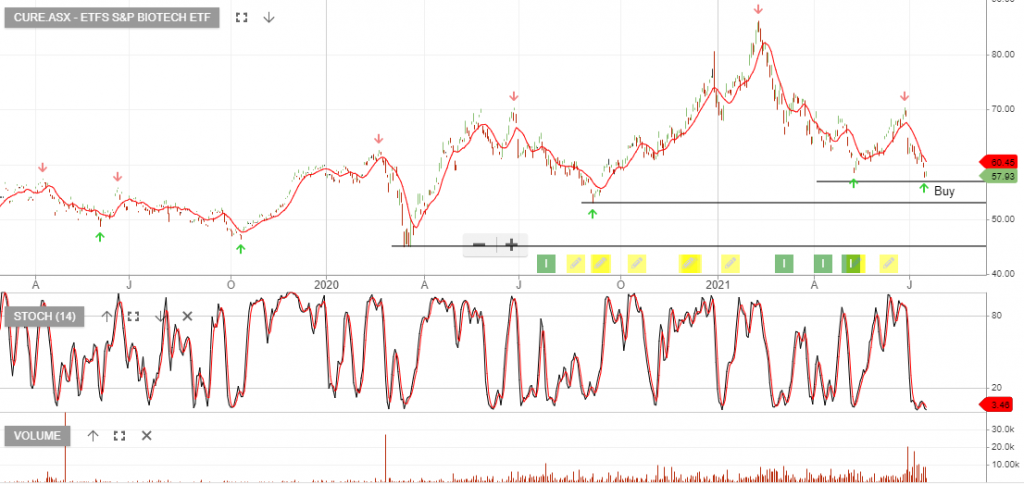

Cure ETF – Buy

CURE:AXW is under Algo Engine buy conditions and the current pullback provides another buying opportunity.

ETFS S&P Biotech ETF (ASX Code: CURE) offers investors exposure to U.S. biotechnology companies. These companies are engaged in research, development, manufacturing and/or marketing of products based on genetic analysis and genetic engineering.

.