Collins Foods – Short-term Trade Setup

Collins Foods is under Algo Engine buy conditions.

Short-term traders may also consider the opportunity here with a stop loss below the recent pivot low.

Collins Foods is under Algo Engine buy conditions.

Short-term traders may also consider the opportunity here with a stop loss below the recent pivot low.

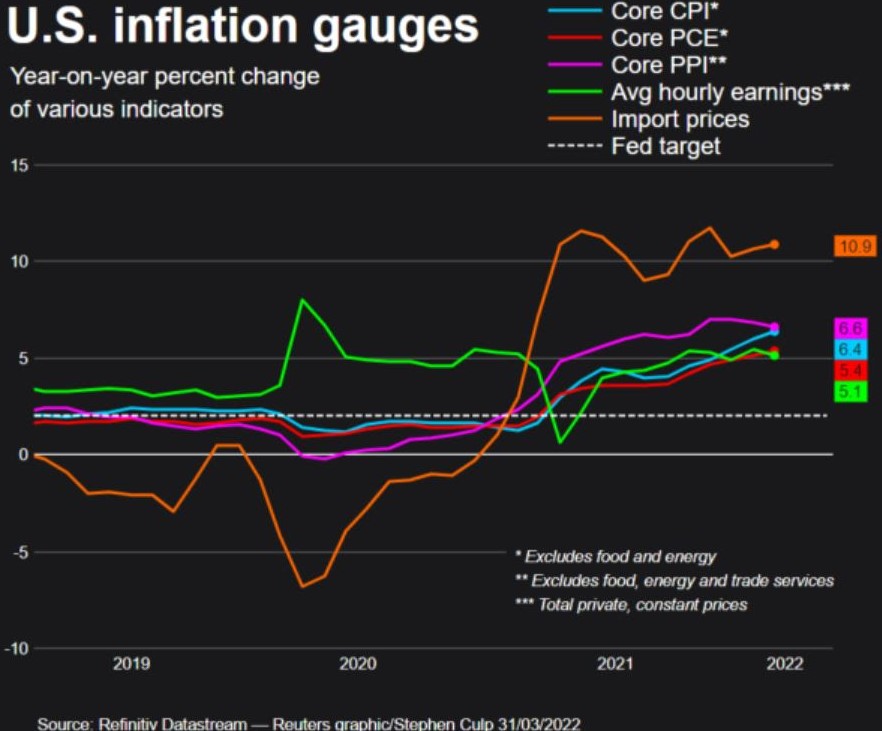

U.S. consumer spending barely rose in February as an increase in spending on services was offset by declining purchases of motor vehicles and other goods, while price pressures mounted, with annual inflation surging by the most since the early 1980s.

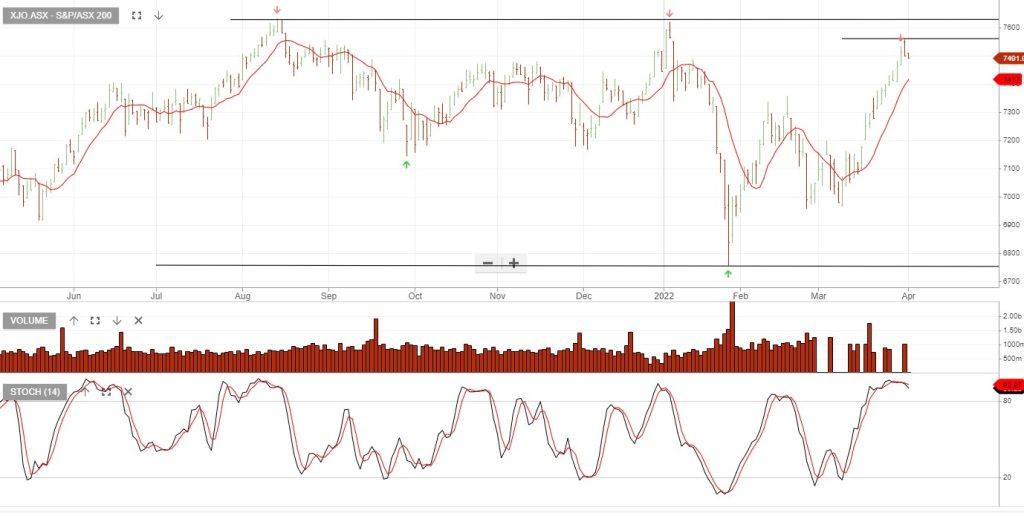

The XJO is now trading at the upper band of the consolidation channel that’s been in place since mid-last year.

