World Stock Market

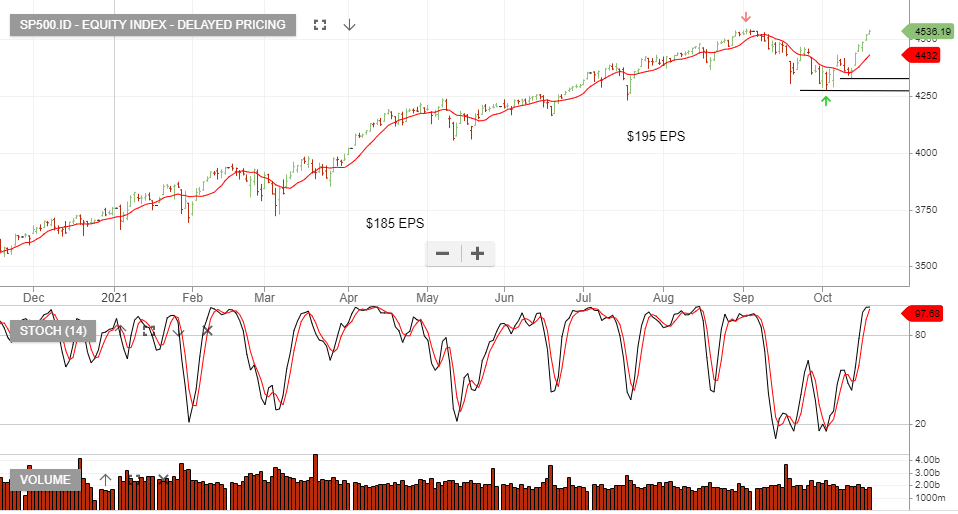

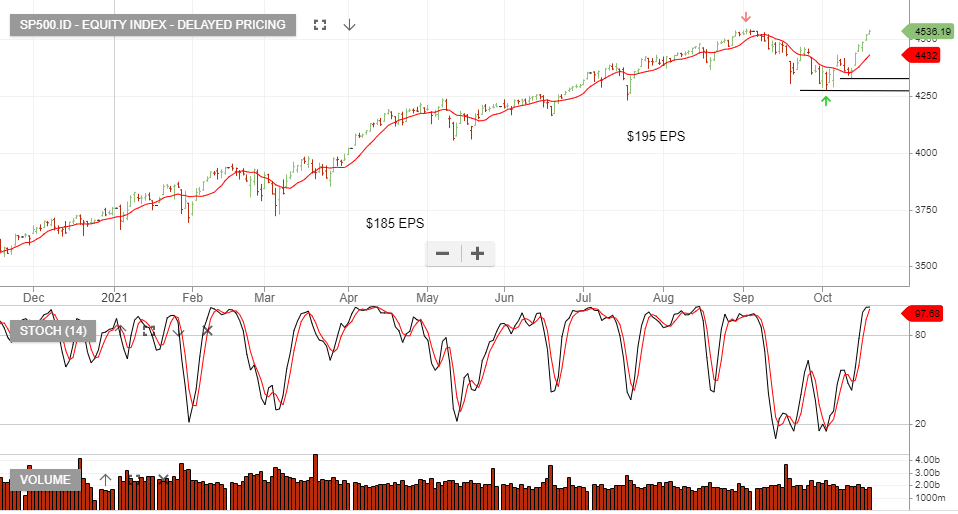

The bullish pattern in the S&P500

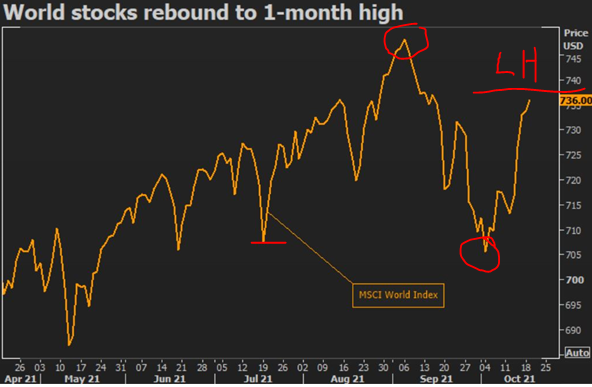

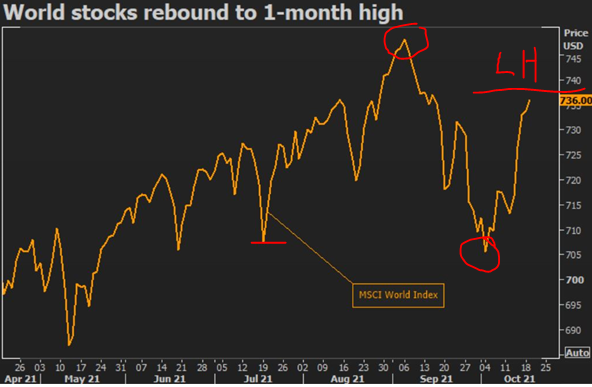

Versus, the potential for a more bearish global pattern to watch.

The bullish pattern in the S&P500

Versus, the potential for a more bearish global pattern to watch.

U.S. home building unexpectedly fell in September and permits dropped to a one-year low amid acute shortages of raw materials and labor, supporting expectations that economic growth slowed sharply in the third quarter.

A separate report from the Mortgage Bankers Association on Tuesday showed mortgage applications for new home purchases decreased 16.2% in September from a year ago.

Permits for future home building plunged 7.7% to a rate of 1.589 million units last month.

Despite the recent weak data the SPDR home builder ETF remains well supported.

Gold Road Resources is under Algo Engine buy conditions.

