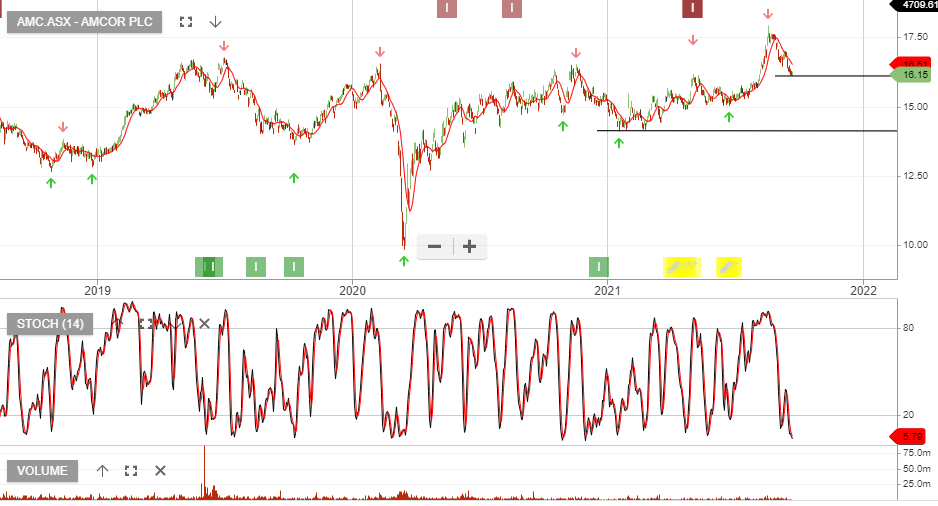

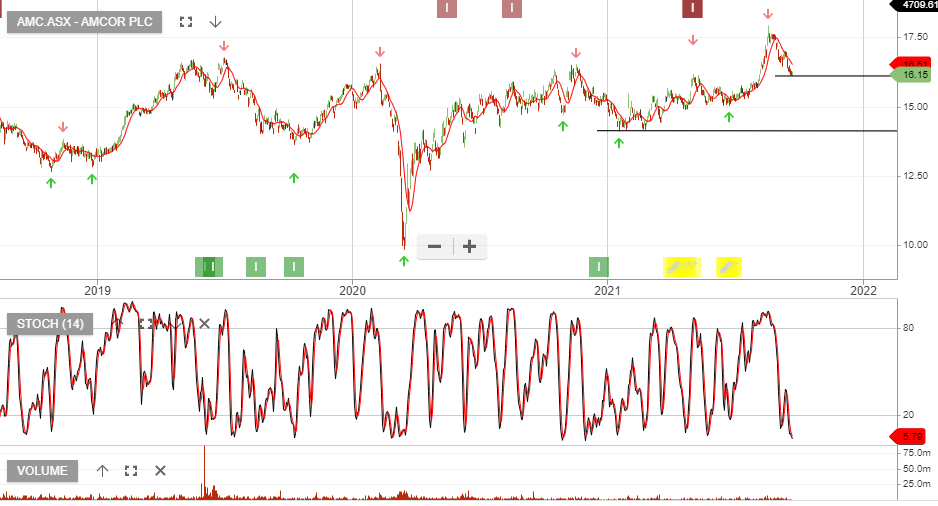

Amcor – Buying Support

Amcor is now on our radar following the price correction from $18 down to $16.

We expect to see a switch to Algo Engine buy conditions in the near term and an increase in buying interest.

Amcor is now on our radar following the price correction from $18 down to $16.

We expect to see a switch to Algo Engine buy conditions in the near term and an increase in buying interest.

Coles Group is under Algo Engine buy conditions.

Investors should look to accumulate a position in Coles, within the highlighted price range.

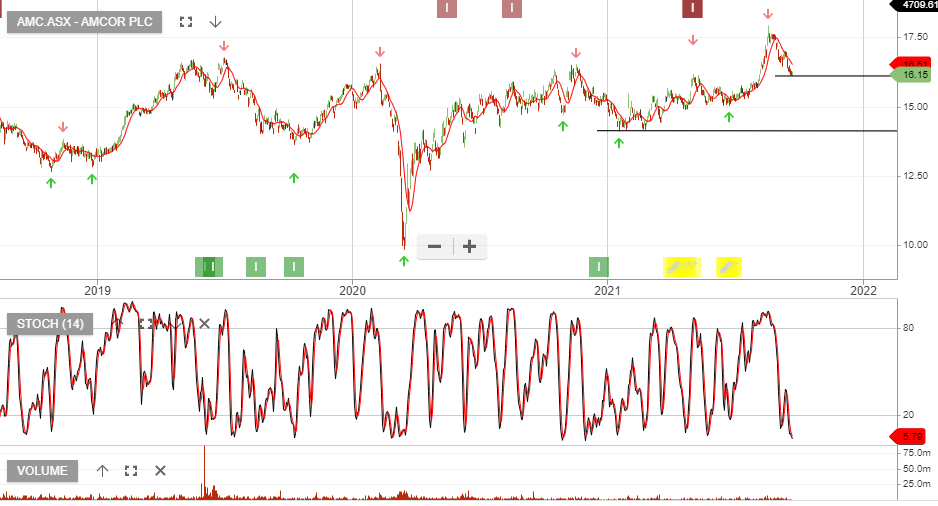

Northern Star Resources is under Algo Engine buy conditions and is our preferred gold exposure.

