Cleanaway – Buy

Cleanaway Waste Management is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

.

Cleanaway Waste Management is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

.

Lendlease is under Algo Engine buy conditions.

Last week’s profit warning could be the first stage of the

new CEO’s company reset. A review, covering the restructuring of operations and impact of market uncertainties will likely lead to further divestment of less-core businesses and re-prioritization of the existing 23 urbanization projects.

FY22 NPAT is forecast to increase, although still remind 20% below pre-pandemic levels. LLC will provide the FY21 results on 16 August.

Our preference is to own LLC via long call options. For further details please call 1300 614 002.

The following stock is approaching support and offers an opportunity for both investors and traders to soon capitalize on renewed buying interest.

Short-term upside of 20%+ and a defensive dividend. To access this unique investment alert, start your free trial today.

WPL:ASX is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

The recent pullback and higher low at $22.50 provide another opportunity to buy the stock.

OZ Minerals is under Algo Engine buy conditions and is a current holding in ASX 100 model portfolio.

Our Algo Engine generated a buy signal in the SPDR S&P/ASX 200 Resources. This “higher low” pattern is referenced to the $13.22 low posted on 21 June.

Our initial target is in the $14.50 area.

The following stock is approaching support and offers an opportunity for both investors and traders to soon capitalize on renewed buying interest.

Short-term upside of 20%+ and a defensive dividend. To access this unique investment alert, start your free trial today.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

The New Zealand Overseas Investment Office (OIO) has given approval to A2Milk’s plan to buy 75% of Mataura Valley Milk.

Full-year 2021 sales are expected to be between $NZ1.2 billion to $NZ1.25 billion and EBITDA margins will fall from 30% to 12%.

We’ve closed out the August $6.00 strike calls at $0.92 after purchasing them in early June at $0.30.

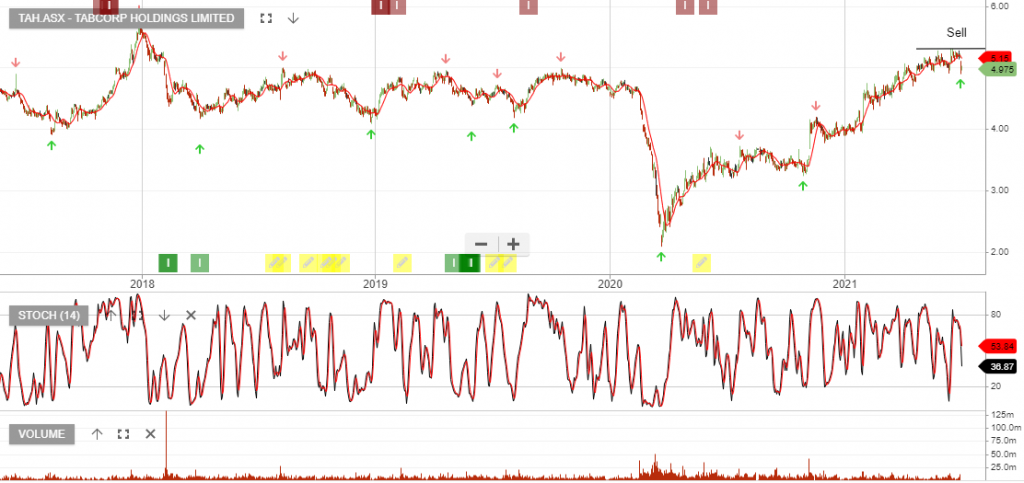

Tabcorp Holdings will demerge its lotteries and keno business. The lotteries and keno business has a low capital intensity and a track record of strong cash flows.

Wagering & Gaming Co will remain the largest gaming services provider in Australia.