Woodside – Buy

WPL:ASX is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

WPL has agreed to an all-scrip acquisition (merger) of BHP Petroleum’s

assets.

Accumulate.

WPL:ASX is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

WPL has agreed to an all-scrip acquisition (merger) of BHP Petroleum’s

assets.

Accumulate.

CURE:AXW is under Algo Engine buy conditions and the current pullback provides another buying opportunity.

ETFS S&P Biotech ETF (ASX Code: CURE) offers investors exposure to U.S. biotechnology companies. These companies are engaged in research, development, manufacturing and/or marketing of products based on genetic analysis and genetic engineering.

.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

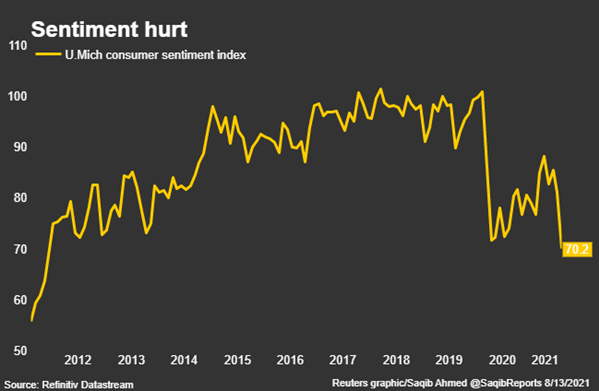

U.S. consumer sentiment dropped sharply in early August to its lowest level in a decade, in a worrying sign for the economy as Americans gave faltering outlooks on everything from personal finances to inflation and employment, a survey showed.

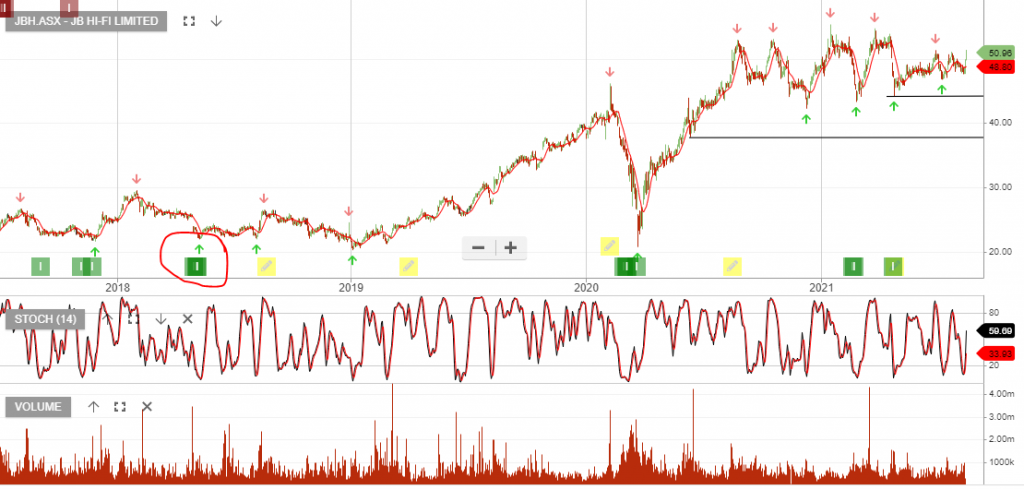

JB Hi-Fi is under Algo Engine buy conditions and is a current holding in our ASX 100 model. The stock is up 126% since being added back in November 2017.

FY21 group sales rose 12% to $8.9 billion and profit jumped to $506 million, which was largely in line with consensus forecasts, however, the electronics retailer warned that the 2022 financial year has had a softer start.

A2 Milk rallied 12% yesterday following speculation it could be the target of a takeover bid by Swiss multinational Nestlé.

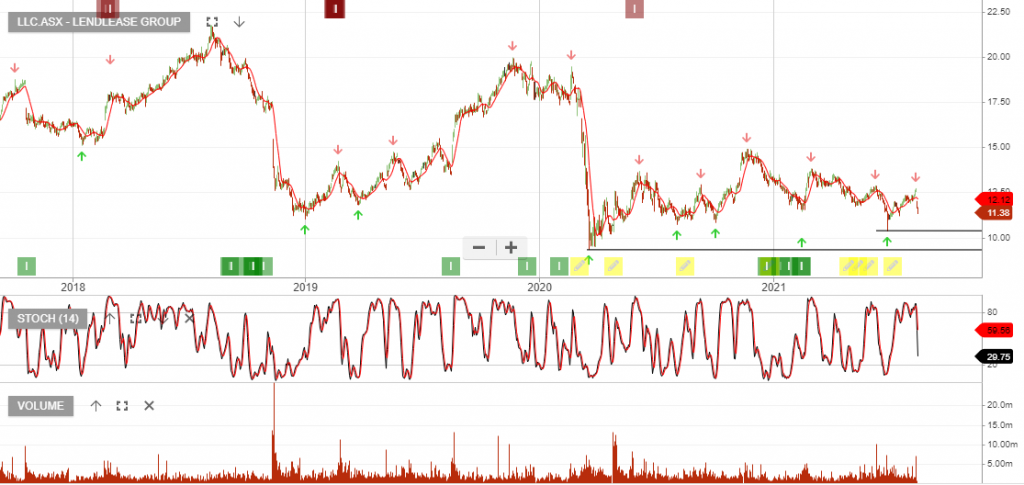

Lendlease has warned of a challenging year to come as COVID-19 puts a dampener on development and construction globally.

FY21 net profit after tax of $377 million was in line with the company’s guidance, largely due to divesting its loss-making engineering and services.

We expect to see an improvement in earnings towards the end of FY22.

CIM:ASX is likely to see improved earnings in FY22 and we expect to soon see a recovery in the share price.

CIMIC is a high-risk counter trend investment with the prospect of a multi-year recovery, once earnings hit an inflection point.

Buy Dec $20 call options as a stock replacement strategy. For more detail, please call 1300 614 002.

Qube Holdings is under Algo Engine buy conditions.

CURE:AXW is under Algo Engine buy conditions and the current pullback provides another buying opportunity.

ETFS S&P Biotech ETF (ASX Code: CURE) offers investors exposure to U.S. biotechnology companies. These companies are engaged in research, development, manufacturing and/or marketing of products based on genetic analysis and genetic engineering.

.