Megacap Tech Spend in 2026

Tech’s megacaps announced major increases in capex for 2026, with the four hyperscalers now expecting combined spending of close to $700 billion.

Reaching those numbers is going to mean a big drop in free cash flow, with Amazon projected to turn negative this year.

The four hyperscalers are now projected to increase capital expenditures by more than 60% from the historic levels reached in 2025, as they load up on high-priced chips, build new mammoth facilities and buy the networking technology to connect it all.

Getting to those kinds of numbers is going to require sacrifice in the form of free cash flow. Last year, the four biggest U.S. internet companies generated a combined $200 billion in free cash flow, down from $237 billion in 2024.

While Amazon laid out the most aggressive spending plan among the megacaps, Alphabet wasn’t far behind. Pivotal Research projects Alphabet’s free cash flow to plummet almost 90% this year to $8.2 billion from $73.3 billion in 2025.

Analysts at Barclays now see a drop of almost 90% in Meta’s free cash flow, after the social media company said last week that capex this year will reach as high as $135 billion.

Inner Circle: Member-Only Content

Microsoft’s commercial RPO reached $625 billion, up 110% YoY, with roughly $156 billion converting within 12 months.

Azure and other cloud services revenue grew 39% YoY, driving Microsoft Cloud’s topline to $51.5 billion, up 26%.

Commercial bookings surged 230% YoY, while remaining performance obligations beyond 12 months climbed 156%, strengthening long-term visibility.

Microsoft 365 Copilot reached 15 million paid seats, with seat growth up 160% QoQ and large-enterprise adoption tripling.

A $625 backlog with a growth rate that is accelerating, 39% growth in Azure, and explosive growth in Copilot all provide a level of revenue visibility .

Fortescue

Fortescue is under Algo Engine buy conditions.

Xero

Xero is likely to find buying support near the $80 support level.

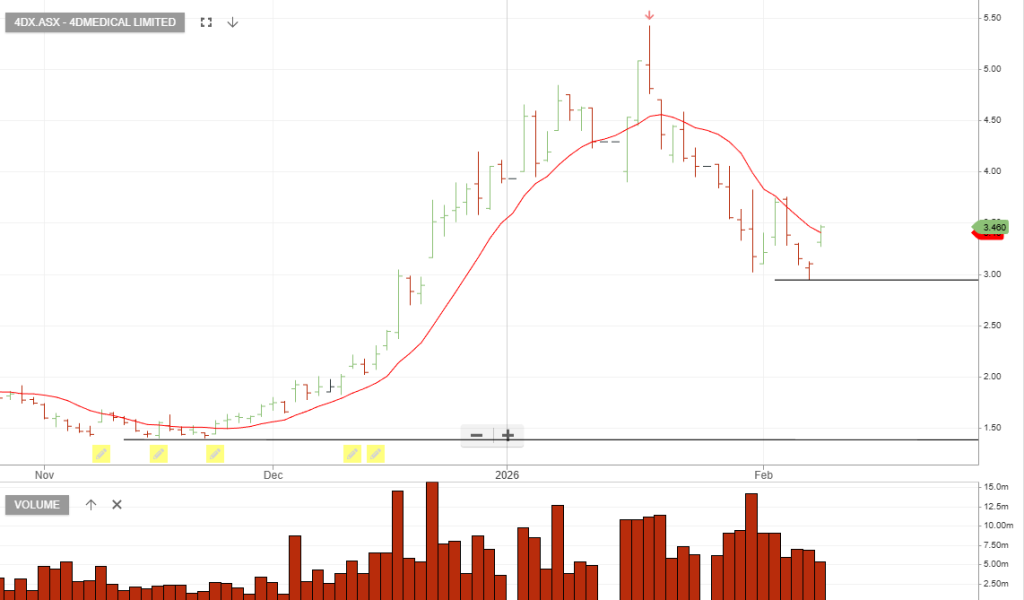

4D Medical

ASX:4DM is finding buying support above the $2.95 low.

Data centre operators

Commonwealth Bank said Australia was one of the world’s top destinations for AI investment behind the US and China. NextDC rallied 4.9 per cent to $13.33, Goodman 6.5 per cent to $30.76 and Megaport 5.2 per cent to $10.84.

Megaport is under Algo Engine buy conditions.

Pro Medicus

Crypto Innovators ETF

Pepper Money

Pepper Money jumps 27%. The company has confirmed that it has received a 100% takeover that could see the prominent non-bank lender delisted from the Australian Stock Exchange (ASX). Under the proposed deal, investment manager Challenger Limited will team up with Pepper Group ANZ HoldCo Limited to jointly acquire Pepper Money.

We’ve been bullish on Pepper Money following the recent string of Algo Engine buy conditions and the improving fundamentals.