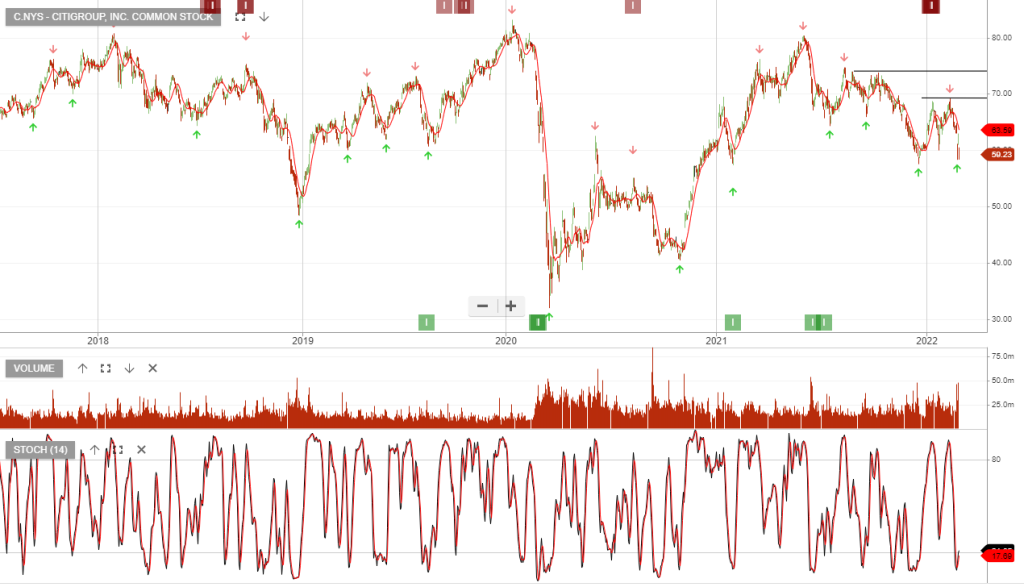

Citigroup – Russian Exposure

Citigroup’s total exposure to Russia amounts to nearly $10 billion. Citigroup warned generally of a potential hit to its business from escalated tensions between the West and Russia following its invasion of Ukraine.

Citigroup’s total exposure to Russia amounts to nearly $10 billion. Citigroup warned generally of a potential hit to its business from escalated tensions between the West and Russia following its invasion of Ukraine.