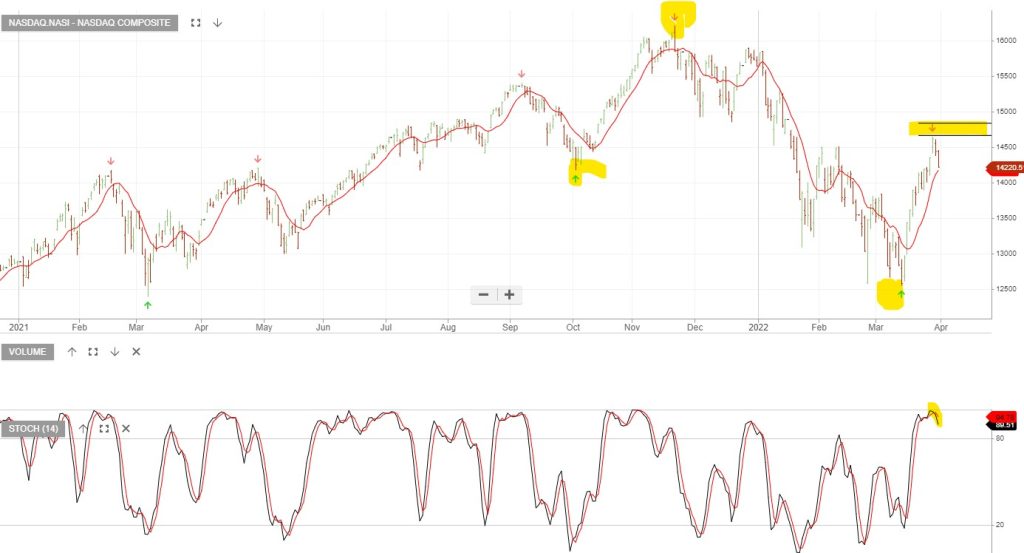

NASDAQ’s PE ratio is now 27X forward earnings with 2022 earnings growth rate forecast at 12.3%. The recent rally is a significant extension given the move higher in interest rates.

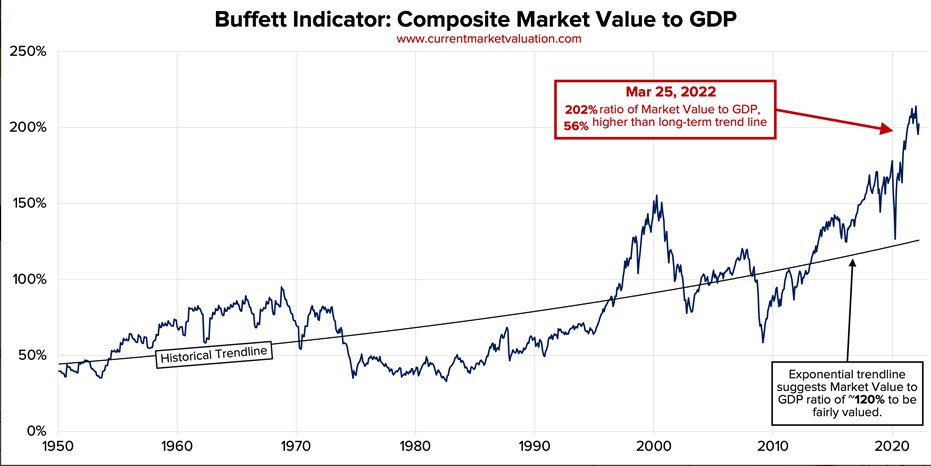

The graph below looks at the valuation of the S&P relative to US GDP.

