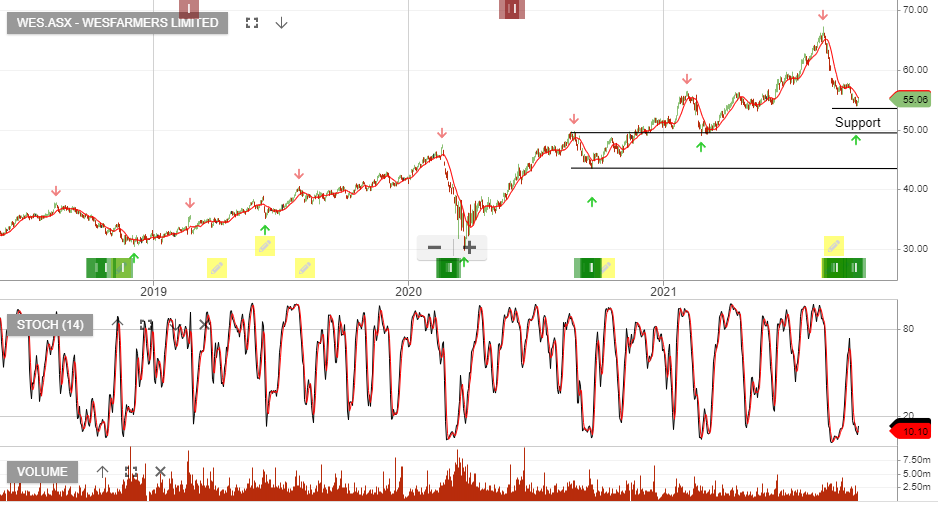

Wesfarmers – Buy

Wesfarmers is under Algo Engine buy conditions and is a current holding in our model portfolio.

Wesfarmers now holds 19.3% of Australian Pharmaceutical Industries. The acquisition has less than two weeks left in confirmatory due diligence. The battle between Sigma and Wesfarmers for the API business and final offers will be worth watching.

Accumulate WES within the $50 – $56 price range.

.