GOR made an unconditional A$166m off-market takeover offer for Apolla Consolidated. GOR is already AOP’s largest shareholder, owning 19.9%.

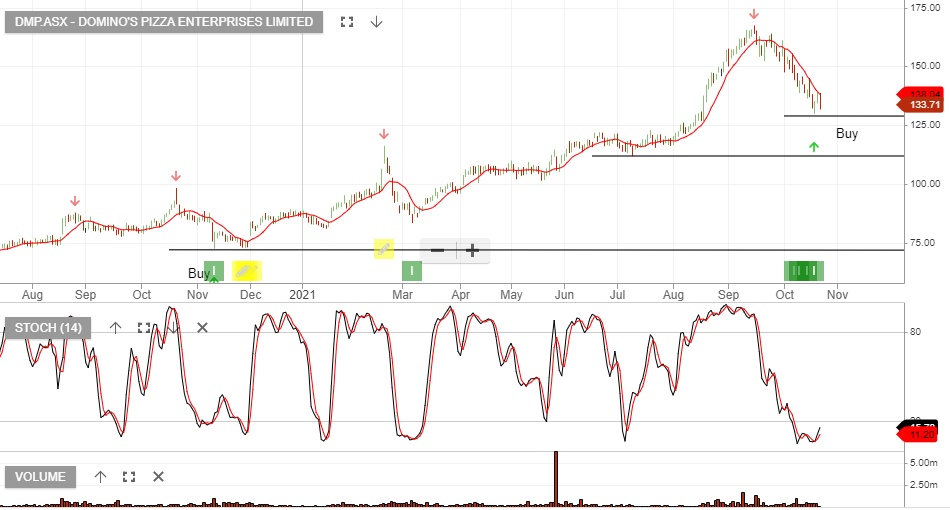

Domino’s Pizza Enterprises is under Algo Engine buy conditions and is among the best-performing stocks in our ASX 100 model portfolio. The stock is up 74% since being added in November last year.

The recent pullback and higher low formation has generated another entry reminder. Accumulate DMP within the $115 to $135 price range.

CIM:ASX is likely to see improved earnings in FY22 and we expect to soon see a recovery in the share price.

CIMIC is a high-risk counter trend investment with the prospect of a multi-year recovery, once earnings hit an inflection point.

Update 21/10: CIMIC Group today announced its financial result for the nine months to 30 September 2021:

NPAT of $303m for 9m of 2021

Group revenue growth of 9.2%2 YoY to $10.9bn, revenue increase of 6.8% YoY to$7.1bn

Revenue growth achieved in Australian Construction and Services

EBITDA, PBT and NPAT margins resilient at 9.6%, 5.1% and 4.3% respectively, despite 3Q21 COVID-19 impact

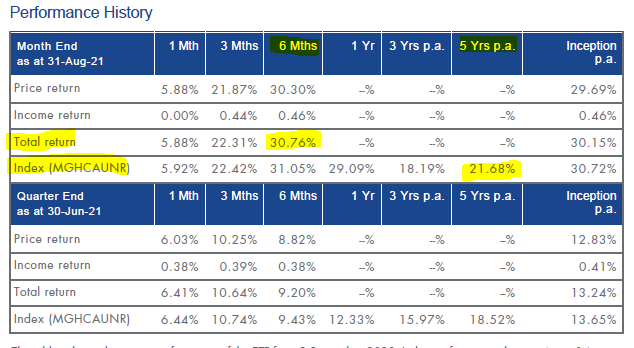

VanEck Vectors Global Health Leaders is under Algo Engine buy conditions.

HLTH invests in a diversified portfolio of leading international developed markets (ex-Australia) companies with the best growth at a reasonable price (GARP) attributes from the global healthcare sector with the aim of providing investment returns, before fees and other costs, which track the

performance of the Index.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Monday, October 18: State Street

Tuesday, October 19: Johnson & Johnson and Procter & Gamble

Wednesday, October 20: Verizon, Biogen, and IBM.

Thursday, October 21: Dow, Intel, and Snap

Friday, October 22: American Express and Honeywell

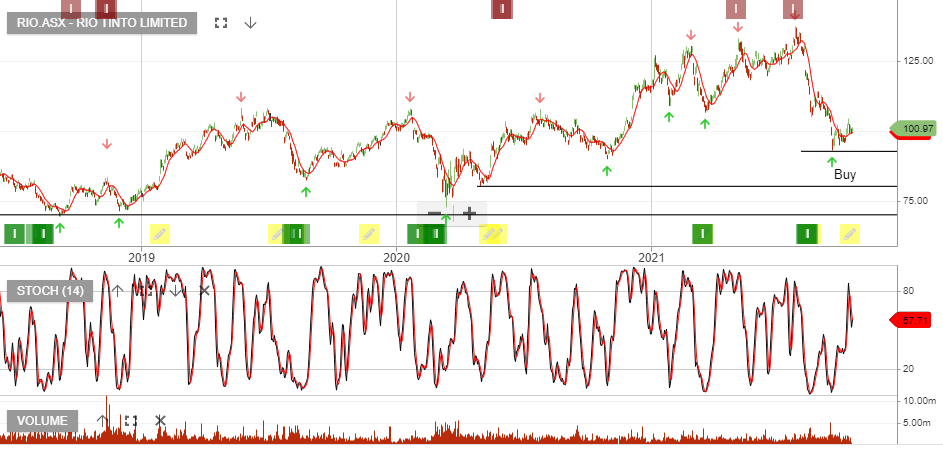

Rio Tinto is under Algo Engine buy conditions.

Ramsay Health Care is under Algo Engine buy conditions and is a current holding in our model portfolio.