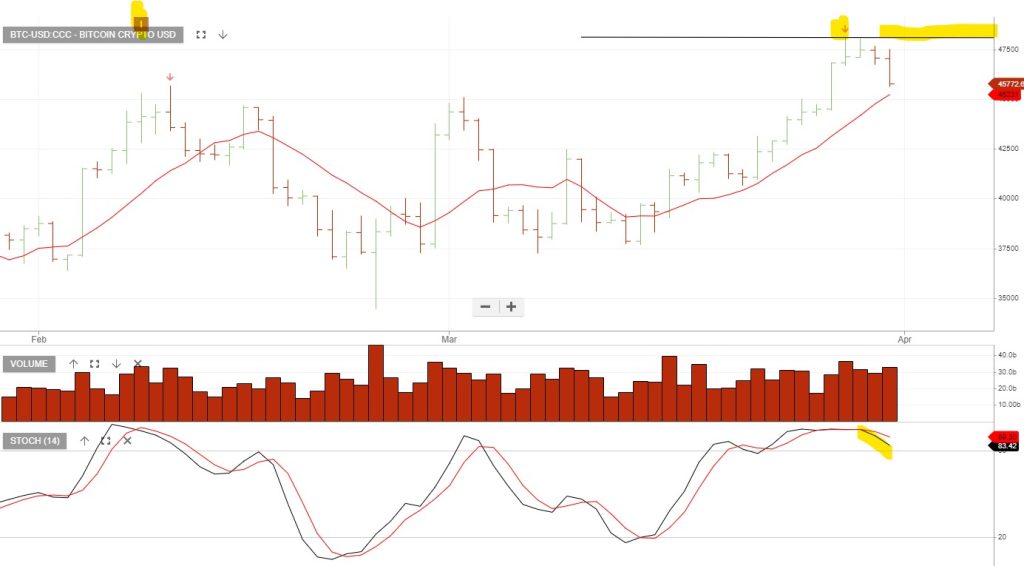

The rebound in the NASDAQ has been sharp and it’s possible we’re now looking at a level of overhead resistance. For crypto investors, this provides an opportunity to consider hedging or an outright short position.

The strategy requires a stop loss which means any short exposure is closed out if the market rally continues.

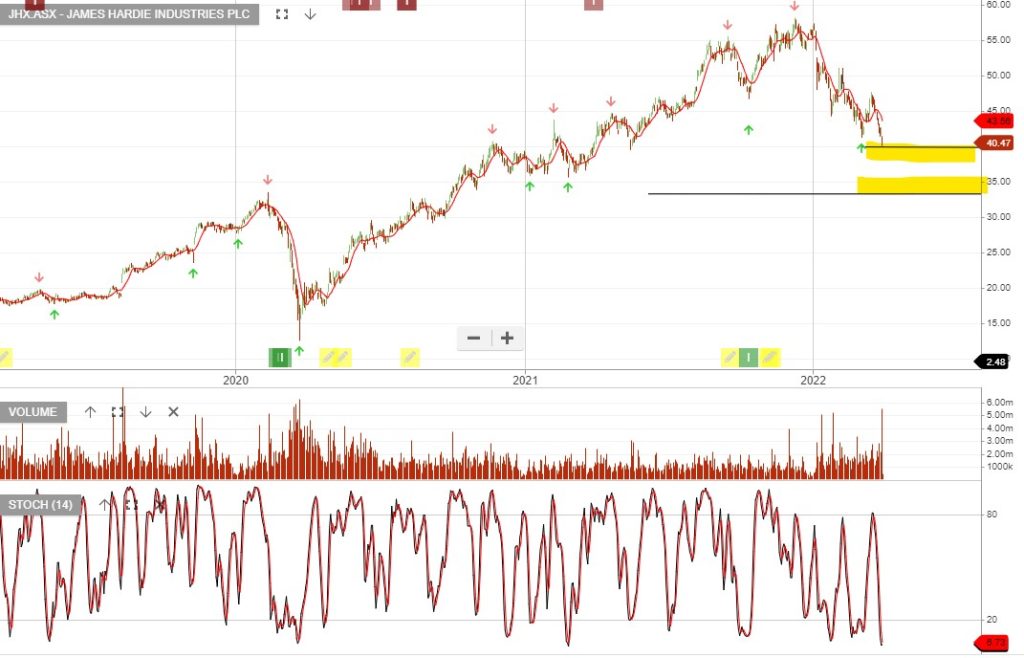

James Hardie Industries is approaching an oversold range where investors should begin monitoring the short-term momentum indicators for a pick-up in buying activity.

The price range for a reversal in price action remains wide at $33 to $39.

Treasury Wine Estates is under Algo Engine buy conditions.

