IAG – Algo Buy

Insurance Australia Group is under Algo Engine buy conditions and has been added into our ASX model portfolio.

Insurance Australia Group is under Algo Engine buy conditions and has been added into our ASX model portfolio.

BHP Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

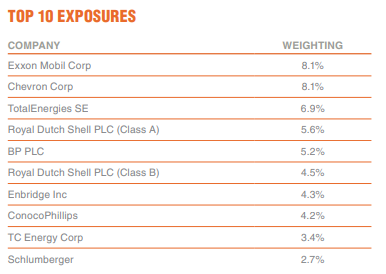

iShares S&P/ASX 20 is now under Algo Engine buy conditions and has been added to our iShares ETF model portfolio.

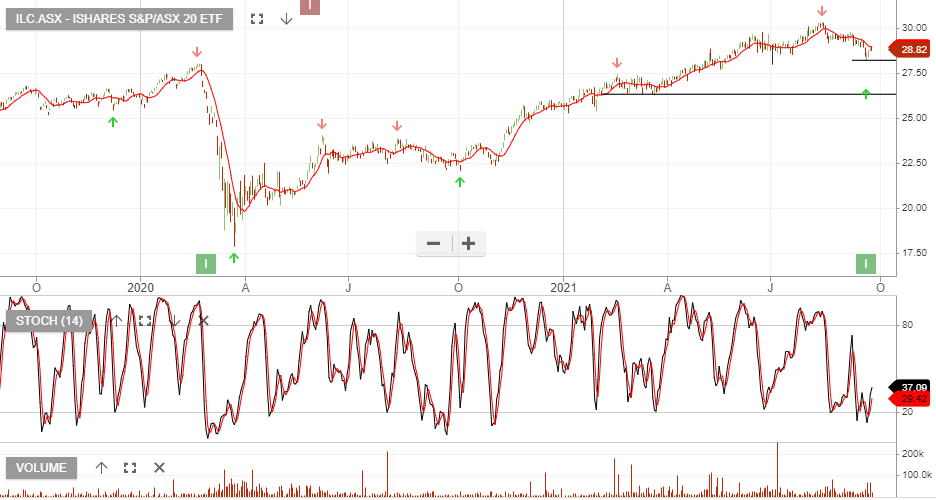

Amcor is now on our radar following the price correction from $18 down to $16.

We expect to see a switch to Algo Engine buy conditions in the near term and an increase in buying interest.

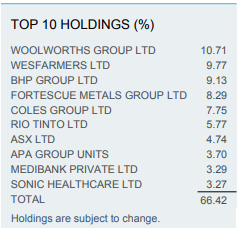

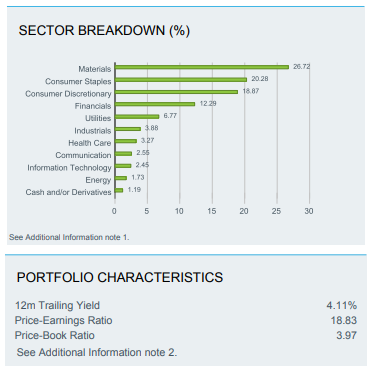

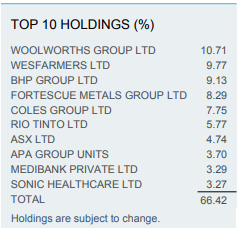

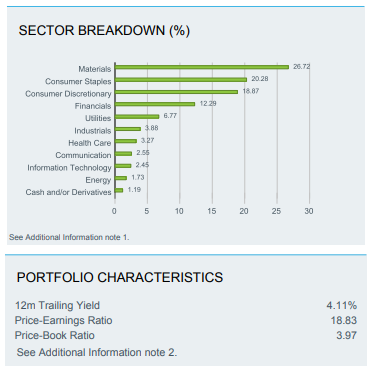

iShares S&P/ASX Dividend Opportunities is now under Algo Engine buy conditions and has been added to our ETF model portfolio.

The fund aims to provide investors with the performance of the S&P/ASX Dividend Opportunities Accumulation Index, before fees and expenses. The index is designed to measure the performance of 50 ASX listed stocks that offer high dividend yields while meeting diversification, stability and tradability requirements.

Coles Group is under Algo Engine buy conditions.

Investors should look to accumulate a position in Coles, within the highlighted price range.

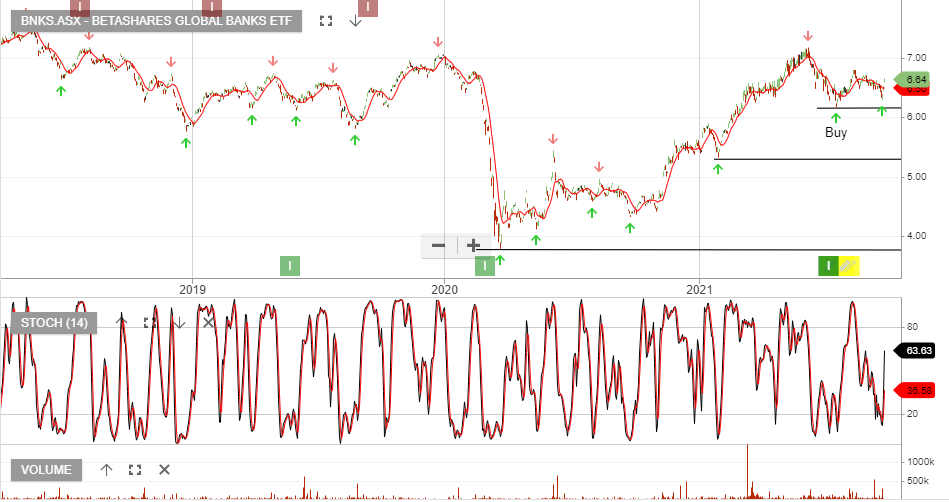

BetaShares Global Banks is now under Algo Engine buy signals and is a current holding in our “ASX All ETF” model.