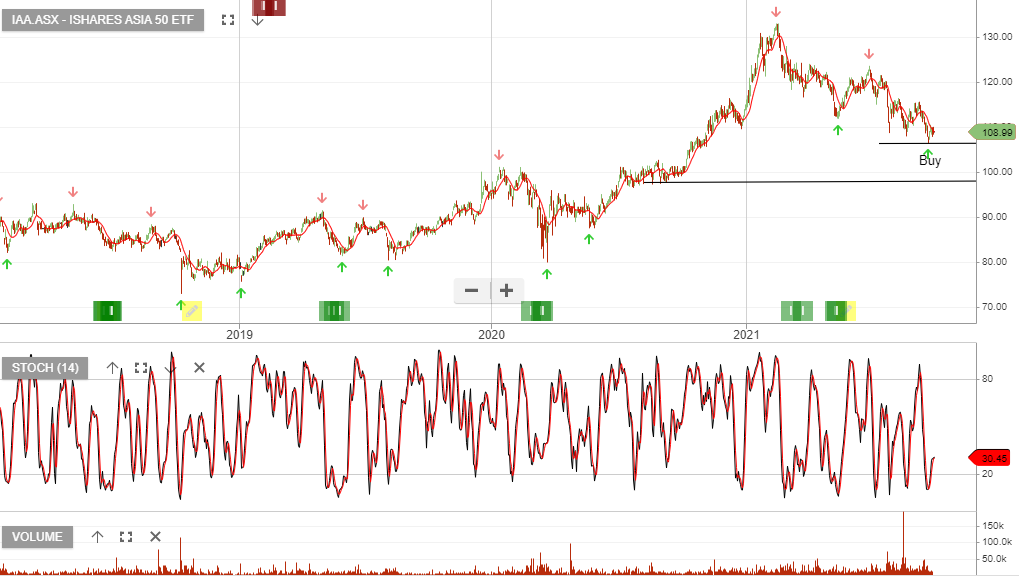

The significance of Chinese house prices to world markets cannot be overstated. For twenty years China has been powering world growth.

There are many times in the past China has been successful in re-inflating its property market and we think that on the balance of probability, they’ll achieve this again.

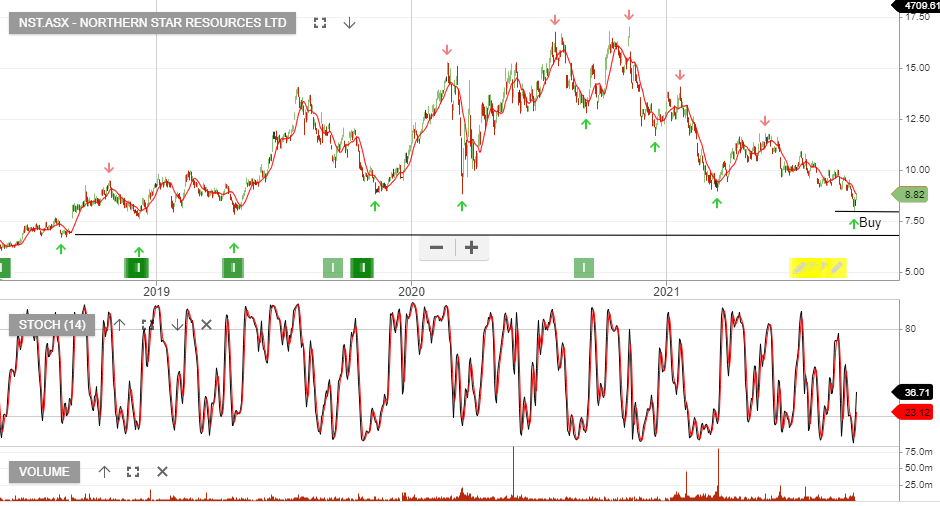

Relative to other global equity indices, the iShares China Large-Cap looks to offer value. The risks are high in the short term, however, an opportunity presents for the long-term investor to consider accumulating the IZZ ETF over the next 6 months.

iShares Asia 50 is our preferred Asia sector ETF.

The XJO is displaying increased buying interest with support at 7190 and 7330.

The short-term momentum indicators have turned higher.

Update 29/9: The sell-off recommenced after Monday’s high at 7416.

Bega Cheese is under Algo Engine buy conditions.

The FY21 result beat forecasts on a number of key metrics, with FY21 sales +38%, underlying EBITDA increased +38%, and NPAT up 24%.

FY22 BGA is targeting further earnings growth and to realise the synergies from the LD&D acquisition.

BGA buying support to increase above the $5.00 support level.

Amcor is now on our radar following the price correction from $18 down to $16.

We expect to see a switch to Algo Engine buy conditions in the near term and an increase in buying interest.

Coles Group is under Algo Engine buy conditions.

Investors should look to accumulate a position in Coles, within the highlighted price range.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

The XJO is displaying increased buying interest with support at 7190 and 7330.

The short-term momentum indicators have turned higher.