Global Dividend ETF

Amcor

Russell Top 200 Growth ETF: Short Position

iShares Russell Top 200 Growth offers one way to capture short exposure to a correction in overpriced US growth stocks.

The iShares Russell Top 200 Growth ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities that exhibit growth characteristics.

Consider the short side if the price break below $156.63

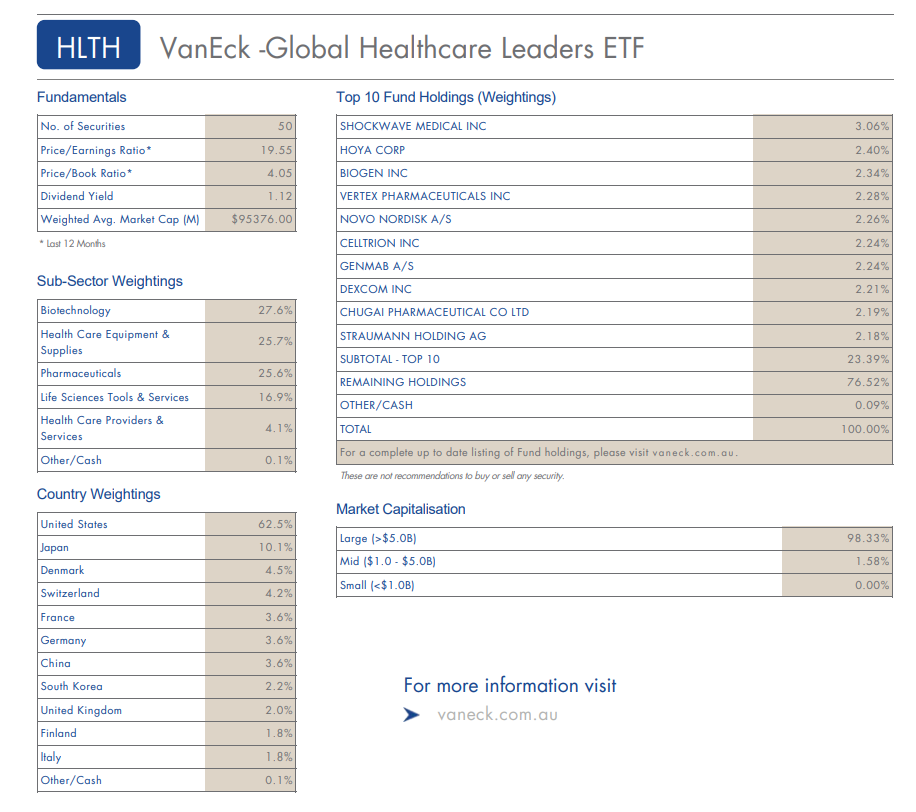

Global Healthcare Leaders ETF

VanEck Vectors Global Health Leaders

HLTH invests in a diversified portfolio of leading international developed markets (ex-Australia)

companies with the best growth at a reasonable price (GARP) attributes from the global healthcare

sector.

CSL

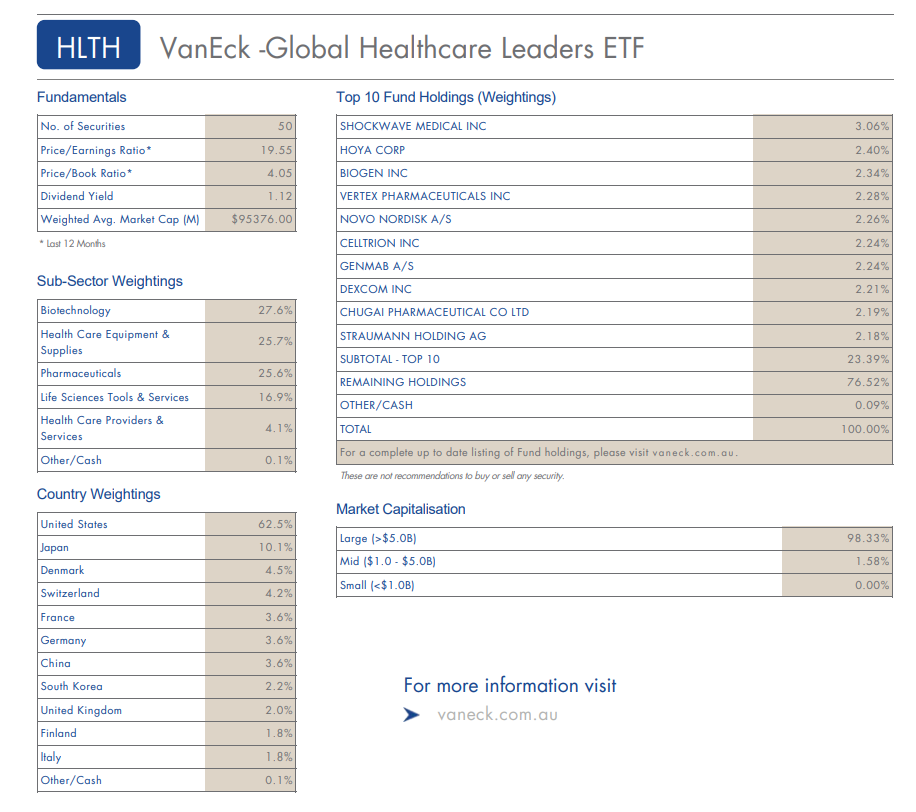

Global Healthcare Leaders ETF

VanEck Vectors Global Health Leaders

HLTH invests in a diversified portfolio of leading international developed markets (ex-Australia)

companies with the best growth at a reasonable price (GARP) attributes from the global healthcare

sector.