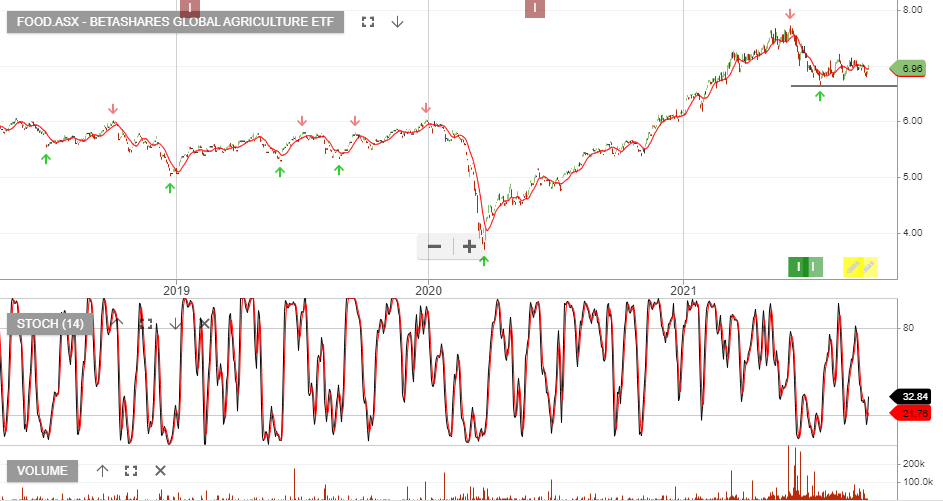

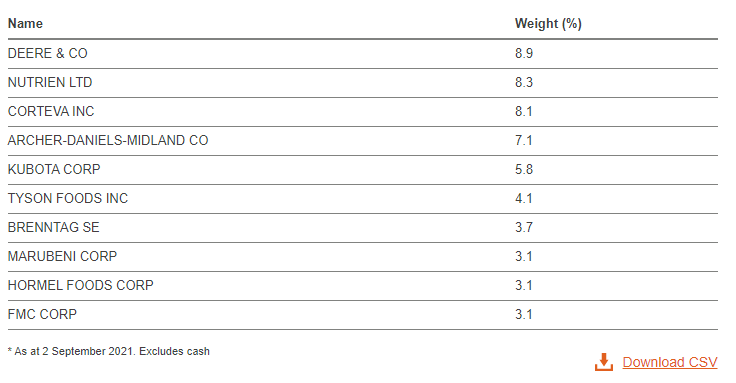

BetaShares Global Agriculture is under Algo Engine buy condition.

FOOD aims to track the performance of an index (before fees and expenses) that comprises the largest global agriculture companies (ex-Australia), hedged into Australian dollars.

iShares S&P/ASX Dividend Opportunities is now under Algo Engine buy conditions and has been added to our ETF model portfolio.

The fund aims to provide investors with the performance of the S&P/ASX Dividend Opportunities Accumulation Index, before fees and expenses. The index is designed to measure the performance of 50 ASX listed stocks that offer high dividend yields while meeting diversification, stability and tradability requirements.

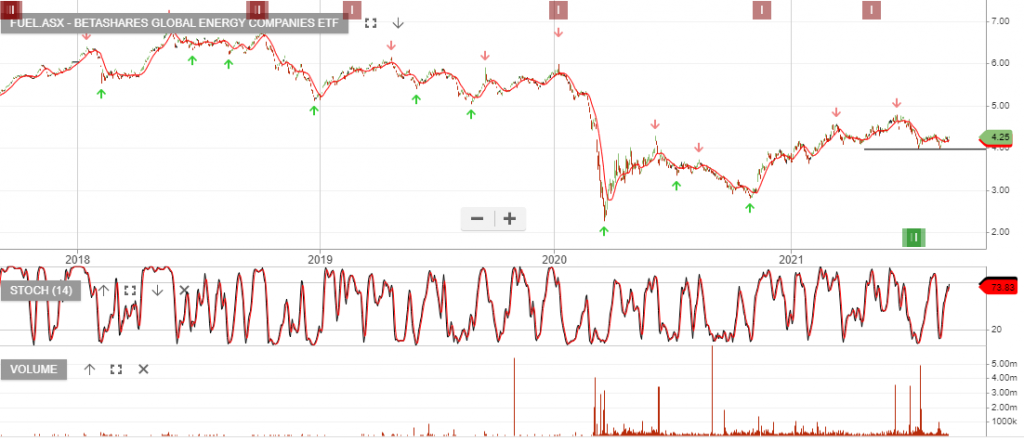

BetaShares Global Energy Companies is under Algo Engine buy conditions.

Fuel aims to track the performance of an index that comprises the largest energy companies (ex-Australia), hedged into Australian dollars.