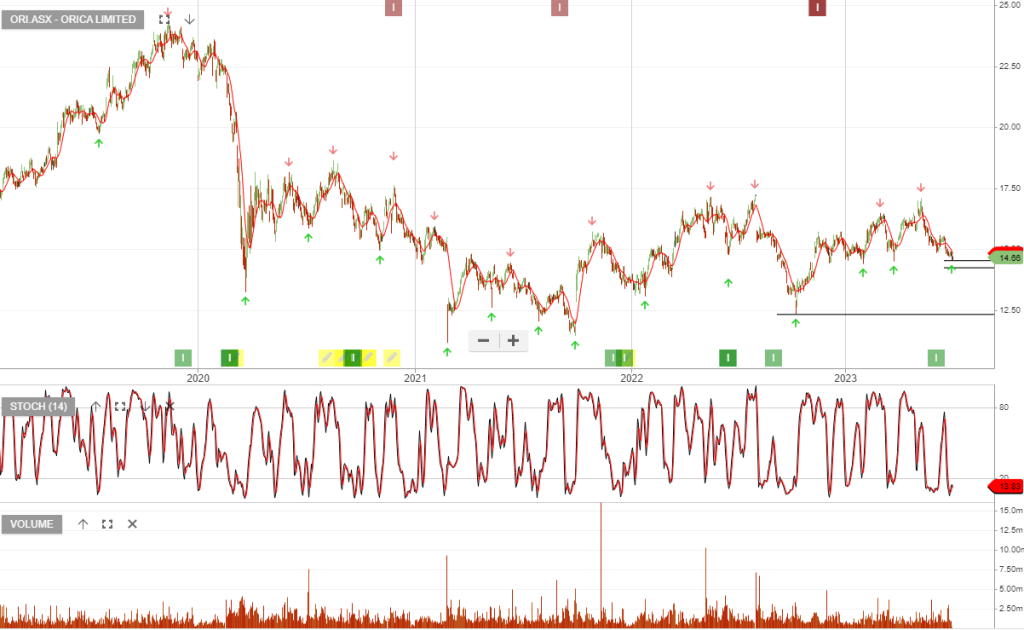

Orica – Algo Buy

Orica is under Algo Engine buy conditions.

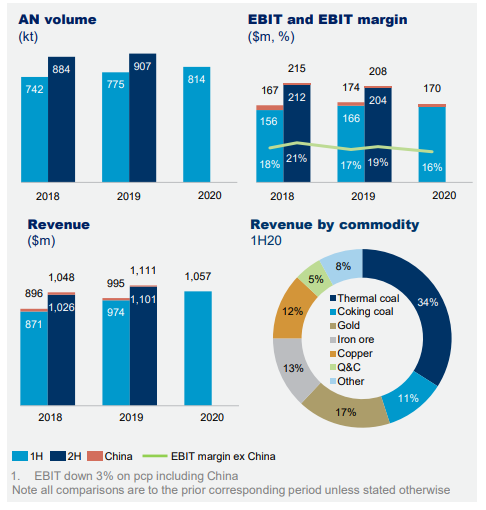

Orica – FY20 Earnings

Orica is under Algo Engine buy conditions and is a current holding in our ASX model portfolios.

ORI reported FY20 results, with EBIT of $605m, (down 9% on the same time last year), and underlying NPAT of $300m.

To support an improving share price we continue to monitor the potential for faster-than-expected resolution of manufacturing of the Burrup Plant.

FY21 dividend yield is forecast at 2.8%.

Orica – Buy Signal

Orica is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Orica

Orica is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

ORI expects FY20 EBIT to be around $600mn which represents a 10% fall on the same time last year.

The full-year results will be announced on 20 Nov.

