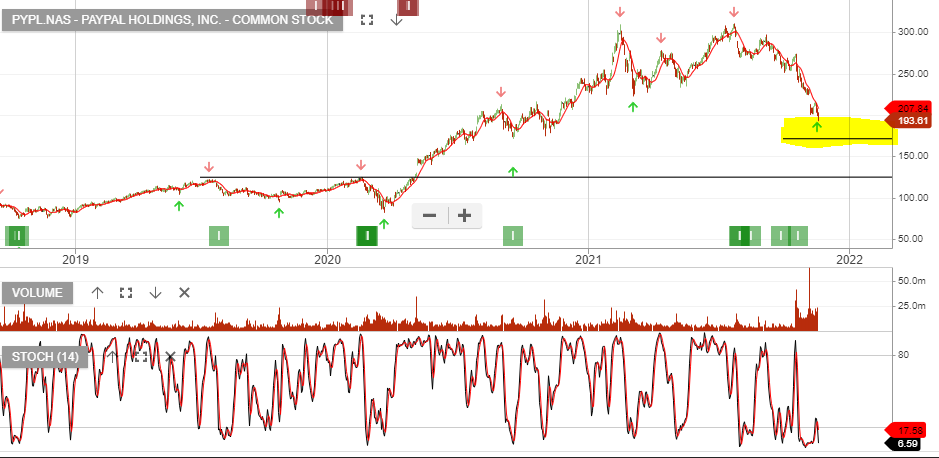

Paypal – Buy

PayPal Holdings, Inc. – Common is a current holding in our US model portfolio. The stock is up 10% since being added last year and the current sell-off provides another entry opportunity.

20/11 update: Paypal remains below the 10-day average and we encourage traders interested in US stocks to track the price action, as a powerful price reversal is likely.