FMG Delivers 157% Gain

Fortescue Metals Group was sold on Friday after being in our model portfolio since July 2019. Following an 840 day holding period, the position was closed for 157% gain.

We continue to maintain exposure to the mining sector and our open positions include RIO, BHP, OZL, and the OZR ETF.

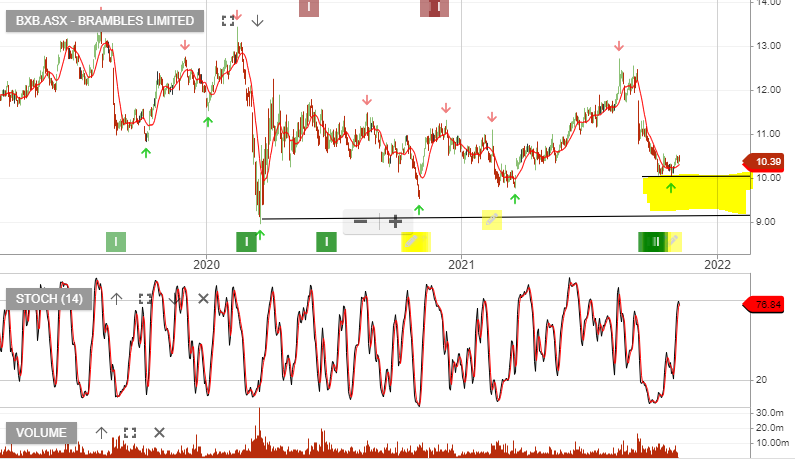

Chart below: SPDR S&P/ASX 200 Resources