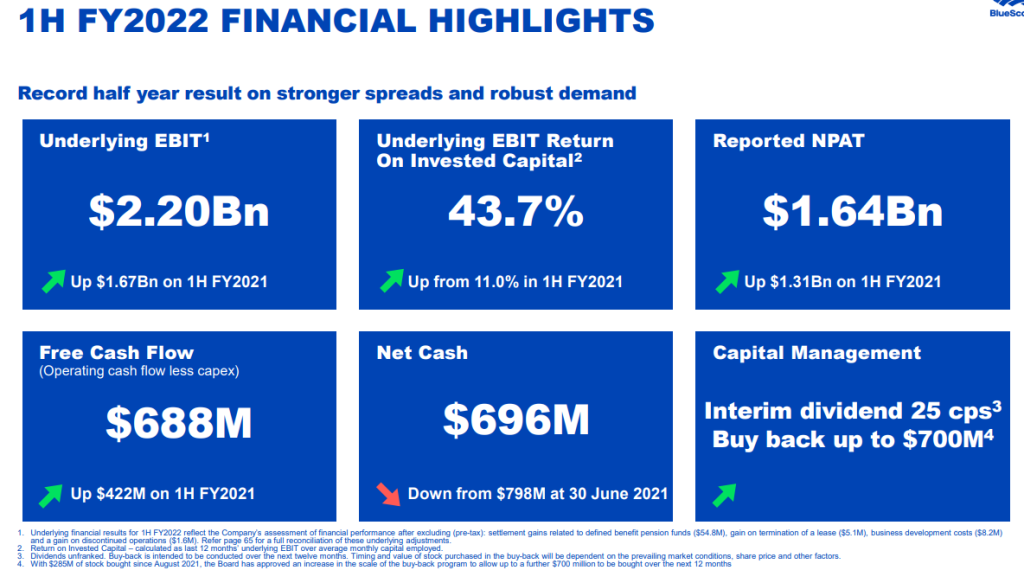

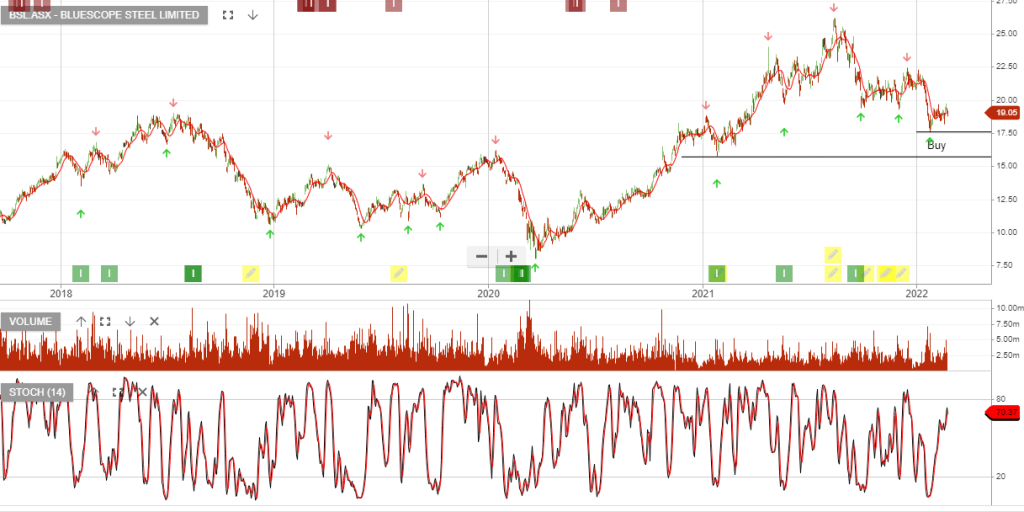

BlueScope Steel is under Algo Engine buy conditions.

With $285M of stock bought since August 2021, the Board has approved an increase in the scale of the buy-back program to allow up to a further $700 million to be bought over the next 12 months

BlueScope delivers record underlying EBIT of $2.20Bn, increases on-market buy-back; commences feasibility, analysis on blast furnace reline at Port Kembla

1H FY2022 Headlines

Reported NPAT: $1.64Bn

Underlying NPAT: $1.57Bn

Underlying EBIT: $2.20Bn

2H FY2022 GROUP OUTLOOK: Underlying EBIT in 2H FY2022 is expected to be in the range of $1.20 billion to $1.35 billion.

Qube Holdings is under Algo Engine buy conditions.

1H22 NPAT of $88 million was ahead of consensus expectations.

We see moderate levels of growth, supported by container volumes and ongoing strength in commodity demand, helping to underpin 3 – 4% EPS growth into FY23 & FY24.

Reece is under Algo Engine buy conditions. 1H22 result was above expectations, with underlying EBITDA increasing 14% to $397m. US performance was a key highlight and we expect 5 -7% EPS growth into FY23.

The stock trades on a forward yield of 1.5%.