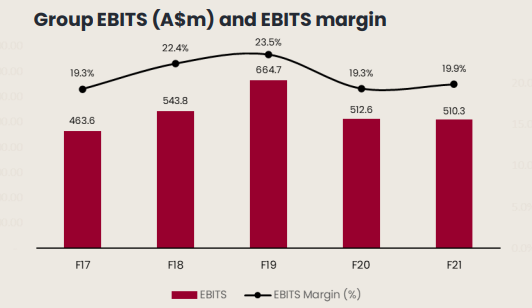

TWE continues to adjust to a post pandemic/post Chinese tariff environment. FY21 EBIT of $510 exceeded market expectations. After a number of years of disappointment for TWE in this region, we see America’s division accelerating growth into FY22.

FY22 EBIT growth is forecast to be in the mid to high single-digit range.

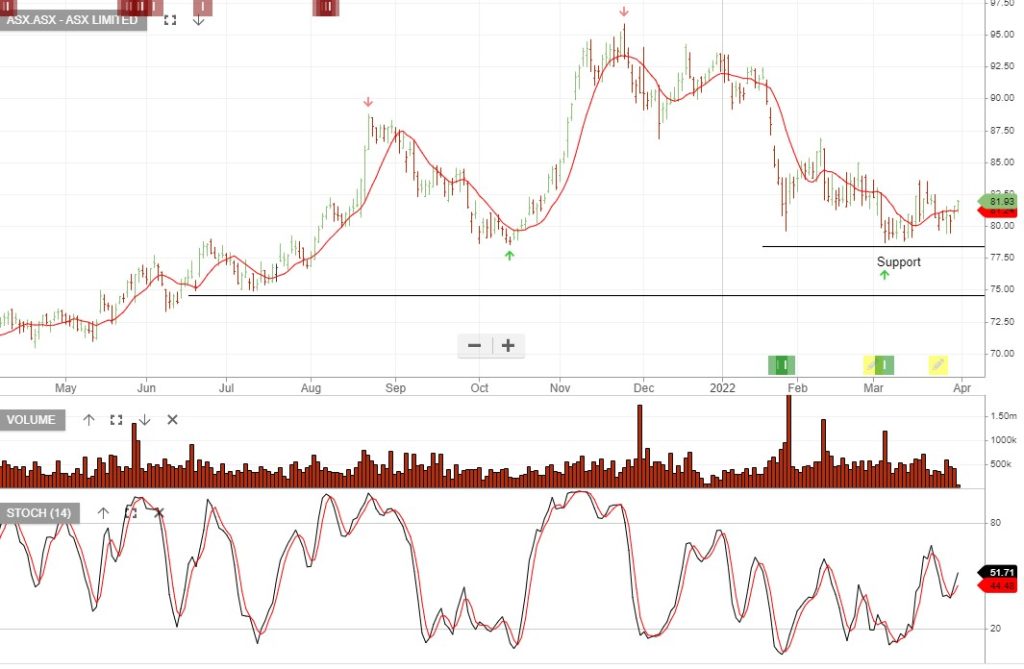

ASX is under Algo Engine buy conditions.

ARB Corporation is under Algo Engin buy conditions.

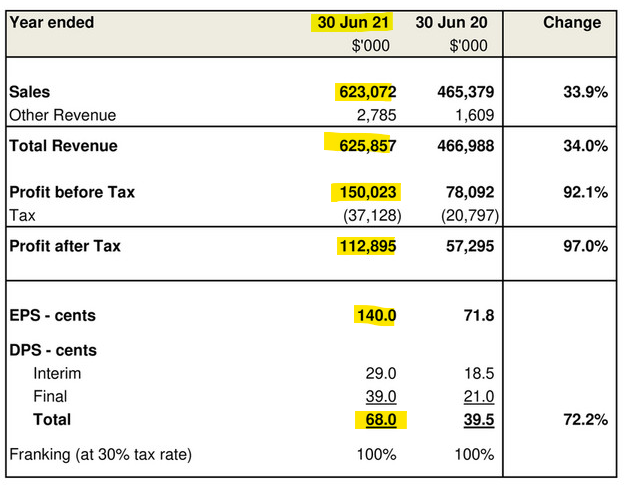

ARB is Australia’s largest manufacturer and distributor of 4×4 accessories. They have a vast international presence, with offices in the USA, Europe and the Middle East, and an export network that extends through more than 100 countries around the globe.

Or start a free thirty day trial for our full service, which includes our ASX Research.