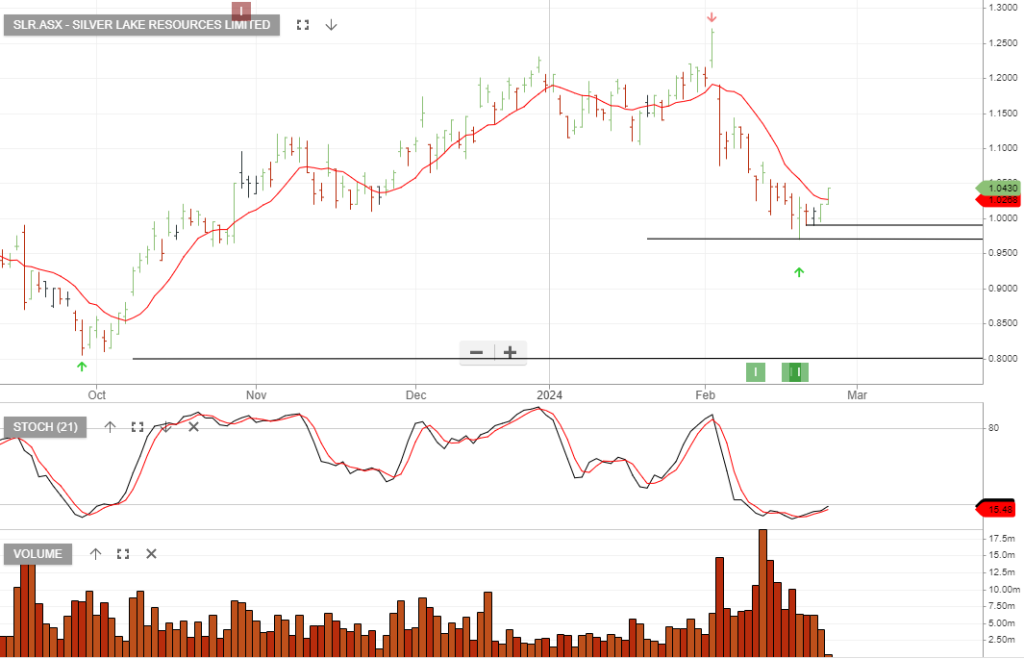

Silver Lake

Silver Lake Resources is a buy with a stop loss at $0.97

Bellevue is up 11.6%

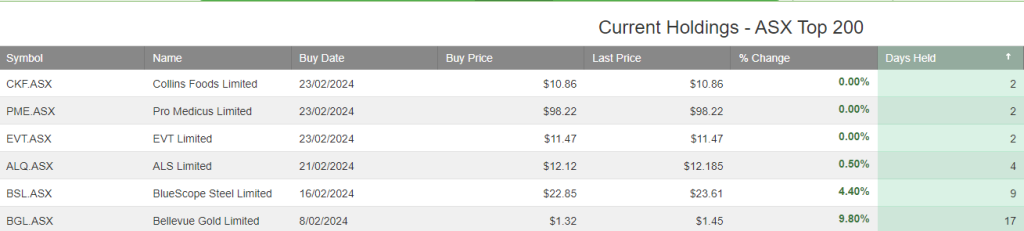

Bellevue Gold remains an open trade with positive momentum lifting the gains to 11.6% after a 17-day holding period.

Gold Road

Gold Road Resources is under Algo Engine buy conditions.

EVT Limited

EVT is now under Algo Engine buy conditions.

EVT Ltd is an Australian company which operates cinemas, hotels, restaurants and resorts in Australia, New Zealand and Germany. It owns Event Cinemas, BCC Cinemas and CineStar, as well as golf courses and the ski resort Thredbo.

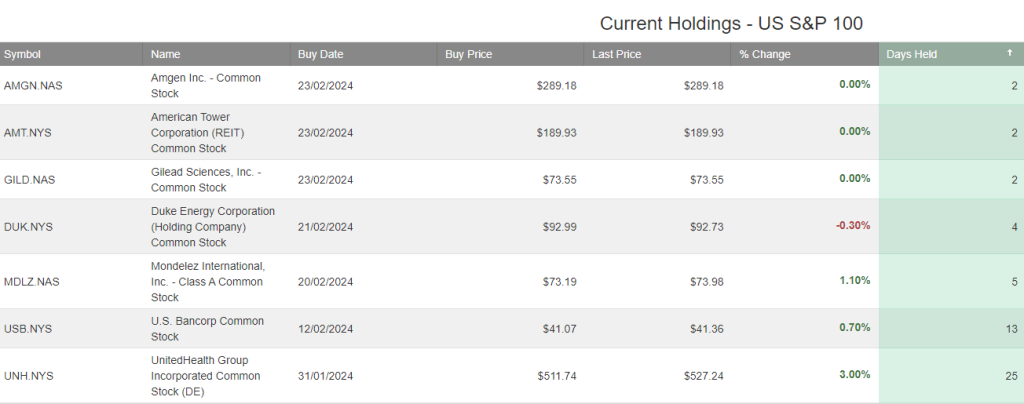

US NASDAQ 100 Trade Table

We’re seeing an increase in the number of holdings in the US NASDAQ 100 Trade Table.

