ASX 200 Resources Fund

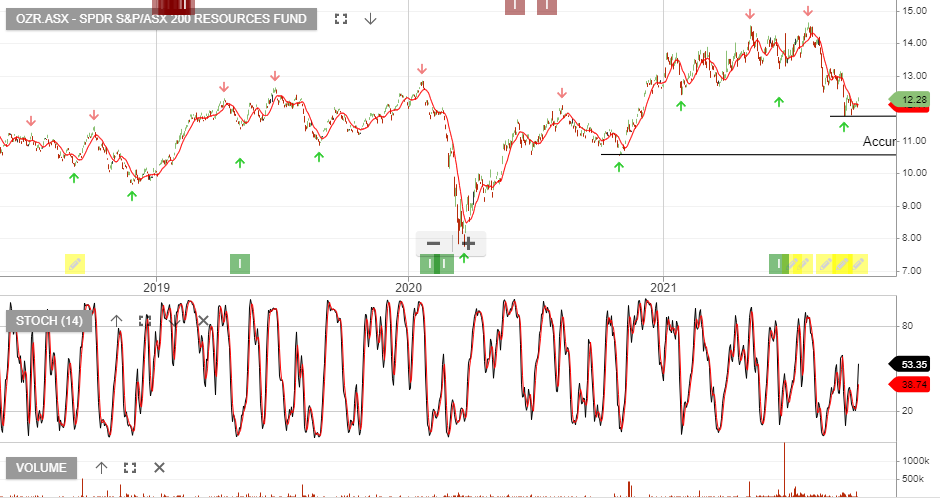

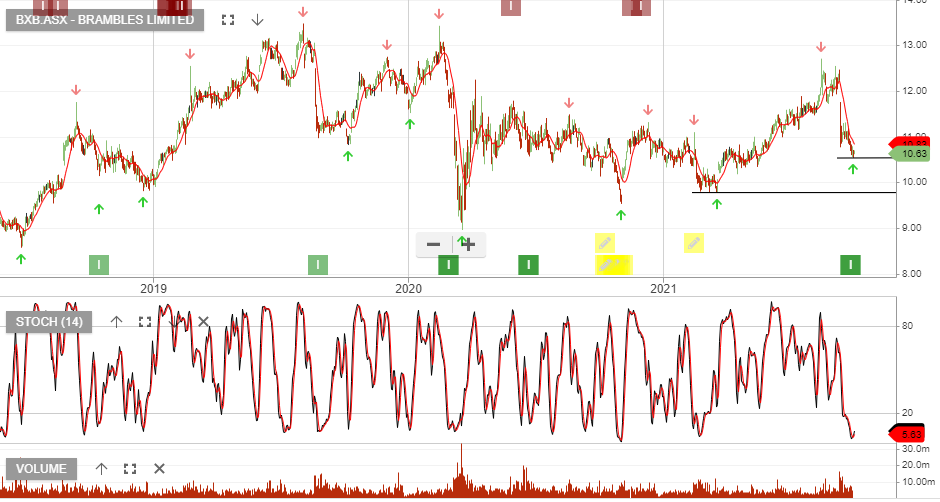

OZR:ASX is under Algo Engine buy conditions and we anticipate buying support to increase within the accumulation range of $10.50 to $12.50.

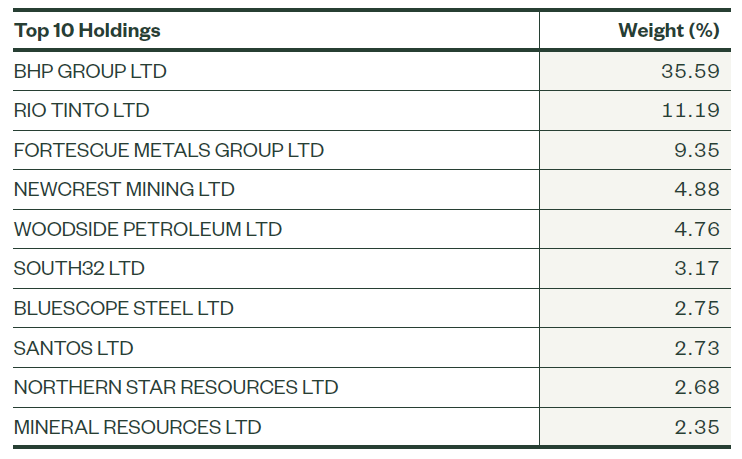

A sector sub-index of the S&P/ASX 200 Index, this index provides investors with exposure to the Resources sector of the Australian equity market as classified as members of the GICS® resources sector. Resources are defined as companies classified in the Energy sector (GICS® Tier 1), as well as companies classified in the Metals and Mining Industry (GICS® Tier 3).