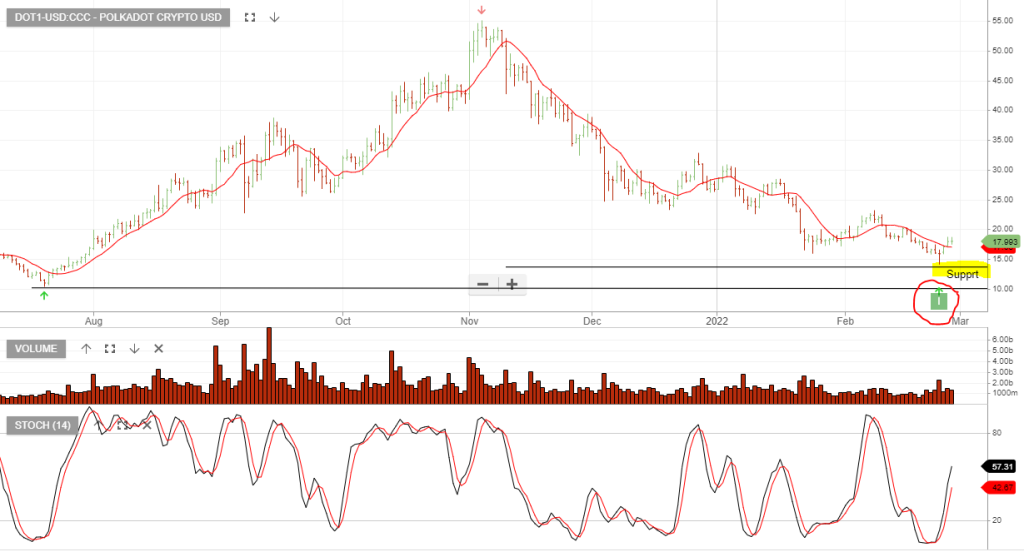

Polkadot Crytop is now under Algo Engine buy conditions after creating a higher low formation and a pivot low at $14.15.

The price action has been supported by increased buying activaty above the $14.15 pivot low and we now have two trading sessions that have closed above the 10-day average.

Polkadot is an open-source platform that allows for distributed computing. The protocol was adapted by the Ethereum co-founder Gavin Wood and is developed by the Web3 Foundation with the initial implementation by Parity Technologies.

Polkadot’s first token sale closed on October 27, 2017, raising a total of 485,331 ETH (Ether, the currency of the Ethereum blockchain).

Polkadot allows for cross-chain transfers of data or assets, between different blockchains, allowing for cross-chain DApps (decentralized applications) to be built using the Polkadot Network.

The Polkadot network has a primary blockchain named relay chain and many user-created parallel chains called parachains. The beating heart of Polkadot is called the Relay Chain. It is the origin of the network’s shared security and consensus and facilitates cross-chain interoperability. Parachains can be attached to the Relay Chain and used for transaction verification and validation.

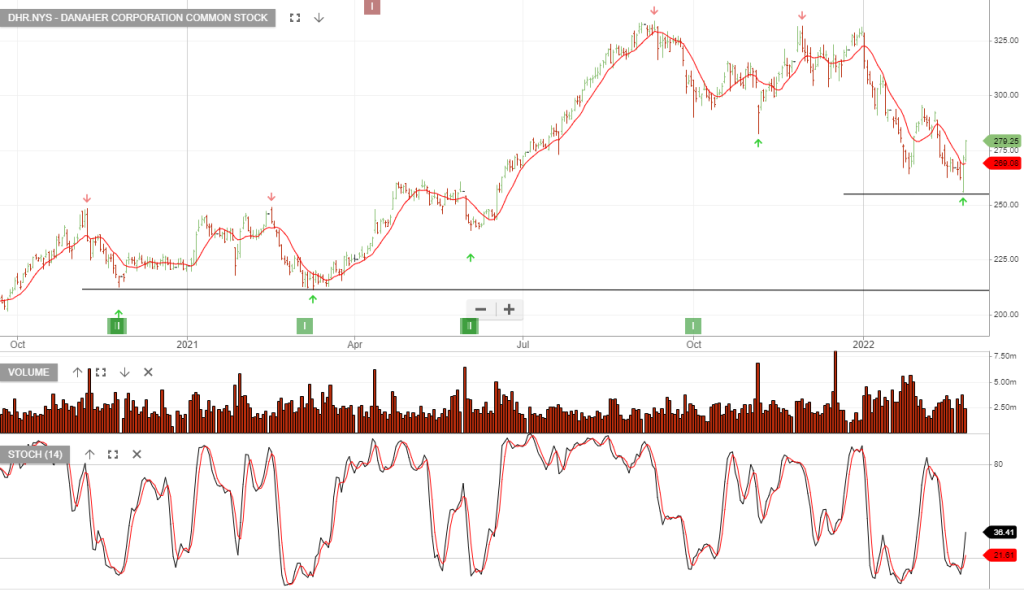

Danaher Corporation Common is under Algo Engine buy conditions.

