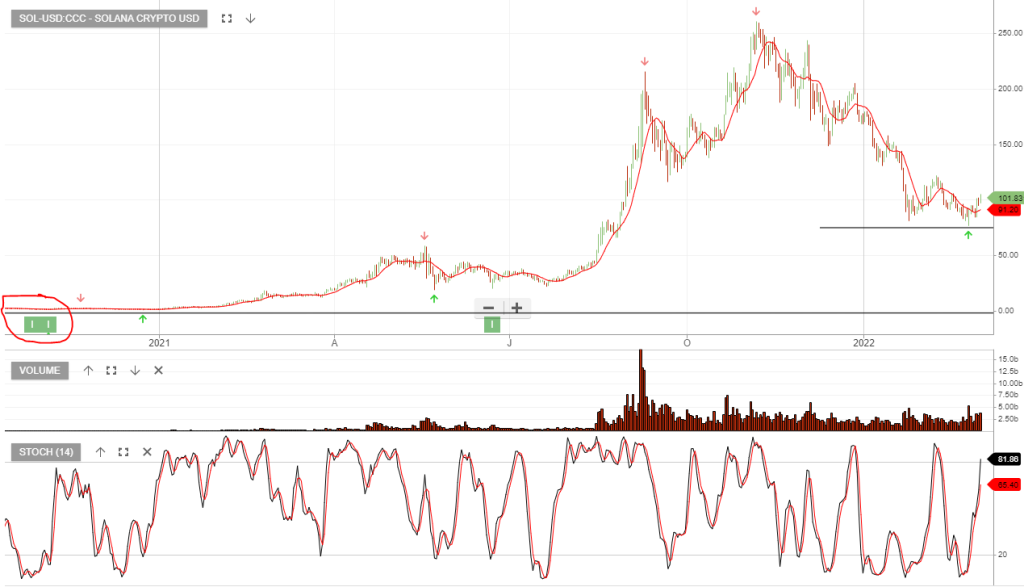

Solana – Larg Cap Crypto

Solana was added to our Crypto Model Portfolio in October 2020 at $1.71. The price has since rallied 5704% and now trades at $101.

SOL remains under Algo Engine buy conditions.

Solana is a public blockchain platform with smart contract functionality, which works to one-up Ethereum by providing faster transaction times and cheaper fees.