India Quality ETF – Buy

BetaShares India Quality is under Algo Engine buy conditions and is a current holding in our ASX ALL ETF model.

BetaShares India Quality is under Algo Engine buy conditions and is a current holding in our ASX ALL ETF model.

iShares Asia 50 is under Algo Engine buy conditions and is a current holding in our iShares ETF model.

INVESTMENT OBJECTIVE: The fund aims to provide investors with the performance of the S&P Asia 50TM Index, before fees and expenses. The index is designed to measure the performance of the 50 leading companies listed in China, Hong Kong, Macau, Singapore, South Korea and Taiwan.

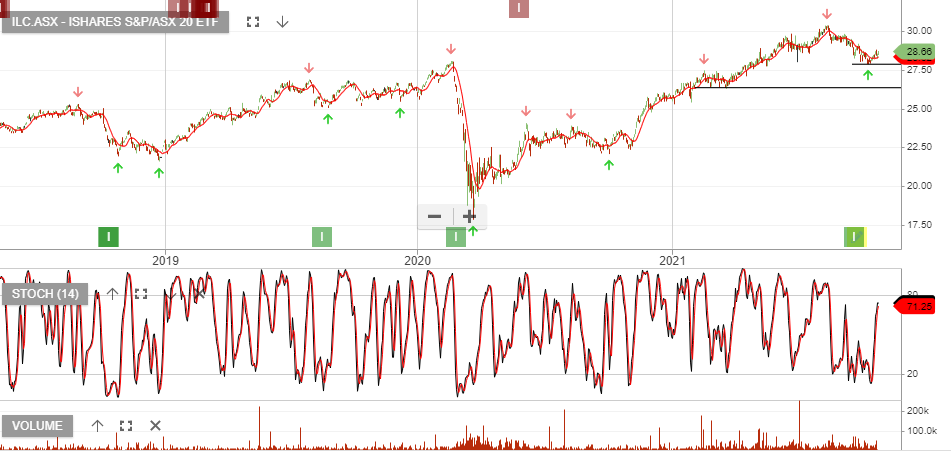

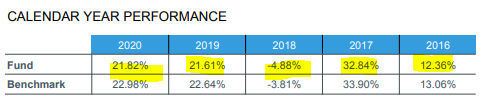

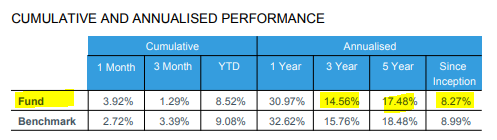

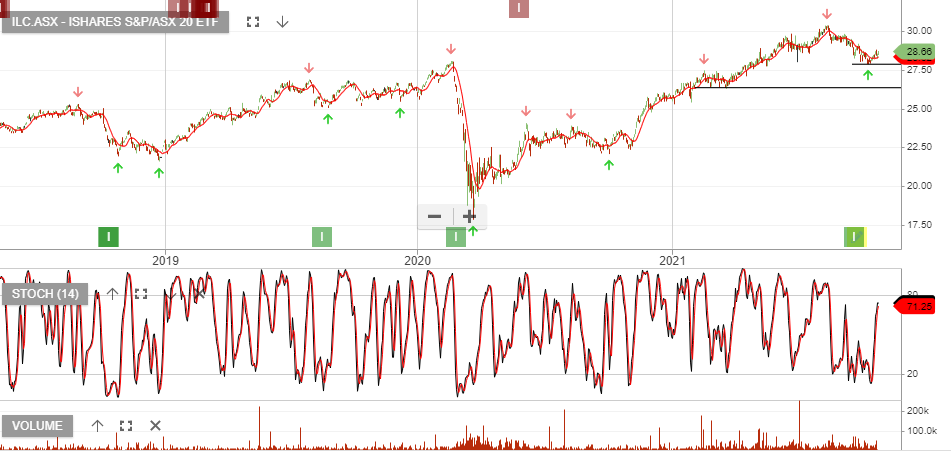

iShares S&P/ASX 20 is now under Algo Engine buy conditions and has been added to our iShares ETF model portfolio.

Telstra Corporation is under Algo Engine buy conditions.

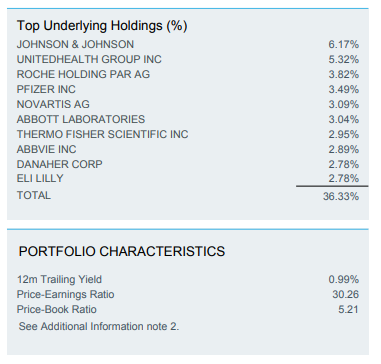

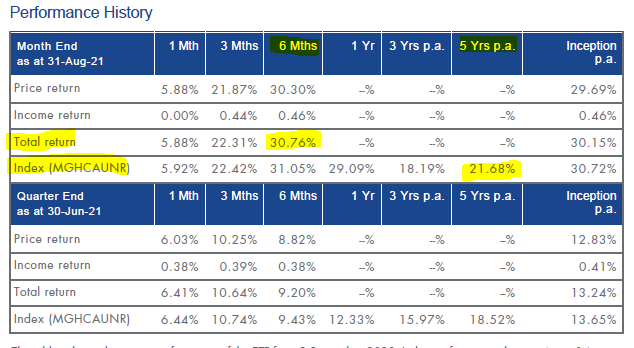

iShares Global Healthcare is now under Algo Engine buy conditions and has been added to our ASX ETF model.

The fund aims to provide investors with the performance of the S&P Global 1200 Healthcare Sector IndexTM, before fees and expenses. The index is designed to measure the performance of global biotechnology, healthcare, medical equipment and pharmaceuticals companies and may include large-, mid- or small-capitalisation stocks.

VanEck Vectors Global Health Leaders is under Algo Engine buy conditions.

HLTH invests in a diversified portfolio of leading international developed markets (ex-Australia) companies with the best growth at a reasonable price (GARP) attributes from the global healthcare sector with the aim of providing investment returns, before fees and other costs, which track the

performance of the Index.

In case you missed it, you can watch last night’s webinar here.

Tonight’s webinar will be available for members and non-members to access. Join us to find out what stocks we’re buying and selling in today’s market.

You can use this link to watch it.

The start time is 8pm NSW time.

iShares S&P/ASX 20 is now under Algo Engine buy conditions and has been added to our iShares ETF model portfolio.