4Q Dec 2021: net earnings were $1.8 billion, or $2.39 per diluted share which represents + 44% year over year. Non-GAAP earnings per share were $2.69 or + 29% y/y.

Revenues increased +20.5% year-over-year to $8.1 billion.

Full-year 2021: net earnings were $6.3 billion, or $8.50 per share which represents +74% year-over-year increase. Non-GAAP earnings per share for 2021 were $10.05, or +59 over the comparable 2020 amount. Revenues for the full year 2021 increased 32.0% to $29.5 billion.

Operating cash flow for the full year 2021 was $8.4 billion, representing a 34.5% increase year-over-year

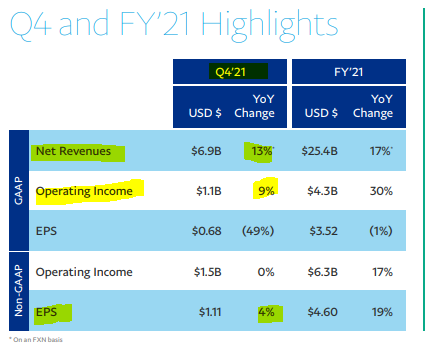

Q4’21: Solid finish to another strong year

Total Payment Volume (TPV) of $339.5 billion, growing 23% on a spot and FX-neutral basis (FXN); net revenues of $6.9 billion, growing 13% on a spot and FXN basis.

FY’22: Expect TPV to reach $1.5 trillion and revenue to surpass $29 billion

• TPV is expected to grow 19%-22% at current spot rates.

• Revenue expected to grow 15%-17% on a spot basis; excluding eBay, revenue is expected to grow 19%-21%

• 15 to 20 million NNAs expected to be added to PayPal’s platform in FY’22.

We see long-term value in Paypal for the patient investor and anticipate that the company will make attractive bolt-on acquisitions, supported by low company debt and free cash flow, which will help support the growth story.

Short term, traders may wish to position a trade around the highlighted setup below, with a stop loss below the recent pivot low.