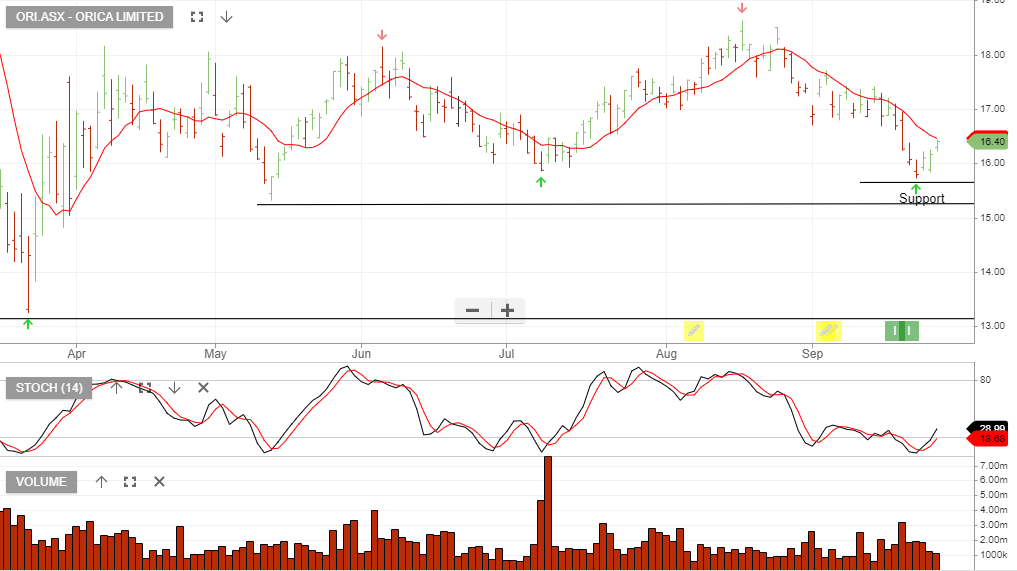

Orica – Finding Support

Orica has found increased buying support at $15.50 and the short-term indicators have now turned positive.

Orica – Valuation Review

Orica is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

FY21 revenue is likely to remain flat at $5.8bn and EBIT is forecast to increase 3-5% to $630mn. This supports a forward yield of 2.8%.

Earnings are likely to be well supported due to higher volumes and the strength in the mining industry, especially from the gold mining market.

Earnings may surprise to the upside and we continue to hold ORI into the next earnings release.

Orica – Finding Support

Orica has found support after re-testing the $17 higher low price point.

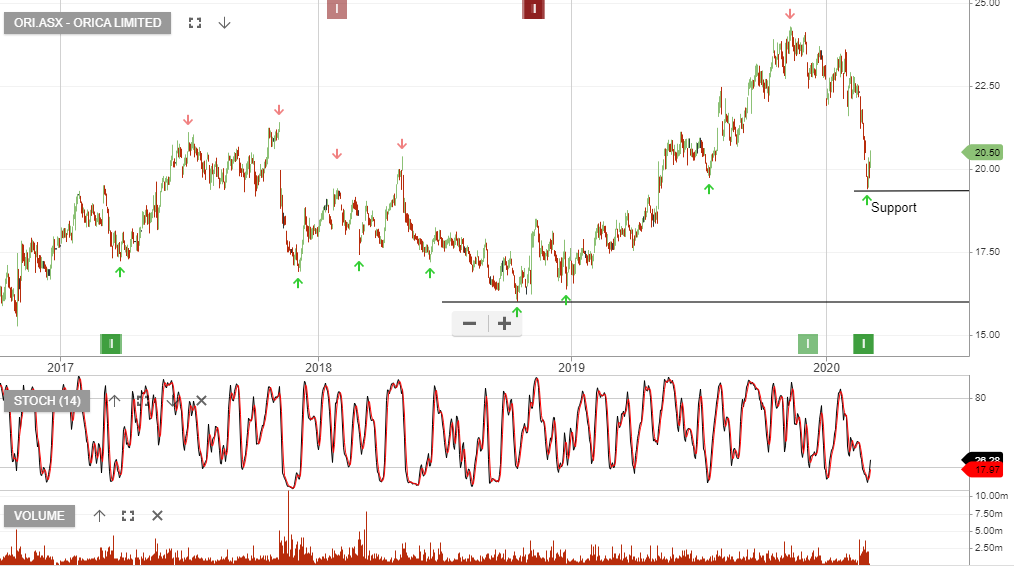

Orica – Higher Low

Orica is under Algo Engine buy conditions. We expect to see the share price continue to move higher.

ORI goes ex-div on 12 November 2020 $0.33.

Orica – Buy Signal

Orica is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Goldman Sachs raised $500 million in acquisition funding for ORI via an institutional placement.

The funds will be used for the acquisition of Exsa, Peru’s No. 1 manufacturer and distributor of industrial explosives and provide greater balance sheet flexibility.

We see strong buying support at $20.

Send our ASX Research to your Inbox

Or start a free thirty day trial for our full service, which includes our ASX Research.