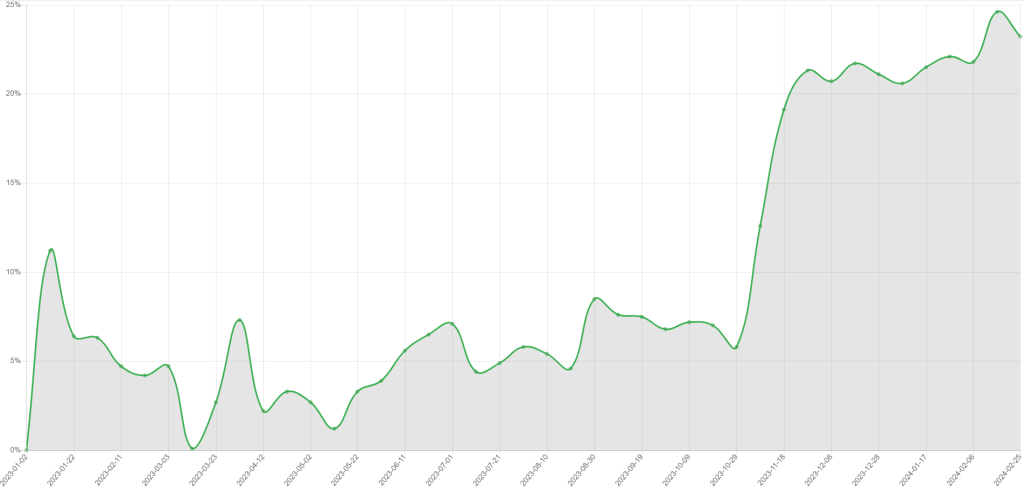

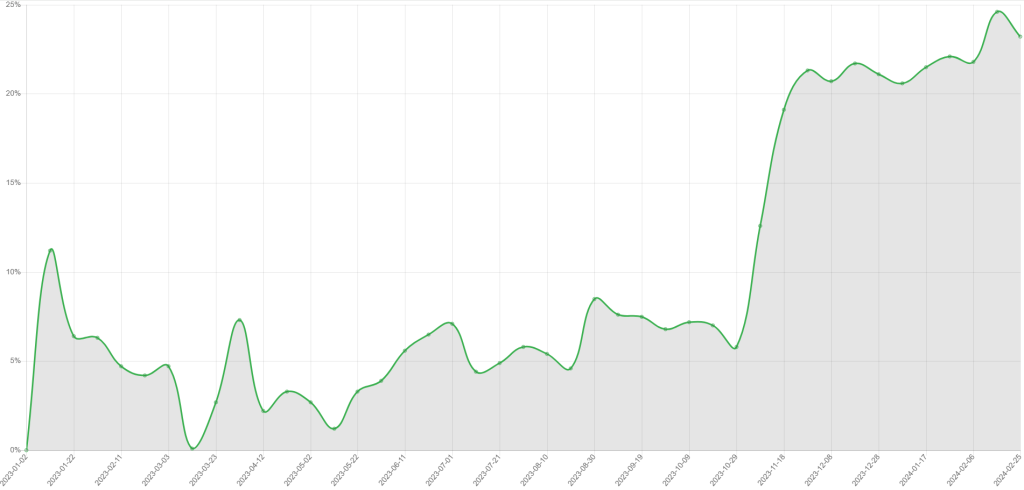

US S&P100 Trade Table

We’re seeing an increase in the number of holdings in the US S&P100 Trade Table.

ASX200 Trade Table

We’re seeing an increase in the number of holdings in the ASX200 Trade Table.

US Earnings

Monday, February 26 – Workday, Li Auto), Domino’s Pizza, and Zoom Video.

Tuesday, February 27 – Lowe’s, American Tower, AutoZone, and eBay.

Wednesday, February 28 – Salesforce, Royal Bank of Canada, Baidu, HP, and Snowflake.

Thursday, February 29 – Anheuser-Busch InBev, Toronto-Dominion Bank, Dell Technologies, and Autodesk.

Friday, March 1 – Plug Power and fuboTV.