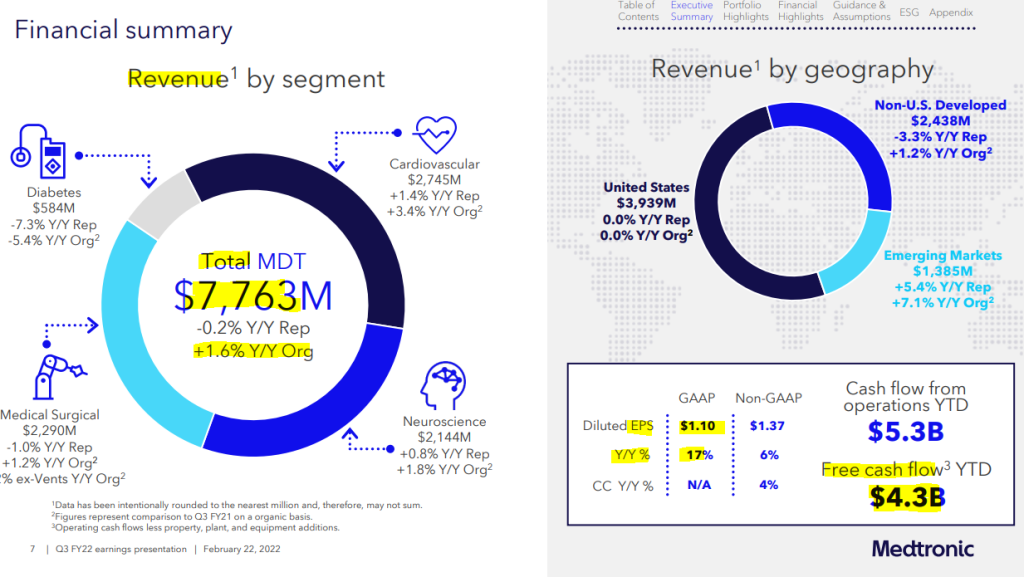

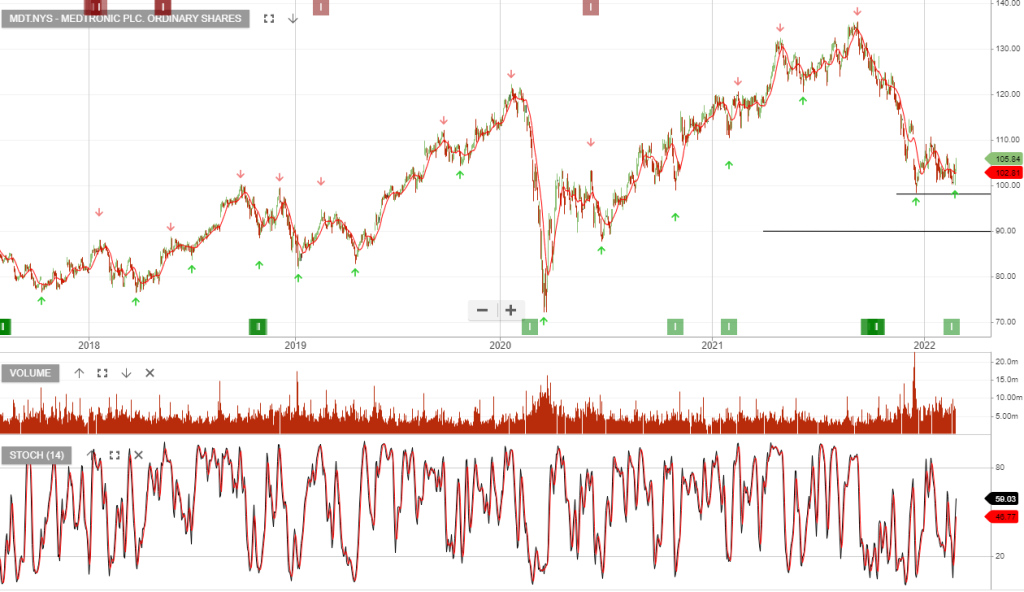

Medtronic plc. Ordinary is under Algo Engine buy conditions.

Medtronic sees rebound in elective procedures as Omicron surge wanes. Fourth-quarter profit was in line with Wall Street estimates.

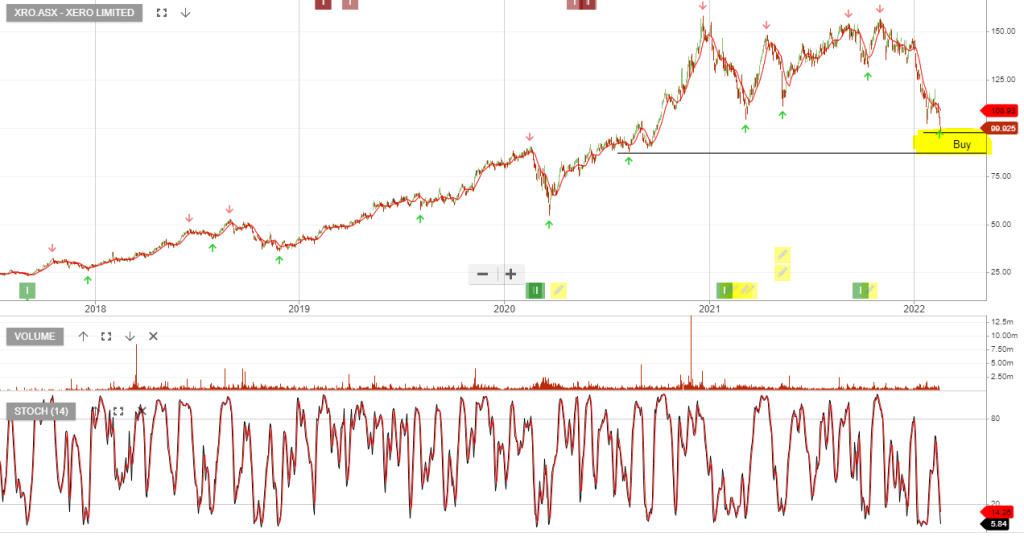

Xero is under Algo Engine buy conditions. Buying support is likely to build within the $86 to $96 price range.